Top 10 Influencers in 2025

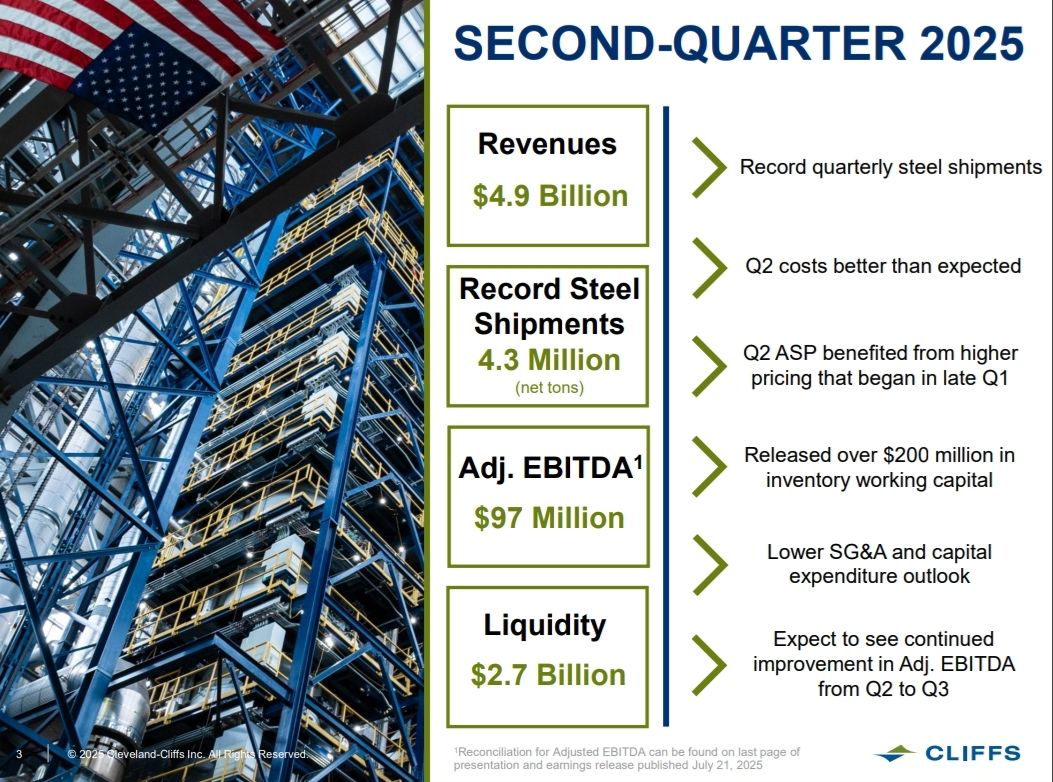

Top 10 Influencers in 2025$Cleveland Cliffs(CLF.US) At least check the report before buying 🙂↕️ Taking a break today 🛌

CLF Observation-1

Why is CLF valued at 15, with a long-term target above 20? First, from a macro perspective: CLF is a vertically integrated moat and the tide of the macroeconomy. Core view: Cleveland-Cliffs (CLF) has successfully transformed into the largest vertically integrated flat-rolled steel producer in North America. Its core investment logic lies in the game between the strong vertically integrated model (low-cost self-sufficiency in iron ore + electric arc furnace steelmaking) and macroeconomic fluctuations (interest rates, industrial activity, automotive cycles). The company can maximize profits from high steel prices...

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.