AST SpaceMobile Inc-A 4000-word in-depth research report

$AST SpaceMobile(ASTS.US)$Iridium Comm(IRDM.US) $Globalstar(GSAT.US) Research on AST SpaceMobile reveals its attempt to pioneer the "direct satellite-to-cellphone" communication market, a niche yet to be conquered. Currently in the "zero-to-one" validation phase, it hasn't proven sustainable profitability.

🎯 Core thesis: Provides low-Earth orbit satellite-to-cellphone connectivity, targeting regions with weak terrestrial networks (Americas, Latin America, Africa), aiming to cover 3B underserved users. Sole FCC-approved operator using 2.5GHz mid-band, partnered with AT&T/Vodafone (19 carriers total) via "satellite-as-a-service" revenue-sharing. BlueWalker 3 test satellite demonstrated two-way calls/data, leading in tech validation. Outsourced manufacturing (Airbus) and launches (SpaceX), reliant on ground gateways.

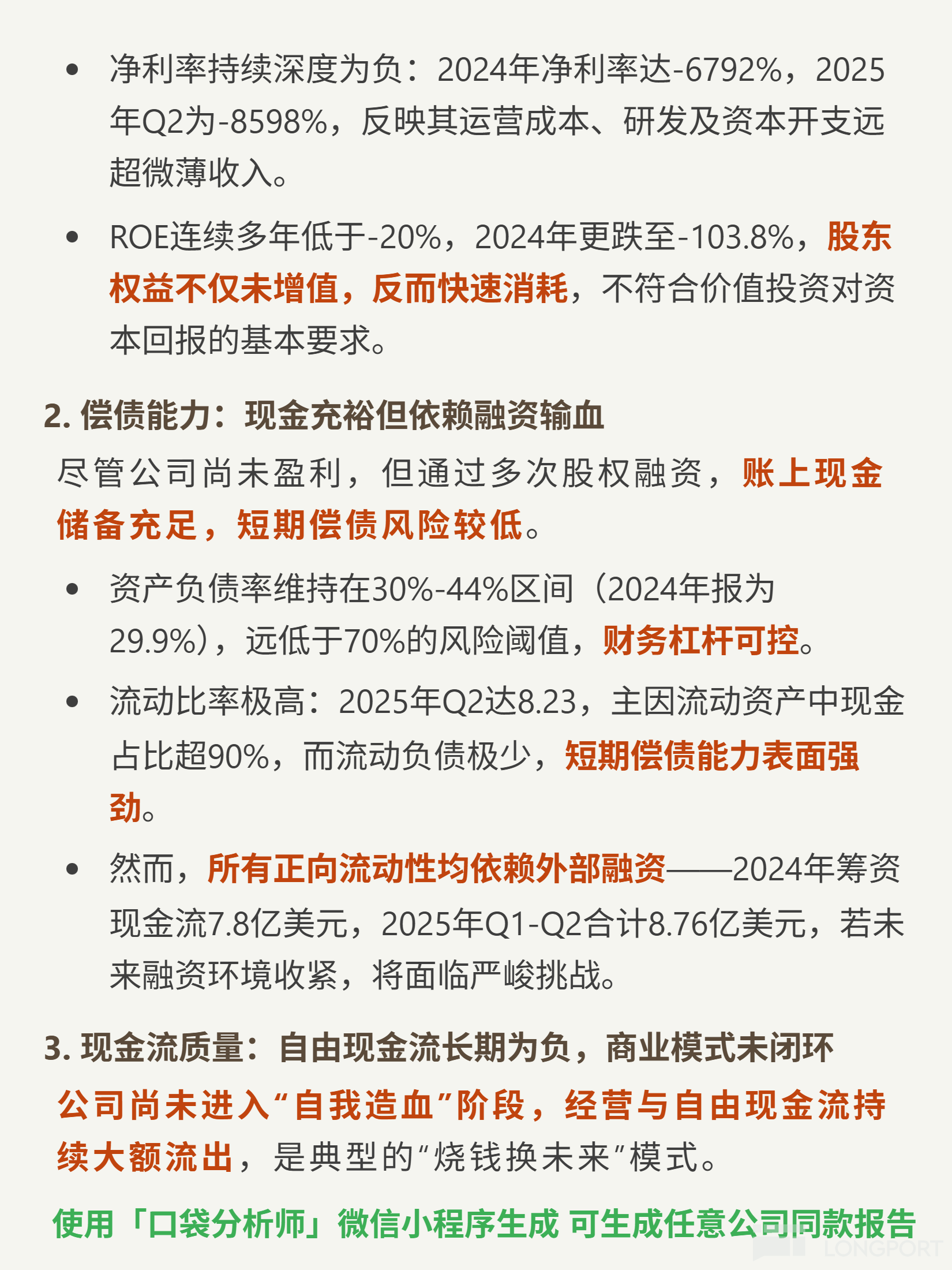

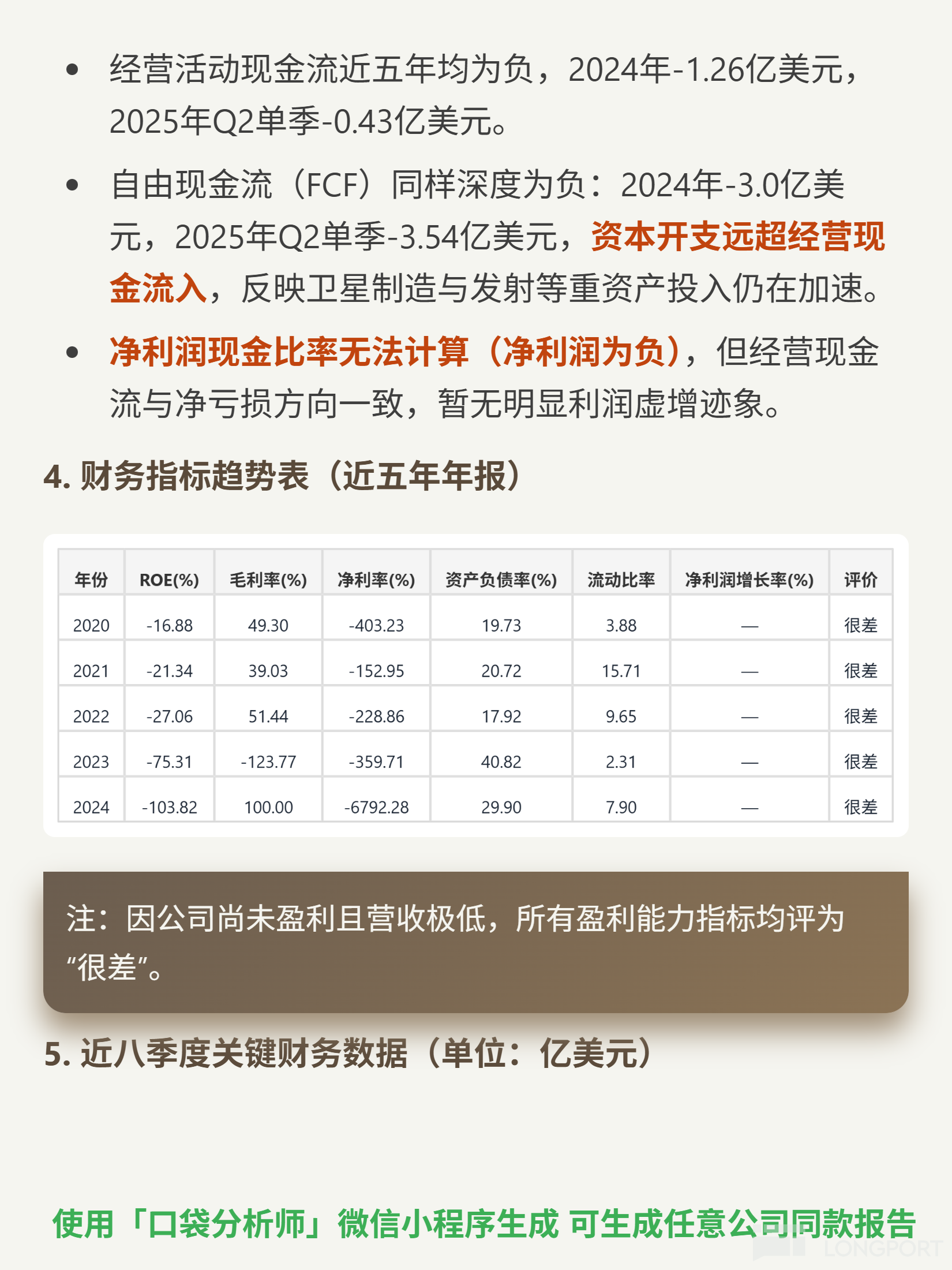

📈 Financials: Pre-revenue with minimal earnings ($4M 2024 revenue, 100% gross margin from low base, -6,792% net margin, -103.8% ROE). 29.9% debt-to-equity, cash-rich but funding-dependent. Negative operating cash flow (-$126M 2024, -$43M 2025Q2). 0.0067 asset turnover (2024) shows low capital efficiency.

🔍 Risks: Valuation purely future-expectation-driven. Satellite comms sector sentiment reversal may trigger refinancing risks/cash crunch. Assets yet to generate revenue, operational inefficiency.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.