Options

Options Total Assets

Total AssetsFinally broke even!!!

This post is to document my journey. Since joining Longbridge in August, I had been using the HSBC app for stock trading, but the fees were too high and it didn't support options trading, so I switched to Longbridge.

Being new here,

everything felt fresh—night trading, pre-market trading. Right at the start, I encountered $Palantir Tech(PLTR.US) plummeting and took a short position. I thought it was a fun experiment to follow the trend and make some profit.

I also tried pre-market trading, which was another new experience.

What really paid off for me was options trading. I had always wanted to trade options, and I saw an opportunity when $PDD(PDD.US) was falling. I bought 5 puts, and the result was good—I made over $1,300 the next morning. (I don’t know how to show stocks I’ve sold and no longer hold.)

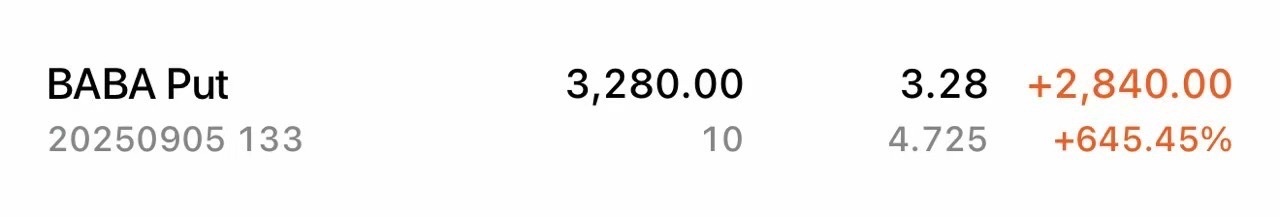

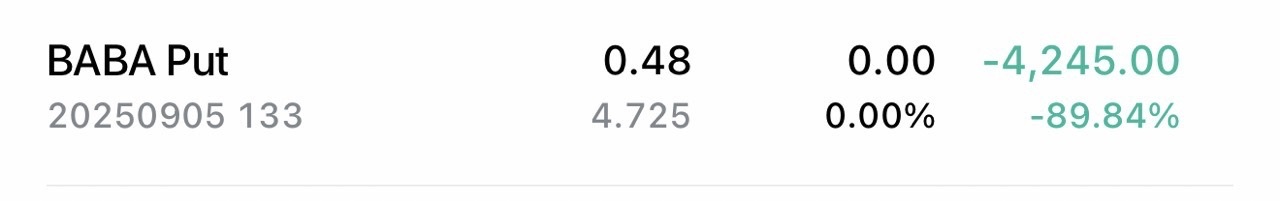

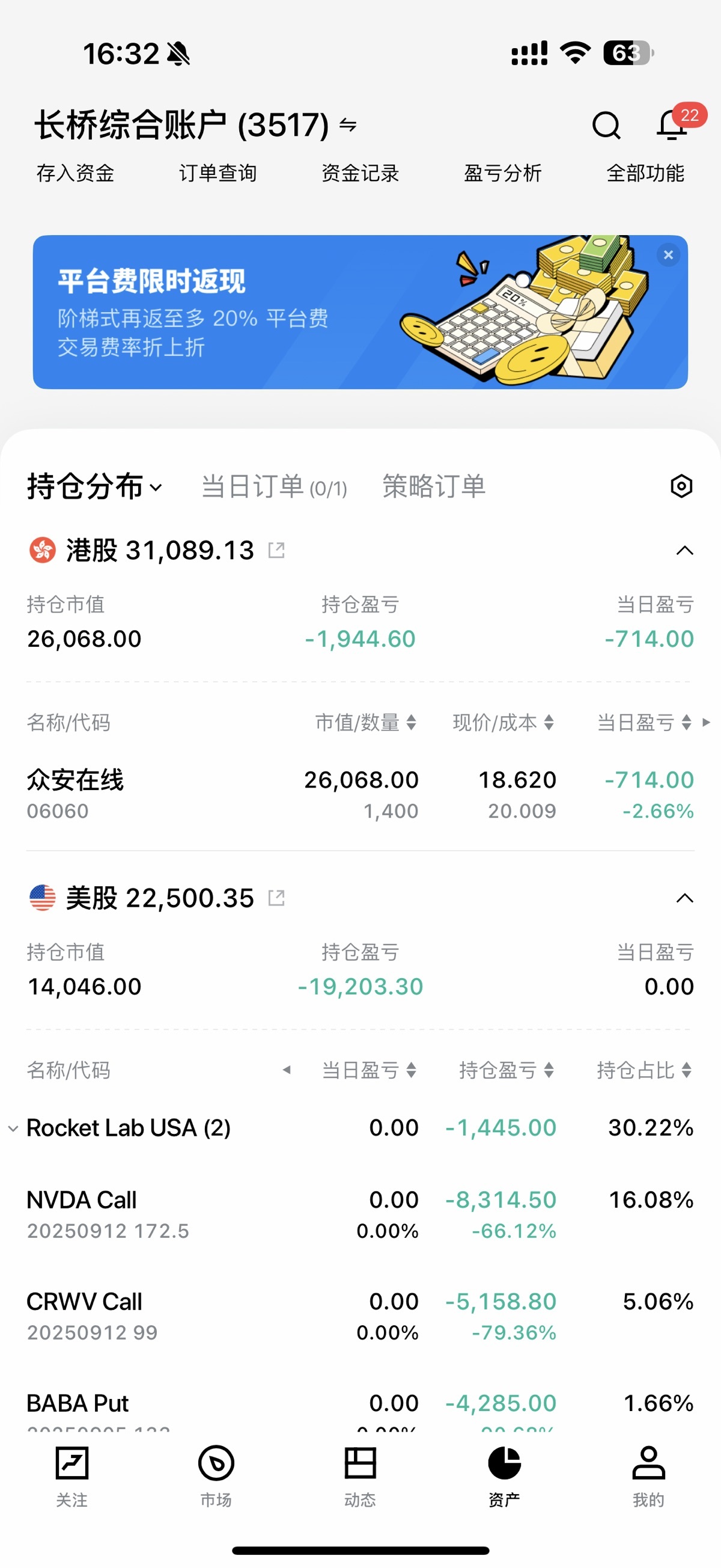

After tasting success, I went all-in on options, ignoring all risks. When Alibaba was about to report earnings, I bought 5 puts at 905, betting on a drop. When things didn’t go as planned, I doubled down instead of cutting losses, adding another 5 puts. The result? $4,000 turned into $100 by September 5th.

This was when I recovered the most:

This was the day it all went to zero:

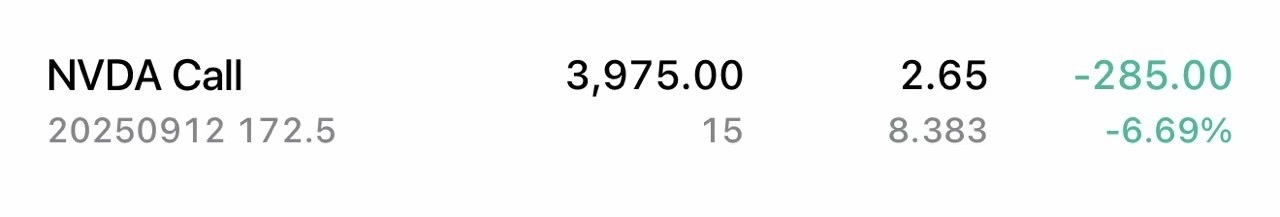

Later, with $NVIDIA(NVDA.US),

I knew it would likely drop after earnings despite the pre-earnings rally, but I still bought short calls, hoping for a post-drop rebound. I repeated my Alibaba play—adding more as it fell, going from 5 calls to 15. The more I added, the more it dropped.

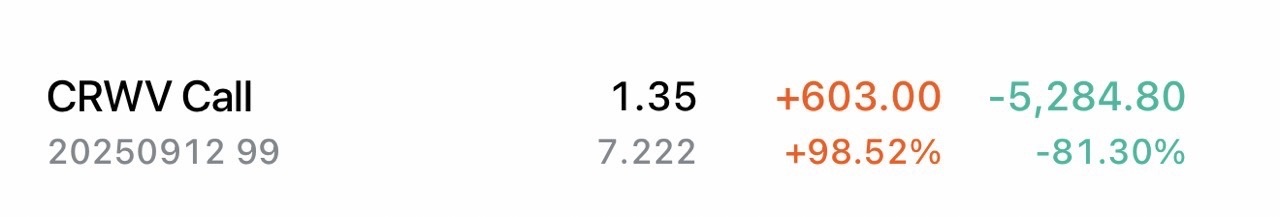

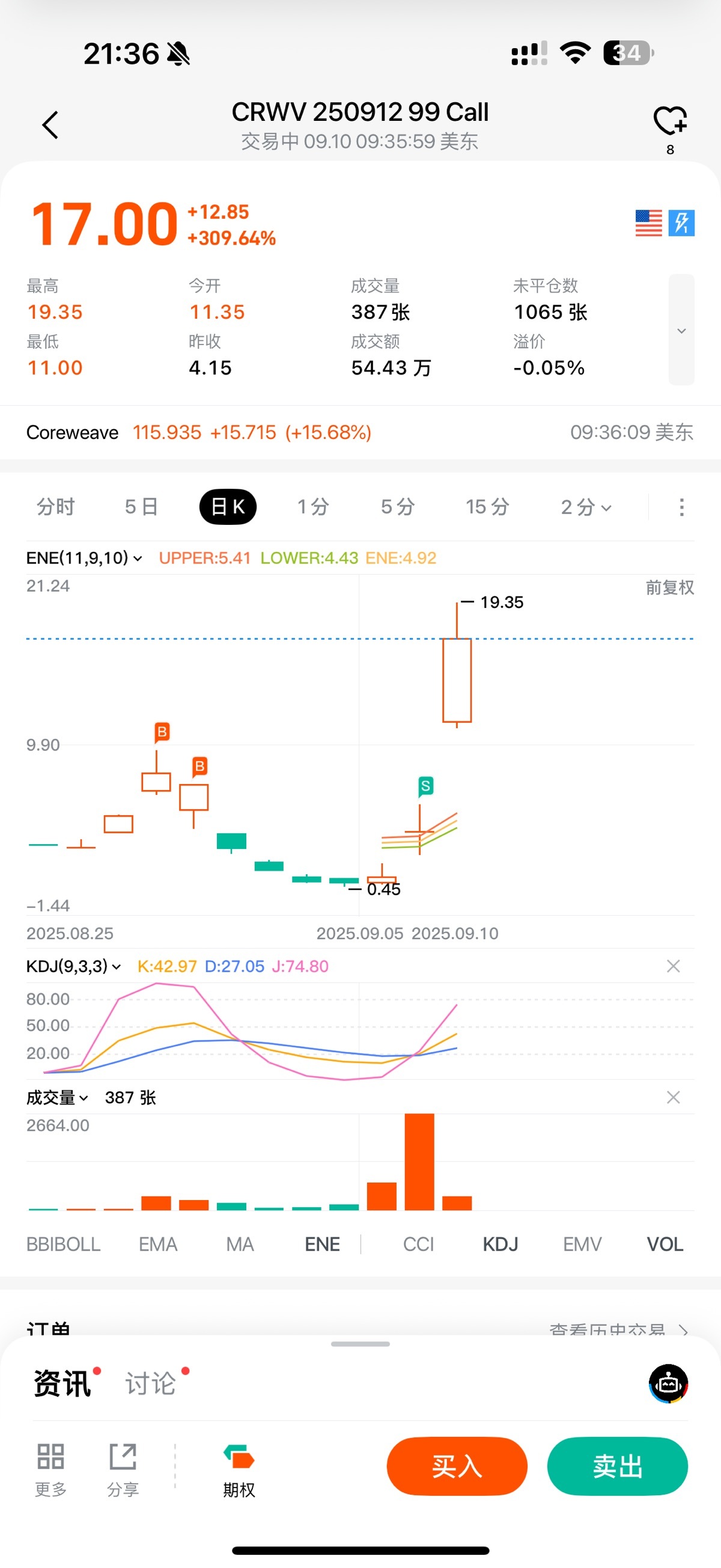

Then came $Coreweave(CRWV.US).

I bought calls when it secured a Saudi deal, making around $1,300. Later, I impulsively bought 10 more calls at 912, 99. I sold at the worst time—right before a rebound. This stock gave me many chances; holding longer would’ve turned a profit. But greed blinded me. The biggest lesson? Patience. I missed selling windows and watched losses pile up.

(Sorry, no screenshot of the lowest point—just this partial recovery.)

Yesterday, when it hit $103, I almost broke even but held out for more. It dropped to $97, and I panicked-sold. Today, it surged. But no regrets—you can’t earn beyond your understanding.

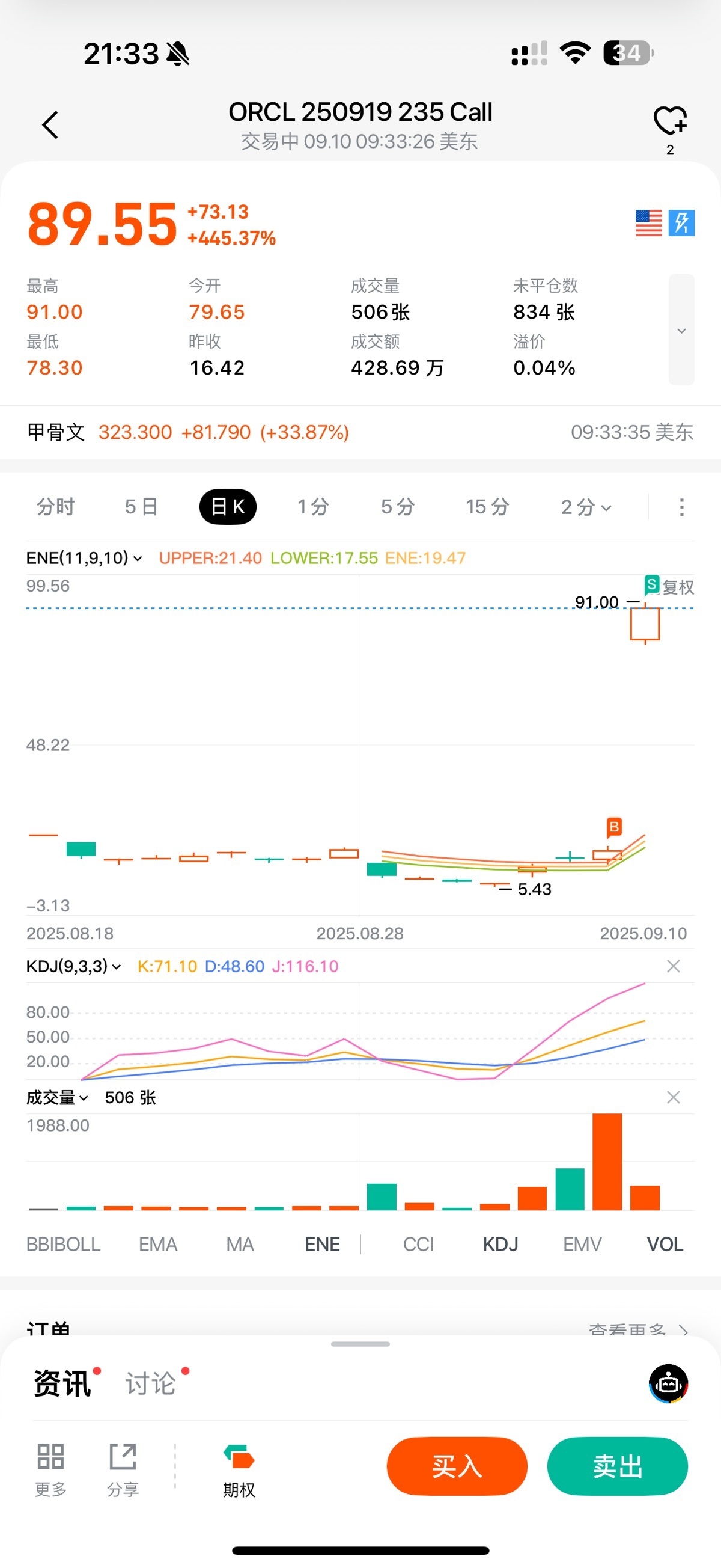

Also yesterday, I bought 2 calls on Oracle at 9.19, 235, knowing their earnings would be strong.

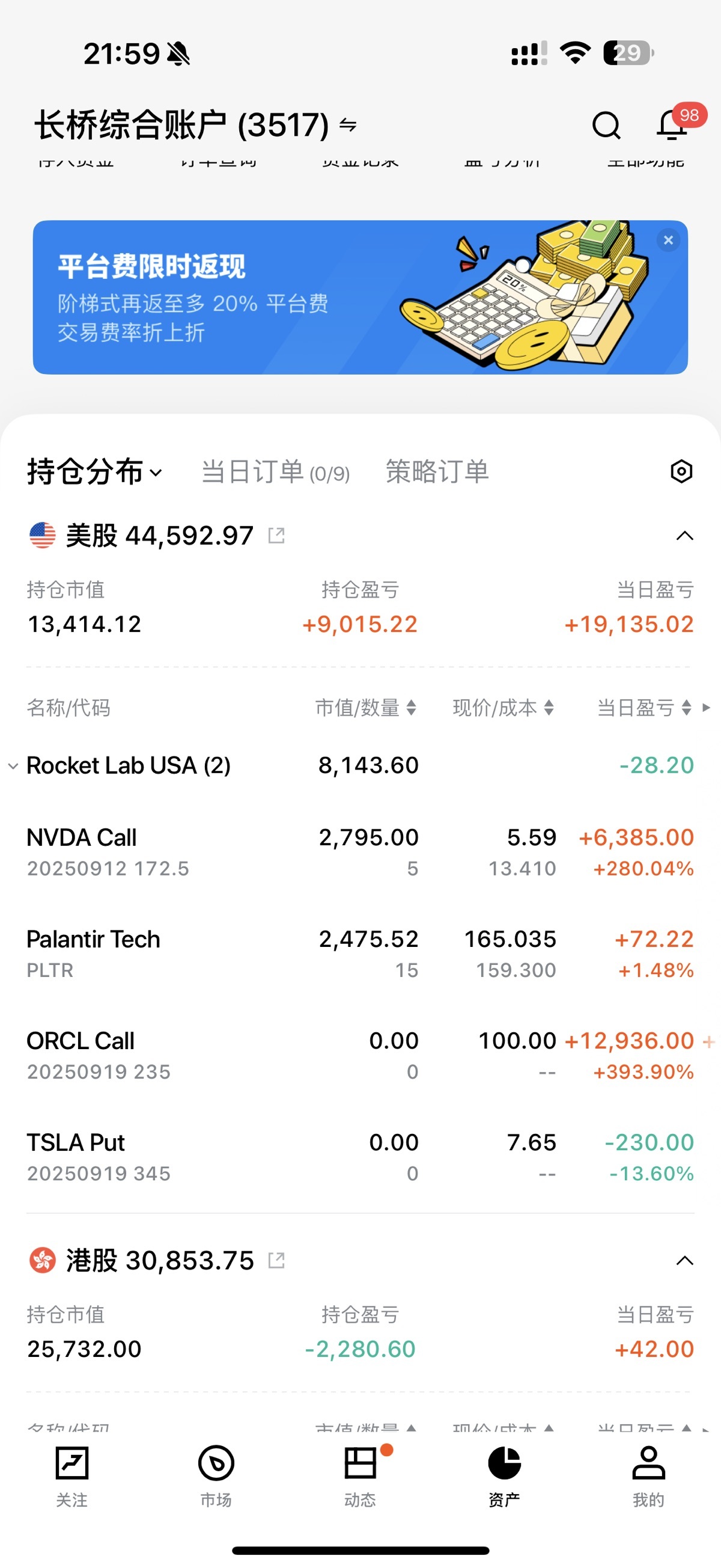

Today, as you know, it soared, lifting NVIDIA too. My account went from its worst:

To this:

As of today, my net P&L is:

It’s ironic—options burned me, then saved me. But I won’t heavy-trade options again. The stress and sleepless nights aren’t worth it. I usually buy at least 5 contracts, but with Oracle, I only bought 2 despite strong conviction. Maybe it’s fate—as the Cantonese say, "What you get is what you’re meant to have."

If you’ve read this far, thank you. This post is for me—a messy record of my journey. Apologies for the disorganization.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.