3M Company 4000-word in-depth research report

$3M(MMM.US)$DuPont de Nemours(DD.US) $Honeywell(HON.US) Research on 3M reveals: The resilience and hidden risks of the materials science giant coexist.

🎯 Core logic: 3M is a materials science solutions provider spanning industrial safety, healthcare, electronic materials, and consumer goods, with a business model centered on "dispersed demand + technology-driven." 60% of its revenue comes from weakly cyclical sectors such as industrial safety and medical consumables, demonstrating strong resistance to economic fluctuations; however, 20% of its electronic materials business is affected by the 4-5 year semiconductor cycle, facing pressure in H1 2025 due to chip destocking. Leveraging 51 technology platforms (e.g., VHB tape with a global market share exceeding 30%) and 120,000 patents, growth is driven by horizontal technology reuse (e.g., extending mask filtration technology to automotive filters), though its high-debt structure poses a major risk.

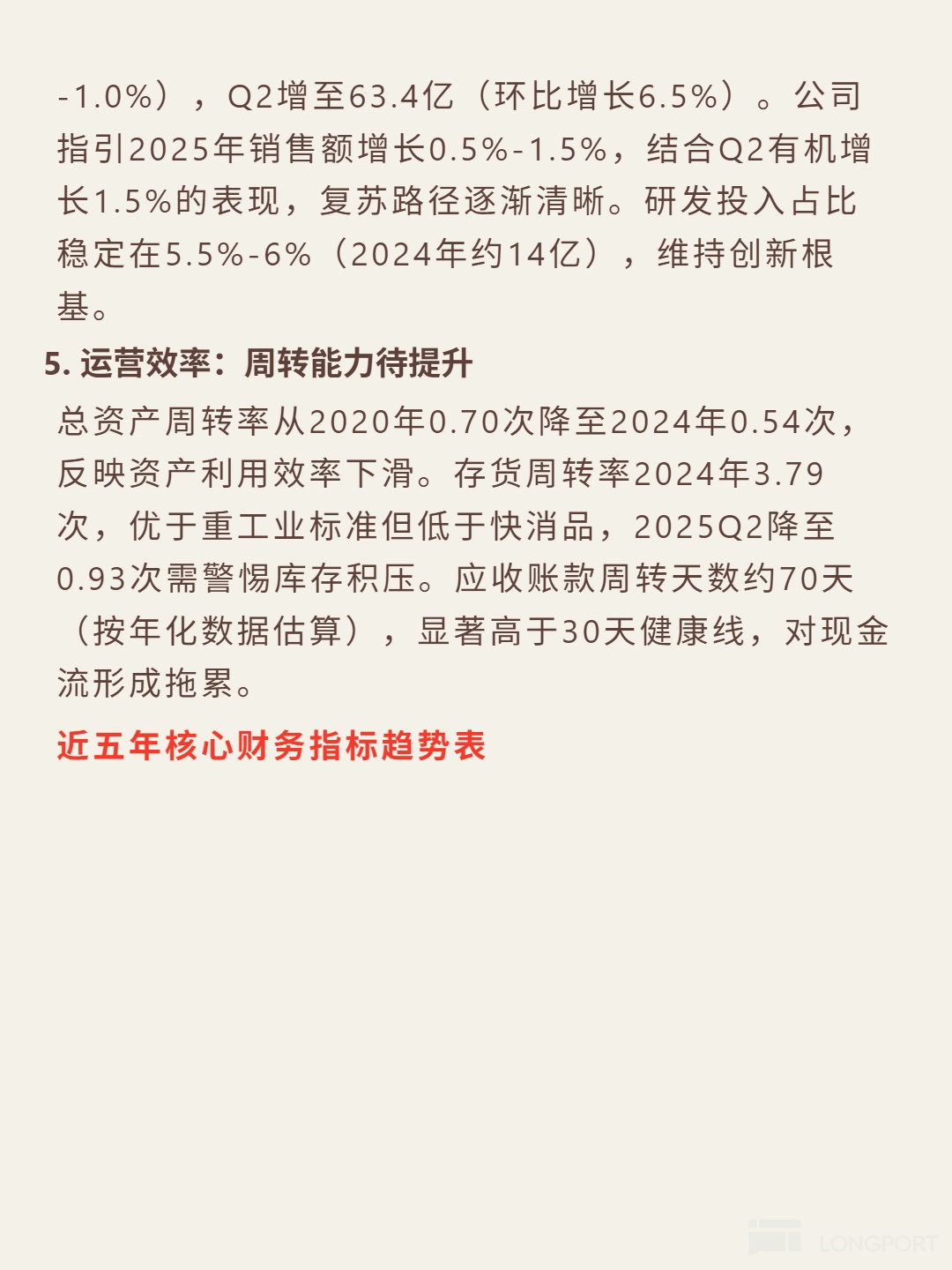

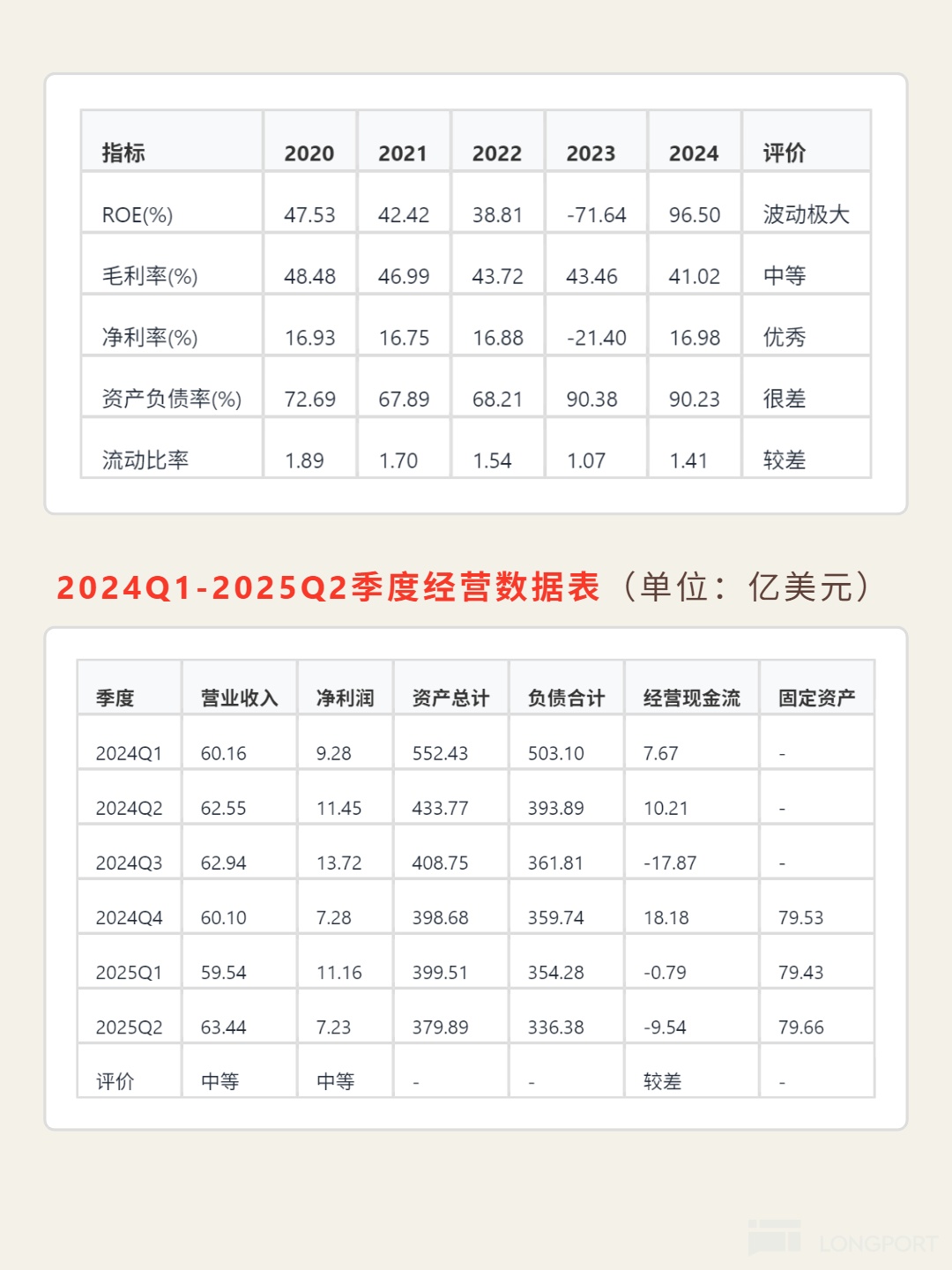

📈 Financial highlights: In 2024, the net sales margin was 16.98%, significantly outperforming the manufacturing industry average of 5%-15%; gross margin rebounded from 41.02% in 2024 to 41.76% in Q2 2025, showing an improving trend. The debt-to-asset ratio reached 88.55% in Q2 2025, far exceeding the safe threshold of 40%-60% for manufacturing, with a current ratio of 1.72 but a quick ratio of only 1.20, indicating significant debt repayment pressure. Free cash flow was ¥638 million in 2024 but remained negative in Q1-Q2 2025 (-¥315 million, -¥1.162 billion). Q2 2025 revenue was ¥6.34 billion, up 6.5% quarter-on-quarter, showing signs of recovery, but full-year growth still depends on the rebound of the electronic materials cycle.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.