Traded Value

Traded Value Likes Received

Likes ReceivedPreview for the Week of 9/25: US August CPI on Thursday

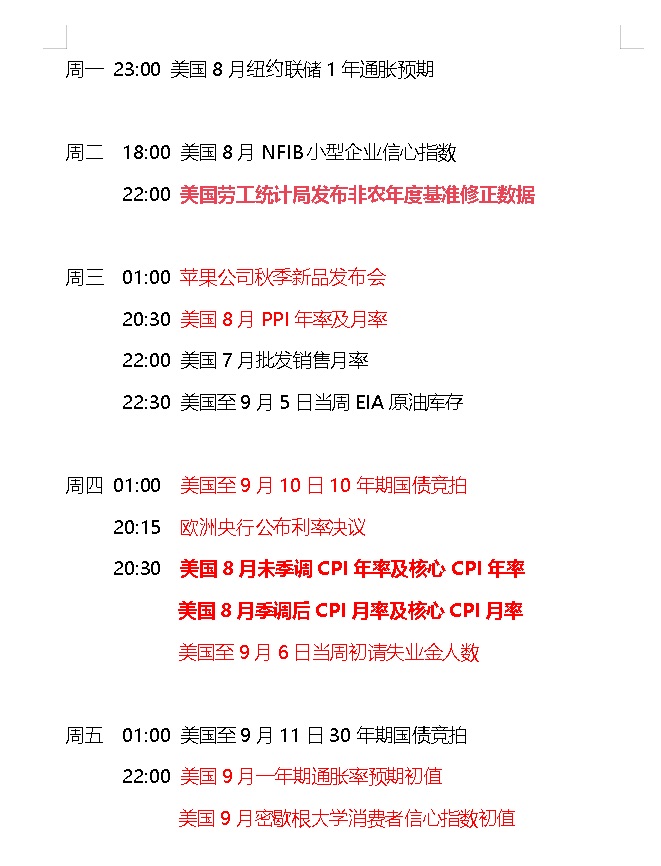

Here’s a preview of the important data and events to be released next week. A summary chart will be provided at the end for you to screenshot and save. Next week is crucial.

First, on Tuesday evening, the US Bureau of Labor Statistics will release the annual revision data for the Non-Farm Payrolls, covering revisions from April 2023 to March 2025. This will show whether the data will be revised upward or downward. Given the recent poor employment data, the market will definitely pay close attention to this. So, stay alert.

Then, in the early hours of Wednesday, Apple’s fall product launch event will take place. Let’s see if it brings any highlights, especially innovations in AI. On Wednesday evening, the PPI data will also be released.

The most critical day, Thursday, arrives. First, at 1 AM, there will be a 10-year Treasury bond auction. Given the recent poor employment market, the performance of the Treasury market can roughly reflect overall market sentiment.

In the evening, the European Central Bank’s interest rate decision will be announced.

Then, at 8:30 PM, the heavyweight US August CPI data will be released. As long as this data isn’t too bad, it won’t affect the September rate cut.

However, if it’s very good—for example, below 2.5—it could further promote a 50-basis-point rate cut.

But if it’s too bad, it could spark concerns about inflation or even stagflation.

Later in the evening, the weekly unemployment claims data will also be released, which reflects the employment market situation.

On Friday, the one-year inflation rate expectations and consumer confidence data will be released. Consumer confidence is also worth noting, as the US is a consumption-driven economy. A decline in consumer confidence could raise concerns about the economy.

Alright, I’ll post updates as soon as any important data or events are released. This preview will also be updated every weekend (pinned on my profile).

$iShares barclays 20+ Yr Treasury Bd(TLT.US)$Invesco QQQ Trust(QQQ.US)$NVIDIA(NVDA.US)$Tesla(TSLA.US)$Broadcom(AVGO.US)$Robinhood(HOOD.US)$Apple(AAPL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.