Orders

Orders Traded Value

Traded ValueThe great repricing: from fiat currency to Bitcoin

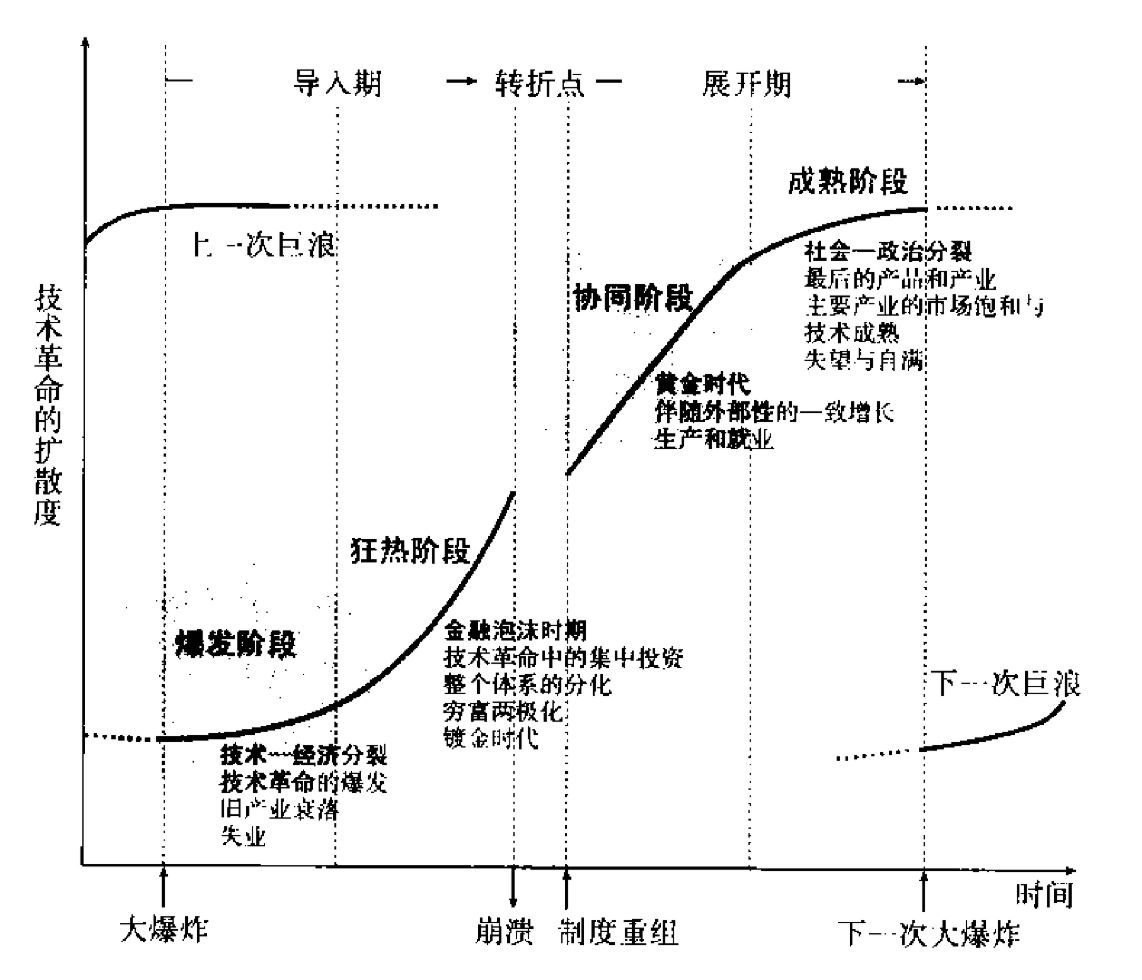

Bitcoin is currently at the beginning of its frenzy phase, with each phase lasting 10 years. Bitcoin was born in 2009, the explosive phase was 2010-2020, the frenzy phase is 2020-2030, the synergy phase will be 2030-2040, and the maturity phase will be 2040-2050.

The U.S. always treats "printing money to solve problems" as a universal formula, having long ago offshored its manufacturing to China while positioning itself as the "world's reserve currency printer." After the decoupling of the U.S. dollar from gold in 1971, it completely broke free from material constraints, piling up $37 trillion in debt. In September, it even boasted of the "largest monthly surplus in history" using accounting tricks like "negative spending," which lacks even a clear definition.

Some shout, "The U.S. is about to collapse." This has been said for decades, but how could such a massive economy fall so easily? They excel at "creating narratives when they can't create productivity." After all, it's not the elites who lose—it's ordinary individuals. Doctors stay up late studying central bank policies after surgeries, teachers monitor exchange rate fluctuations after preparing lessons, and even young people have to rely on OnlyFans to scrape together a down payment for a home. The value of labor is completely diluted by the flood of printed dollars. This is the real risk for ordinary people.

America's game plan? The same old bluffing. One moment, they threaten 100% tariffs on Chinese goods; the next, they claim to hold the initiative. And the result?

China controls heavy rare earths and the world's top manufacturing capacity. Most of what the world eats and uses is made in China. America's tariff threats lack real weight—otherwise, they wouldn't be rushing to restart trade talks with China the moment they make a statement.

In this tug-of-war, Bitcoin's reaction is the most honest—falling from $120,000 to $105,000, then rebounding to $114,200, with a market cap nearing $2.3 trillion, just 9.4% shy of its all-time high of $126,000. Don't mistake this volatility for weakness. Bitcoin is a "truth machine." It isn't controlled by any nation, using price to reveal the reality of geopolitical games and fiat money printing—far more reliable than U.S. Treasury reports. This is how it functions.

Who dares call Bitcoin a small-time game for retail investors now? JPMorgan—one of America's largest banks—directly treats Bitcoin as collateral on par with Treasury bonds and gold. IBM has launched Bitcoin custody and payment services for U.S. institutions. Even Russia has authorized Bitcoin for foreign trade to bypass dollar sanctions.

This isn't a coincidence. The world is searching for a "neutral reserve asset." The dollar and euro have been weaponized for sanctions, and everyone fears their settlement channels could be cut off. Bitcoin, requiring no endorsement, flows globally 24/7, perfectly filling this gap. The U.S. and China are fighting over the 21st century's reserve collateral, and Bitcoin has quietly positioned itself at the core of this competition—not due to hype, but because it solves problems fiat can't.

For ordinary people, don't blindly follow America's narratives into anxiety. The key is protecting your wealth. In 10-20 years, people will use Bitcoin as collateral to borrow fiat for bills, daily expenses, or even business investments—without selling their Bitcoin. You can hold Bitcoin as its value gradually rises (there are only 21 million, unlike endlessly printed dollars) without being forced to liquidate for living costs. This is Bitcoin's most practical value: it locks in your labor's worth, shielding it from fiat inflation. No longer will your earnings quietly depreciate the moment they hit your account just because the Fed printed another batch.

Don't chase America's false narratives or panic over Bitcoin's short-term swings.

First, allocate a fixed percentage of monthly income to Bitcoin, then use the rest for living expenses. Don't wait to "save enough"—inflation won't wait. Hold onto your Bitcoin; don't let fiat tie you down or force painful sales to pay bills.

Hold long-term. Watch institutions and nations gradually integrate Bitcoin into the financial system. Watch the dollar slowly lose its hegemony. We can't change the rules, but Bitcoin ensures we aren't the ones being harvested. The next monetary era won't be won by nations that print money—it'll be won by those who hold real value. And Bitcoin is the key ordinary people can grasp.

$iShares Bitcoin Trust ETF(IBIT.US) $Strategy(MSTR.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.