Traded Value

Traded Value Top 10 Influencers in 2025

Top 10 Influencers in 2025By contrast, the risks of banks may be increasing, especially as the uncertainty of local finance has not been effectively cleared. The debt entities centered on state-owned enterprises and the government, coupled with the fiscal revenue decline brought by the deflation cycle, make people feel nervous. Hope I'm overthinking it.

Summary of Q3 2025 financial reports of the four major US banks and verification of post conclusions

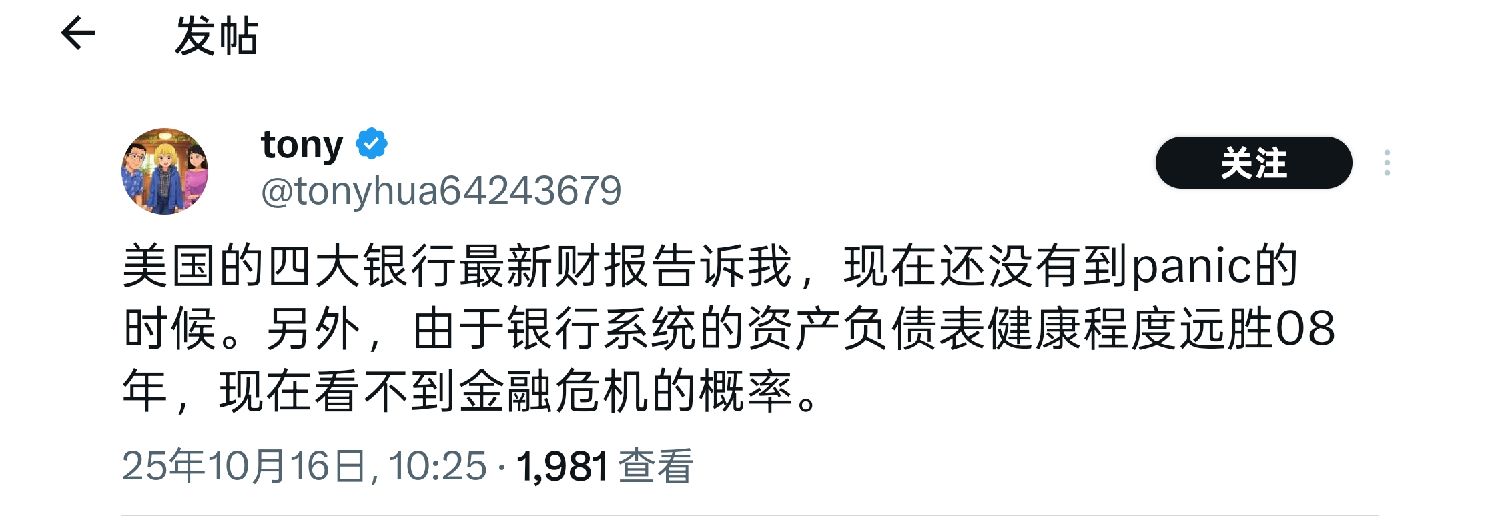

X post (from @tonyhua64243679) discussed the latest financial reports of the four major U.S. banks (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo), concluding that there is no need to panic. The banking system's balance sheet is far healthier than in 2008, and a financial crisis is unlikely to erupt at present. Below is a summary and verification based on the financial report data: The reports indicate that these banks released their Q3 results around October 14-15, 2025, showing strong overall performance. Driven by the resilience of the U.S. economy, investment banking, and trading activities, both profits and revenue grew, exceeding analysts' expectations...

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.