Waste Connections Inc 4000 字深度研报

$Waste Connections(WCN.US)$Republic Services(RSG.US) Research on Waste Connections, the third-largest waste management company in North America, whose core value lies in "essential demand + consolidation," but high debt risks require caution.

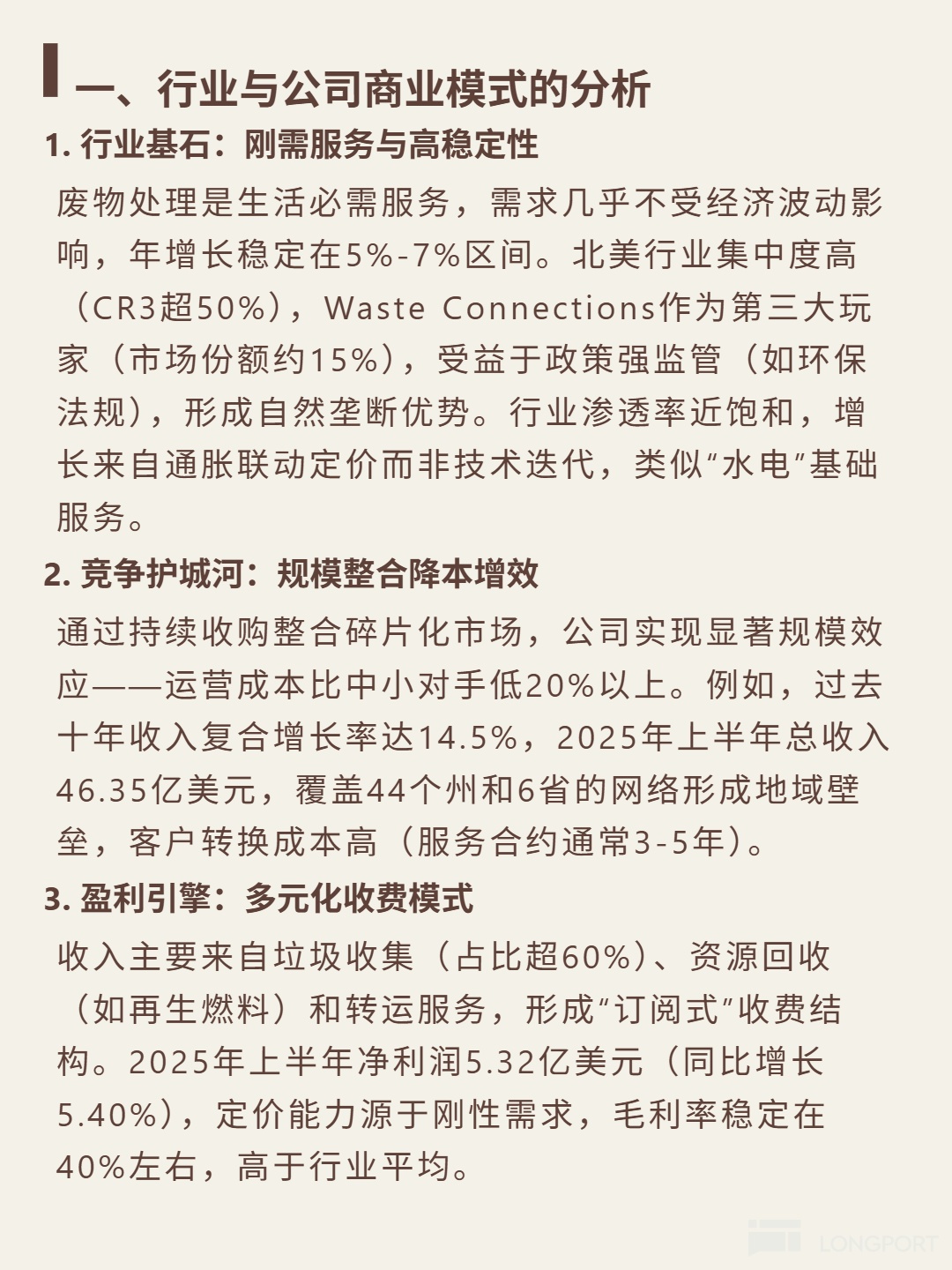

🎯 Core logic: Waste management is an essential service, with annual demand growth of 5%-7% unaffected by economic fluctuations, similar to the stability of "utilities." The company consolidates a fragmented market through continuous acquisitions (covering 44 U.S. states and 6 Canadian provinces), with operating costs 20%+ lower than smaller competitors, high customer switching costs (3-5-year contracts), and strong regulatory policies creating a natural monopoly, holding ~15% market share. Revenue primarily comes from waste collection (>60%) and recycling, with a stable subscription-based fee model.

📈 Financial highlights: 10-year revenue CAGR of 14.5%, H1 2025 total revenue of $4.635B (+7.28% YoY). 2024 gross margin at 41.79% (vs. 39.83% in 2020), but dropped to 29.35% in Q2 2025; 2024 net margin at 6.92%, down from 11.59% in 2022. Positive free cash flow for 5 consecutive years, reaching $1.173B in 2024, with a cash conversion ratio of 3.6 (high efficiency). 2024 debt-to-asset ratio at 60.34% (approaching industry warning level), current ratio at 0.65 (high short-term debt pressure).

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.