Seagate Technology 4000-word in-depth research report

$Seagate Tech(STX.US)$Western Digital(WDC.US) Research on Seagate Technology focuses on cyclical recovery under oligopoly and high debt risks.

🎯 Core logic: The HDD industry has an oligopoly structure with CR3 over 90% (Seagate, Western Digital, Toshiba), with stable pricing power but obvious cyclicality (4-5 year fluctuations). HDD still dominates in high-capacity storage (data centers). Competitive barriers come from economies of scale (40%+ production share, 10-15% lower unit costs than competitors), 1000+ storage technology patents (e.g., HAMR hard drives), and high switching costs for enterprise customers (migration costs exceed millions of dollars). Profits mainly come from HDD (70% of revenue), with SSD accounting for 30%. HDD gross margin is 30%, SSD 40%, relying on high turnover for profitability. Growth drivers are HAMR technology (capacity increased to 30TB+, new product revenue up 15% YoY) and cloud storage demand (enterprise demand up 20% YoY).

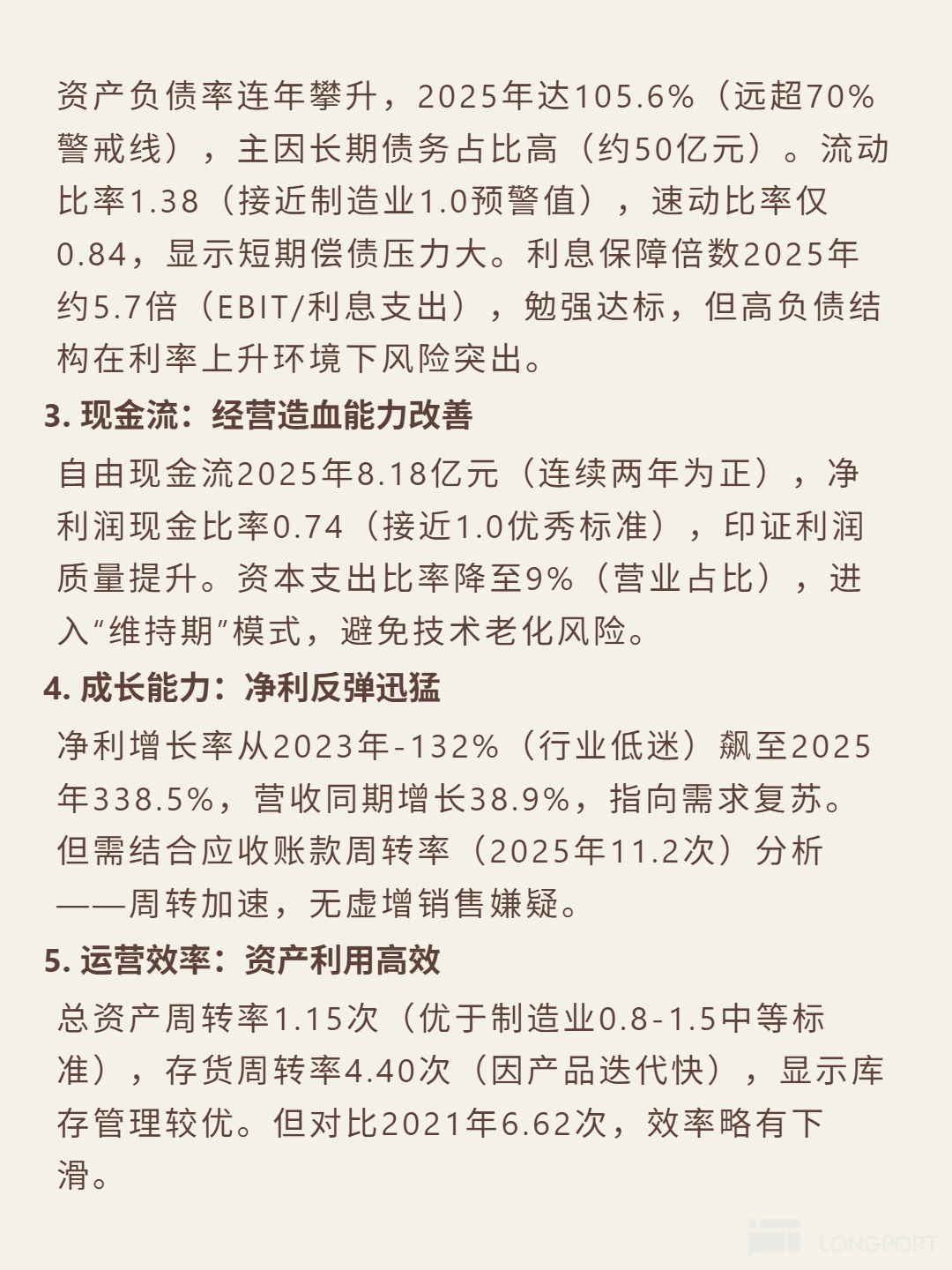

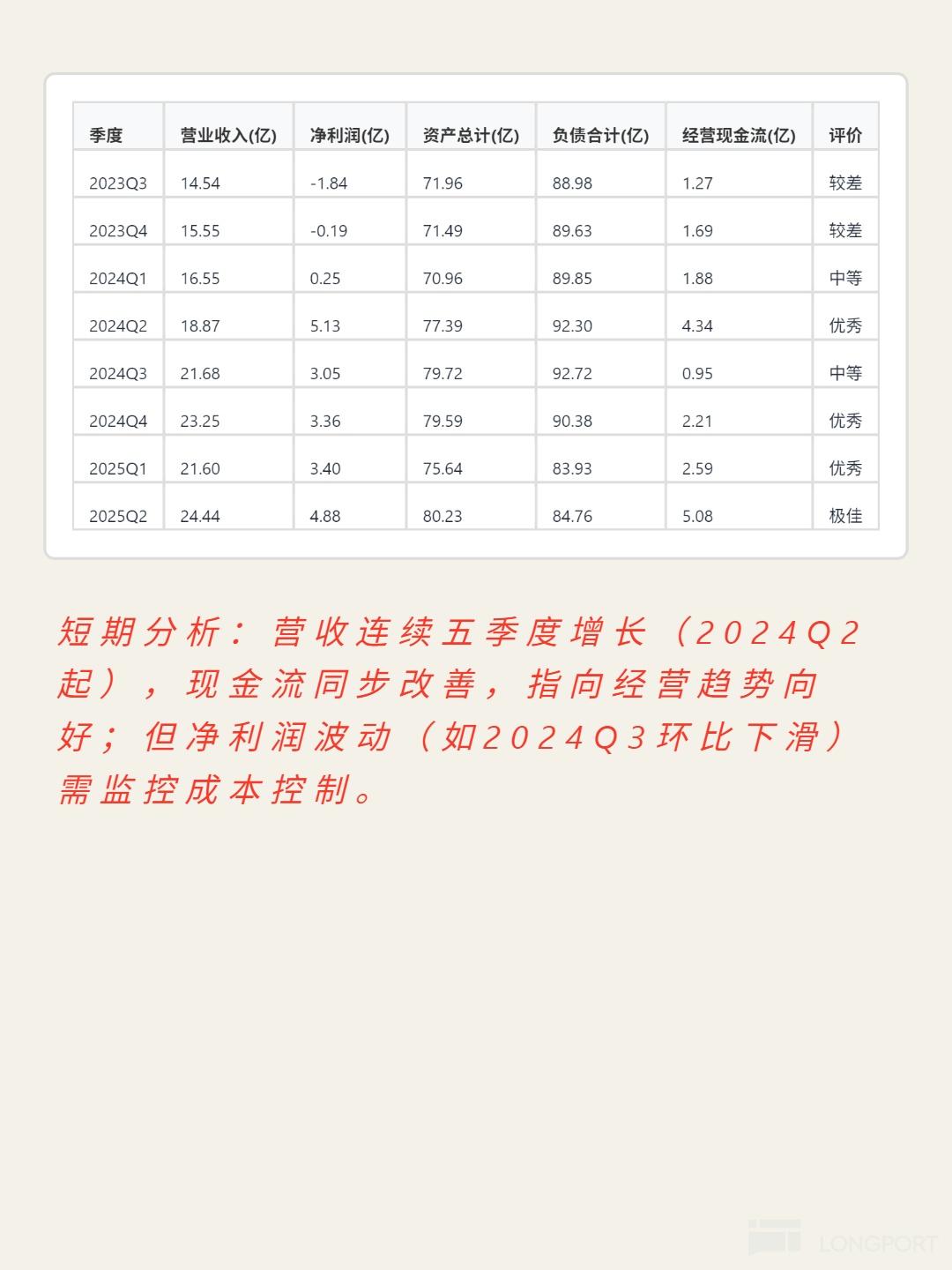

📈 Financial highlights: FY2025 gross margin 35.2%, net margin 16.1% rebounded significantly, net profit up 338.5% YoY, revenue up 38.9%. However, the debt-to-asset ratio is 105.6% (long-term debt ~$5B), current ratio 1.38, quick ratio 0.84, indicating short-term debt pressure. Free cash flow $818M (positive for two years), net profit cash ratio 0.74, profit quality improved. Revenue grew for five consecutive quarters, 2025Q2 net profit $488M (best quarter), but ROE -151.1% shows high debt drags shareholder returns.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.