LMND StockPro

LMND StockPro Total Assets

Total AssetsWas ALL IN LMND really a spur-of-the-moment decision?

This article will bring the author's perspective to review the emotional and rational journey of going ALL IN on LMND.

Insurance is boring but huge. The insurance industry is not appealing—it's not liked by consumers, nor is it favored by retail investors. Why? Because it's dull. It lacks the grand vision of disrupting the future social structure like autonomous driving or embodied AI, nor does it have the vast potential of commercial space or quantum computing. For the insurance sector, there are only cold numbers on financial statements. Retail investors don’t like numbers; they prefer stories. But the insurance industry is an enormous market, accounting for 7% of global GDP, a trillion-dollar track. The one thing the insurance industry never lacks is money, from Buffett’s GEICO to Progressive—these industry giants are all multi-billion-dollar behemoths, ruthless money-making machines.

At the beginning of 2025, I happened to hear the name LMND, which claimed to use AI to disrupt the insurance industry. At the time, I was dismissive, especially seeing its chronically sluggish stock price and bearish technical patterns. A "main uptrend" triggered by a shareholder meeting and better-than-expected earnings didn’t seem particularly noteworthy. But gradually, this name started popping up frequently in discussions by high-conviction bloggers, and I began to seriously research the company. Despite still in the red, what caught my eye was management’s accuracy in forecasting performance—the so-called "corporate integrity." Over a dozen consecutive quarters of beating expectations gave retail investors a quantifiable way to predict the company’s fundamentals over the medium to long term. So, I started digging into LMND’s valuation.

Many people take one look at LMND’s financials and run: a P/S ratio of 5-8x, P/B over 10x, and negative EBITDA. If you only focus on the current losses, the stock seems outrageously "expensive." But this is precisely where the gap in perception lies—the market is still looking at it through the rearview mirror of traditional metrics, while to those of us who’ve done the deep dive, LMND isn’t trading on today’s earnings per share but on the rapidly crystallizing "Terminal Value."

It’s like when Amazon was still losing money selling books—were you staring at its losses or its terrifying flywheel effect?

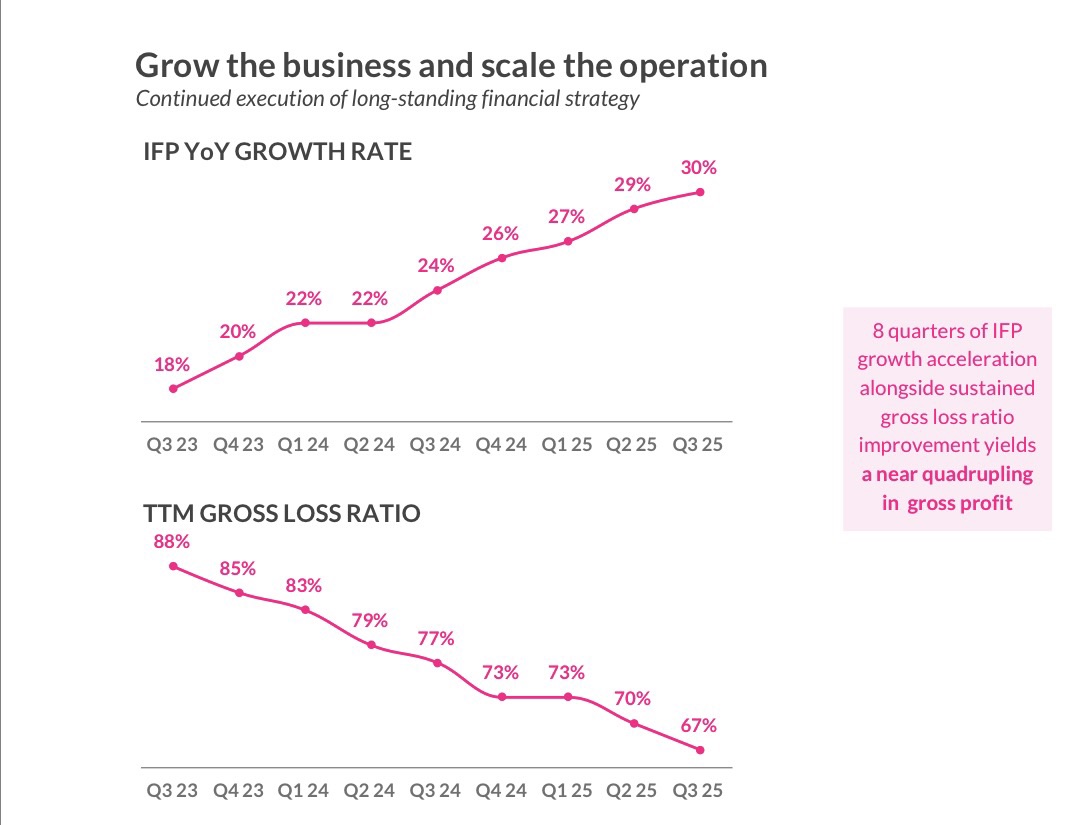

Today’s LMND is experiencing its "flywheel moment." According to the latest Q3 2025 data, its car insurance business is exploding at an unexpected pace. In-force premiums (IFP) for car insurance grew 40% YoY to $163 million. Even more impressive, over half of new car insurance customers came directly from existing renters or homeowners. What does this mean? It means customer acquisition costs (CAC) are nearly zero! These "bundled" existing customers are not only stickier but also have lower loss ratios, directly reducing the overall risk pool.

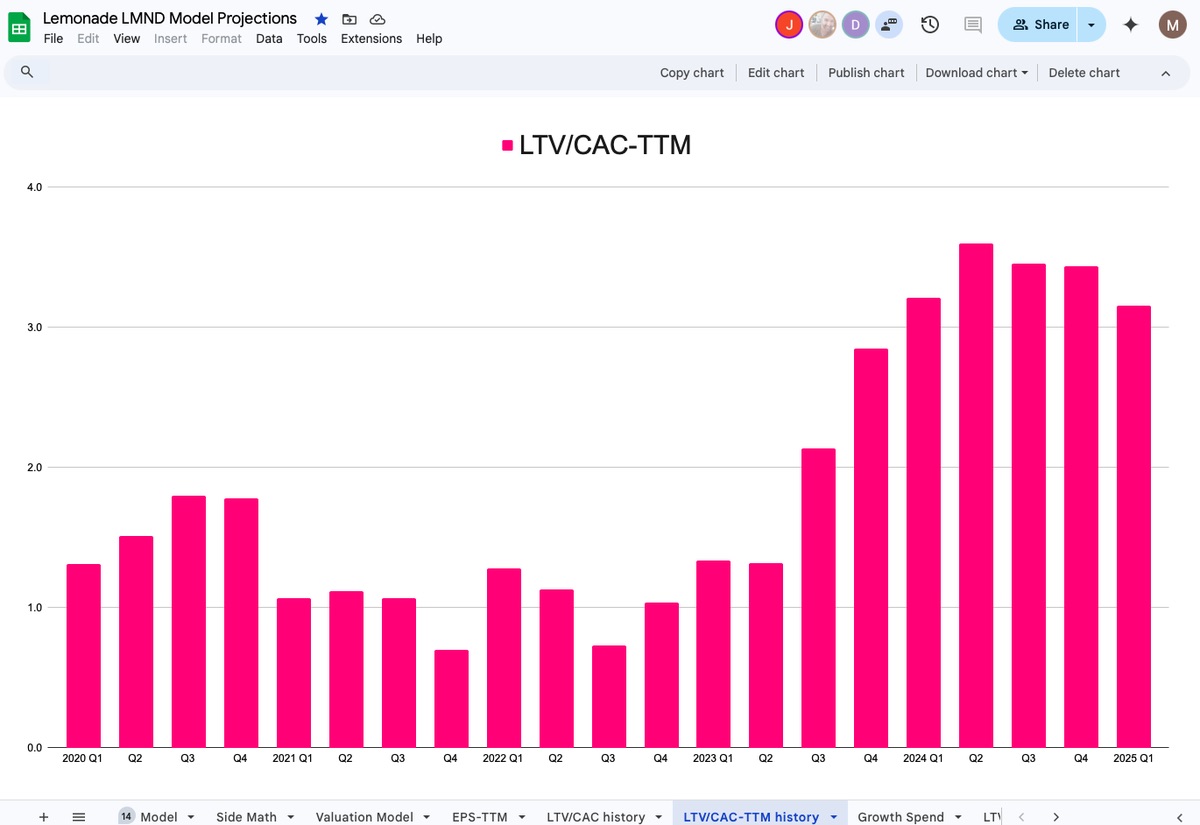

This is the logical validation we’ve been waiting for: as marketing expenses are amortized over longer customer lifetimes (LTV), CAC structurally declines, and the LTV/CAC ratio keeps expanding. Even management has hinted that the cash-burning growth phase may have peaked.

Then there’s the once-criticized loss ratio, now decisively trending downward, forming a beautiful smile curve. Q3’s total loss ratio hit a record low of 62%. What does this show? That the underwriting and dynamic pricing system powered by AI is actually working—not just PowerPoint hype. According to Paperbaginvestor’s analysis, this improvement stems from AI-optimized risk pricing, with loss adjustment expenses (LAE) dropping from 7% to 3.5%, potentially falling further to 2%, directly boosting gross margins to 41% (Q3 2025 data).

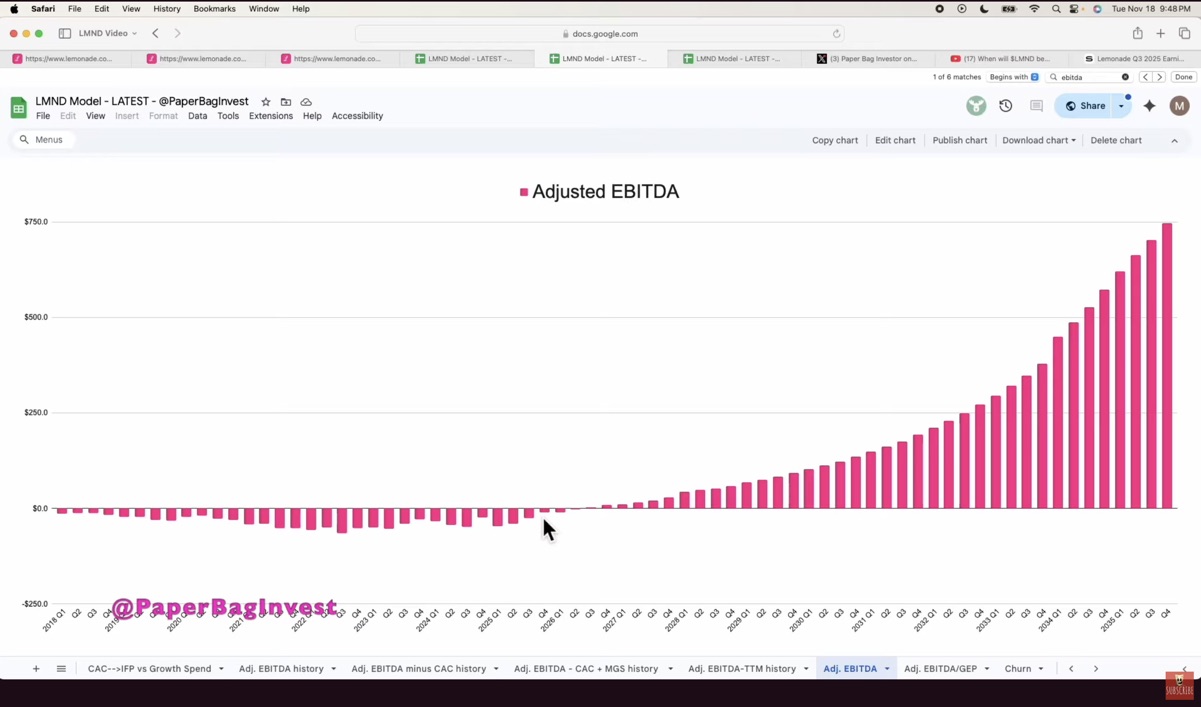

Given these fundamental shifts, I didn’t pull numbers out of thin air but built two discounted cash flow (DCF) + terminal value models. The logic is simple: discount the company’s future cash flows back to today. Inputs include revenue projections (based on IFP growth), margin assumptions (from losses to profitability), discount rates (reflecting risk), and terminal value (perpetual growth or multiples).

Model 1: Conservative Estimate (5-Year DCF + Terminal Value)

This is my baseline logic to convince myself to "hold on."

Here, I assume LMND turns EBITDA-positive by 2026—not just management’s promise but a trend supported by reinsurance ratios dropping from ~50% to ~20% and more premium revenue recognized as GAAP revenue. Using company guidance and Paperbaginvestor’s conservative scenario, given management’s strong execution, we assume 30% IFP CAGR, 85-87% customer retention, and EBITDA margins eventually reaching 25% due to AI-driven efficiency.

2030 Free Cash Flow = $789M

Terminal Value (from 2030) = $789M × (1+3%) ÷ (9% - 3%) = $13.545B

Discounting 2026-2030 cash flows + terminal value to today (9% discount rate):

PV = $101M (first 5 years) + $13.545B/1.09⁵

= -$83M + $63M + $275M + $497M + $685M + $11.75B ≈ $9.813B

Fair value: $135, range $130-$150.

This means even at today’s ~$74 share price, ignoring the "dream" and just looking at the business, the margin of safety is sufficient. That’s why, even if some veteran investors find the current valuation uncomfortable, I believe the underlying unit economics have never been healthier: LTV/CAC >3, 85% ADR, supporting sustainable growth.

Model 2: Optimistic Estimate (10-Year DCF — Paperbaginvestor’s View)

Of course, investing requires some imagination. Stretching the horizon to 10 years and adopting Paperbaginvestor’s (a prominent LMND bull) forward-looking logic, the story changes entirely.

Here, we’re betting on "escape velocity."

Assume LMND achieves its ambitious goal—$10B in IFP. This isn’t fantasy; the insurance industry is a multi-trillion-dollar space, where $10B is pocket change for giants but represents multi-bagger potential for LMND. Paperbag projects $10B IFP by 2033, $14.5B by 2035 (30% CAGR), driven by car insurance expansion ($300B market) and global penetration.

Projections:

IFP growth: 30% to $14.5B by 2035.

Revenue: ~$10B (2035).

EBITDA margins: rising to 25% (AI cost advantages, near-zero marginal cost, LAE at 1-2%).

FCF: ~$1.5B by 2035 (post-tax, low capex).

Discount rate: 10% (increasing certainty, per Paperbag’s long-term view).

2035 Free Cash Flow = $11.72B × 25% = $2.93B

Terminal Value (from 2036) = $2.93B × (1+3%) ÷ (10% - 3%) = $43.11B

Discounting 2026-2035 cash flows + terminal value to today (10% rate): PV = $5.29B (first 10 years) + $43.11B/1.10¹⁰ = $1.128B (first 5) + $4.16B (next 5) + $16.62B ≈ $21.91B

10-year super-compounding DCF implies intrinsic value of ~$301.4.

Fair value: $250-$350/share.

If this plays out, today’s growth is just the appetizer. The real structural tailwinds will blow well past 2030. Under this optimistic model, using lower discount rates (as certainty increases) and higher terminal growth, the numbers far exceed the earlier $180—a figure that could elevate early holders to new wealth tiers. Paperbag stresses that with execution, LMND could transform into a SaaS-like tech giant, trading at multiples comparable to Progressive ($150B market cap).

Final Thoughts

So, is ALL IN LMND gambling?

For those fixated on next quarter’s earnings, yes. But for those who grasp the combo of "car insurance scaling + cross-selling + AI cost cuts," it’s a precision strike amid others’ panic.

The market is shifting from "Will this ever work?" to "How big can it get?" At this inflection point, I choose to trust the math and the AI-driven insurance future unfolding. Between cold numbers and 热血 stories, I’ve found my own certainty.

$Lemonade(LMND.US)$Strategy(MSTR.US)$Coinbase(COIN.US)$Circle(CRCL.US)$Alphabet - C(GOOG.US)$Unitedhealth(UNH.US)$NVIDIA(NVDA.US)$Rocket Lab(RKLB.US)$Tesla(TSLA.US)$Oscar Health(OSCR.US)$Root(ROOT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.