Earnings season trading tool: New feature of combination options + 3-phase guide for pre-earnings, during earnings, and post-earnings, full strategy analysis!

Earnings season is here again!

This week, hot companies like $Microsoft(MSFT.US), $Meta Platforms(META.US), $Qualcomm(QCOM.US), $Apple(AAPL.US), $Amazon(AMZN.US), and $HSBC HOLDINGS(00005.HK) will release their earnings, and market volatility is imminent.

As we all know, earnings season is when stock prices fluctuate the most, with ups and downs, and market sentiment is tense.

At this time, the advantages of options can be fully demonstrated. Whether the market rises or falls, you can find suitable strategies to flexibly respond to various situations.

New combo options feature helps you seize opportunities!

Here’s some good news! The new combo options feature is officially live!

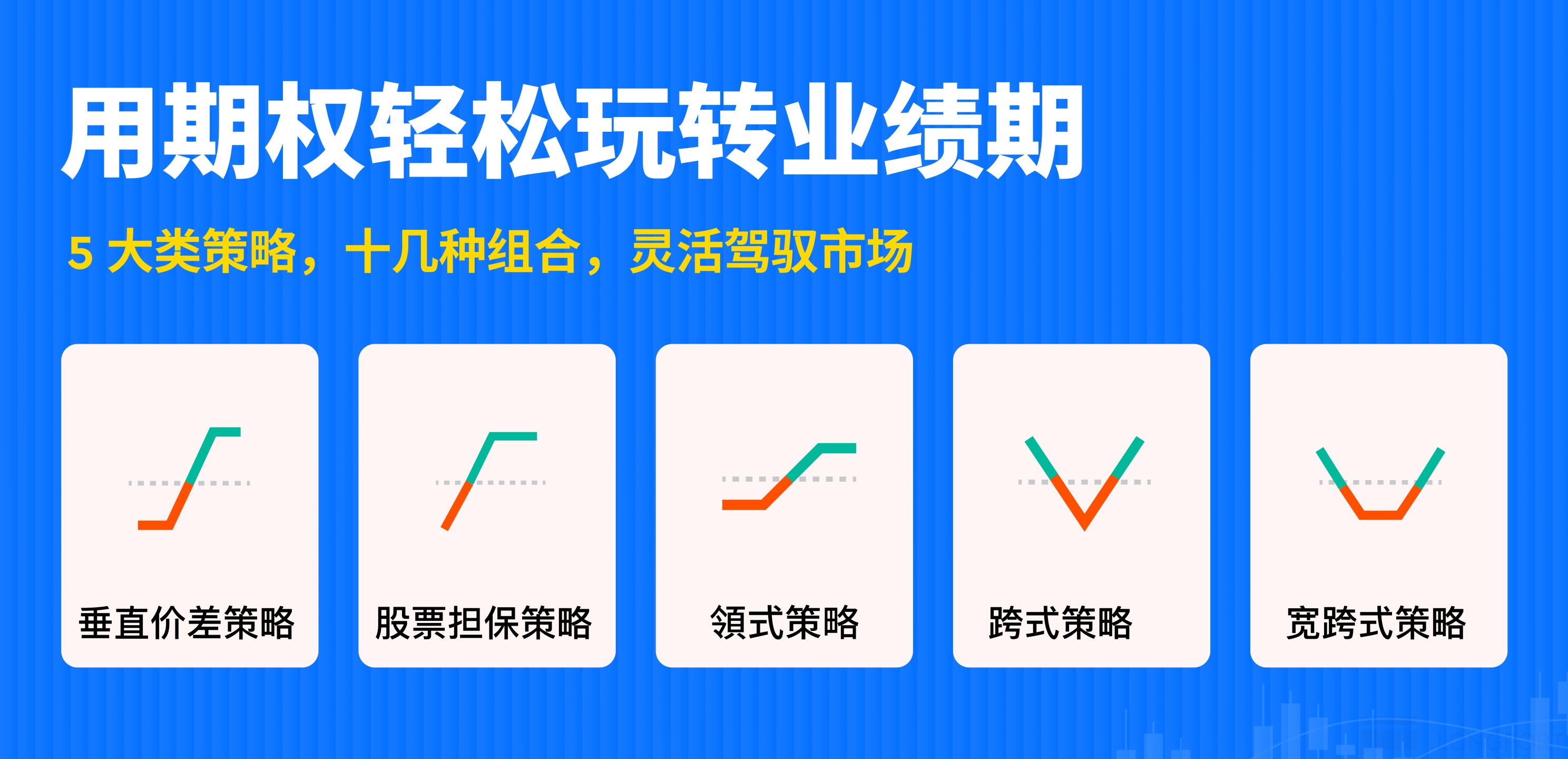

With 5 major strategies and dozens of combinations to choose from, it helps you stay one step ahead in the earnings season.

Whether it’s a bull market, bear market, or volatile market, this new feature can help you navigate the trends with ease!

How to find combo options?

Open the stock details page, click "Options" to enter the options chain, and you can switch between different strategies in the top-left corner of the options chain.

Friendly reminder: The combo options feature is not fully open yet. If you don’t see the switch entry, please leave a comment saying "Apply to open," and the product team will process all applications by 21:00 on the next trading day!

Now, let’s get back to the topic and unlock the golden trading logic of the earnings season to see how options can be played in new ways!

1. How to play the earnings season? Focus on two key points

When it comes to options, the two most critical factors are: the direction of the stock price and the level of implied volatility (IV).

Simply put, it’s about where the stock price is heading and how IV will change.

Everyone understands stock price movements: if the stock rises, the call options you buy will rise. If the stock falls, the put options you buy will fall. No difficulty there.

So how do you understand IV levels? IV is one of the core factors in options pricing, reflecting the market’s expectation of future stock price volatility.

Typically, high IV means the market expects significant volatility, making options more expensive. Low IV indicates a calmer market, so options are naturally cheaper.

IV also has a mean-reverting characteristic, meaning that if IV rises too high, it will gradually fall, and if it drops too low, it will rebound, always adjusting to find balance.

For investors, IV levels directly affect options strategy selection.

When IV is low, options are cheap, making it a good time for buyers, especially those betting on a direction.

When IV is high, options are expensive, making it a good time for sellers to earn time value.

Back to the earnings season, IV changes usually have two characteristics:

Before earnings, everyone is guessing, market uncertainty is high, and IV typically rises quickly.

Once earnings are released, the suspense is over, market sentiment calms down, and IV usually drops quickly.

2. A phased guide to trading the earnings season

Therefore, timing is crucial! We can divide the earnings season into three phases, each with different suitable strategies:

1) Preparation phase: Weeks before earnings, go long on IV

Typical characteristics:

In this phase, the market is guessing how earnings will turn out, uncertainty is high, and implied volatility (IV) starts to rise gradually, peaking just before earnings. The exact timing varies by stock, so keep an eye on IV charts to find the right entry point.

Strategy idea:

The core of this phase is "going long on IV." Simply put, it means positioning early before IV peaks to capture its upward momentum. Combine this with your directional view to choose the best strategy. Exit in time before or after earnings to avoid the risk of IV decline.

Common strategies:

Single-leg strategies: Long Call or Long Put, suitable when you have a clear directional view.

Spread strategies:

Bull Call Spread for bullish markets, "buy low, sell high" to lock in profits. Buy lower-strike Calls to capture upside, a buyer’s strategy.

Bear Put Spread for bearish markets, "buy high, sell low" to lock in profits. Buy higher-strike Puts to profit from downside, also a buyer’s strategy.

Straddle/Strangle: Long Straddle or Long Strangle, suitable when expecting big moves but unsure of direction.

Friendly reminder:

Click the strategy name to jump to the course for more details.

2) Battle phase: Days before or on earnings day, go short on IV

Typical characteristics:

Market sentiment is very tense, and implied volatility (IV) has surged to a peak. Option prices are pushed very high, so days before earnings, it’s better to consider being a "seller." The exact timing varies by stock, usually 1-2 days. Again, watch IV charts for the right entry.

Strategy idea:

Unlike the preparation phase, the core here is to capture IV at its peak and harvest premiums via seller strategies. Option prices are inflated, so buying now risks IV crashing and option prices shrinking. Selling options with high IV lets you collect higher premiums. Of course, manage risks like unexpected IV behavior or extreme price moves.

Common strategies:

Single-leg strategies: Short Call or Short Put.

Spread strategies: Bull Put Spread, Bear Call Spread.

Straddle/Strangle: Short Straddle or Short Strangle, suitable when expecting post-earnings volatility to be mild.

Friendly reminder:

Click the strategy name to jump to the course for more details.

3) Wrapping up: After earnings, follow the new trend with directional strategies

Typical characteristics:

IV drops quickly, and the stock price starts a new trend.

Strategy idea:

Close previously sold contracts to lock in profits. Choose directional strategies based on the latest trend.

Tip:

Move fast—don’t linger!

That’s all for today!

Next time, we’ll dive deeper into each strategy. Stay tuned! If you have questions, leave a comment.

If you don’t see the combo options switch, reply with "Apply to open" in the comments, and we’ll process your request by 21:00 on the next trading day!

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.