Likes Received

Likes Received Posts

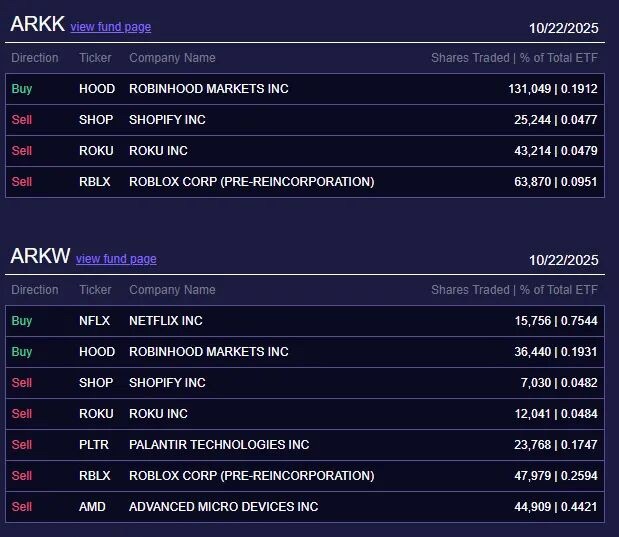

PostsNuclear energy stock KOLO fell -13.68%, bought $21.3 million HOOD, sold $10.3 million AMD

Today was another day of steep declines, with the Nasdaq down 0.93%, the S&P 500 down 0.53%, and the Dow down 0.71%. Nuclear energy stocks, which had been opening higher all last week, plummeted, with OKLO dropping 13.86% in a single day. The trigger was market concerns over the company's valuation bubble, leading to a reassessment of the entire market, though this is just one specific factor among others.

A look at the tech sector shows it didn't fall much, with stocks like Google and Facebook holding up well. Microsoft even saw a slight rise, likely boosted by other collaborations, and it's already moved past my cost price. AMD's decline this round was due to market concerns over software export sanctions to China, causing a pullback. As Nvidia's perennial runner-up, it just needs to follow along.

Cathie Wood bought $21.3 million worth of HOOD today. Cryptocurrencies have been weak lately, dragging down related stocks. Earnings are due on November 5, and institutions predict they'll exceed expectations. At this price, it's indeed somewhat attractive.

She also bought $17.6 million worth of Netflix, which plunged over 7% at the open and extended losses to 10% by the close after reporting Q3 earnings far below expectations and cutting full-year guidance. She bottom-fished $2.3 million worth of ARCT, which dropped 50.17% last night. Both stocks saw sharp single-day declines but have started to inch up.

Today's sales were more substantial: $15 million worth of RBLX, $5.2 million of ROKU, $5.2 million of SHOP, $4.2 million of PLTR, $1.4 million of ADPT, and $10.3 million of AMD.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.