Rate Of Return

Rate Of ReturnLululemon:一个绝佳的价值投资机会

$Lululemon(LULU.US) has fallen 50% this year, but I see an excellent entry opportunity in it. Here's why.

1. Saturation in North America is a fact, but not the end

The decline in Lululemon's stock price this year was mainly due to the continued slowdown in revenue growth in North America, which even turned negative in the last quarter. Coupled with uninspired designs and increasingly strong competitors, its future looks very uncertain.

Although the era of high growth in North America is over, it doesn’t mean Lululemon is doomed.

The market’s biggest mistake is applying the growth expectations of a startup to a mature company. For example, we don’t expect Apple or McDonald’s to grow 30% annually, but as long as they can generate stable cash flow and modest growth, they remain massive profit machines. According to Lululemon’s financial data, it clearly falls into this category, generating substantial cash flow annually, with management actively repurchasing shares.

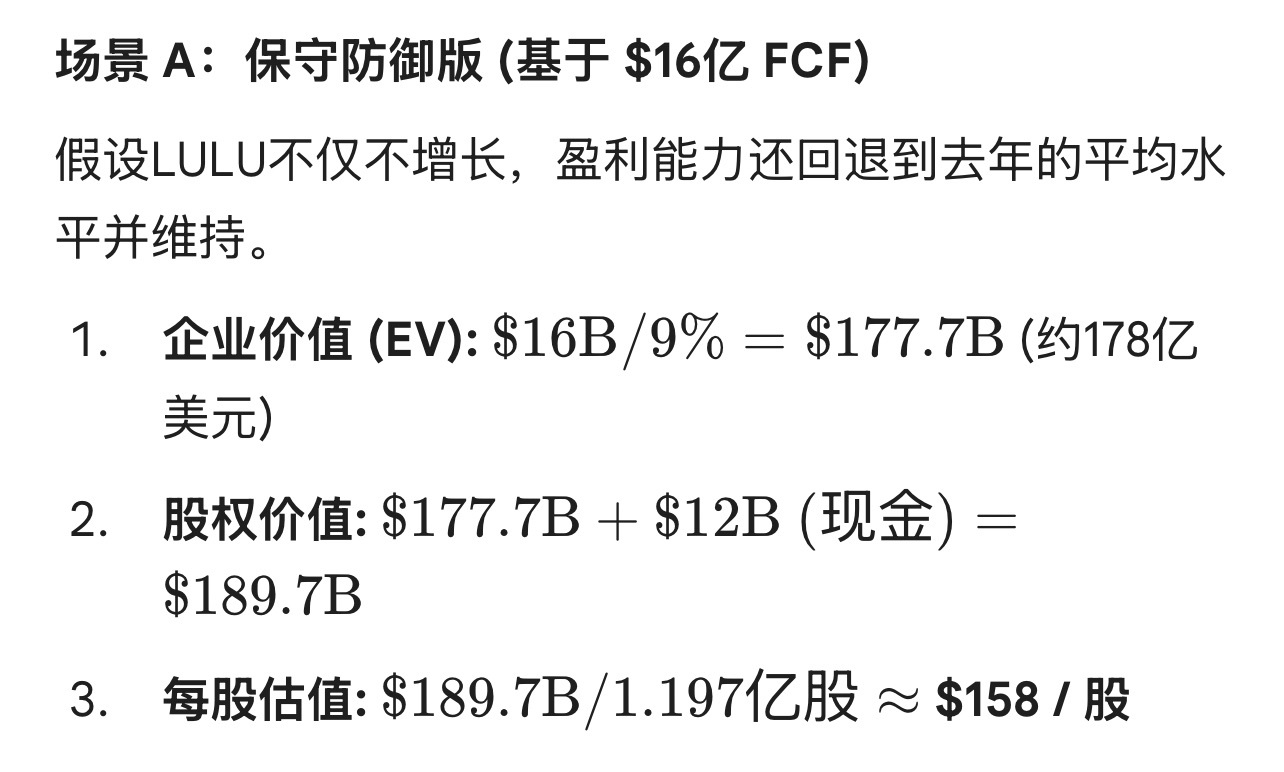

Second, the market has already priced in the worst-case scenario. If you bought Lululemon at over $300, that’s indeed concerning, but now it’s only at $190 with a P/E of just 12. Even the famous defensive stock$Walmart(WMT.US) has a P/E three times higher than Lululemon’s, showing how undervalued it is. Looking at Lululemon’s zero-growth DCF model, even if it stops growing entirely, the stock price should still be around $160, meaning a maximum downside of about 15% from current levels. That’s the limit. Unless Lululemon’s total revenue starts declining—which I’ll explain later is impossible.

The Asia-Pacific market is gradually growing and now accounts for 30% of total revenue, with annual growth in the high double digits. There’s clearly significant room for growth in this region. Over time, as Asia-Pacific’s market share increases, Lululemon’s total revenue will depend more on this region than North America. Of course, this is the ideal scenario. Realistically, looking at the latest earnings report, despite a 4% decline in comparable sales in North America, Asia-Pacific still drove total revenue growth to +7%, which is impressive.

Some might ask, what if North America continues to decline? Note that North America is currently just saturated, not declining.

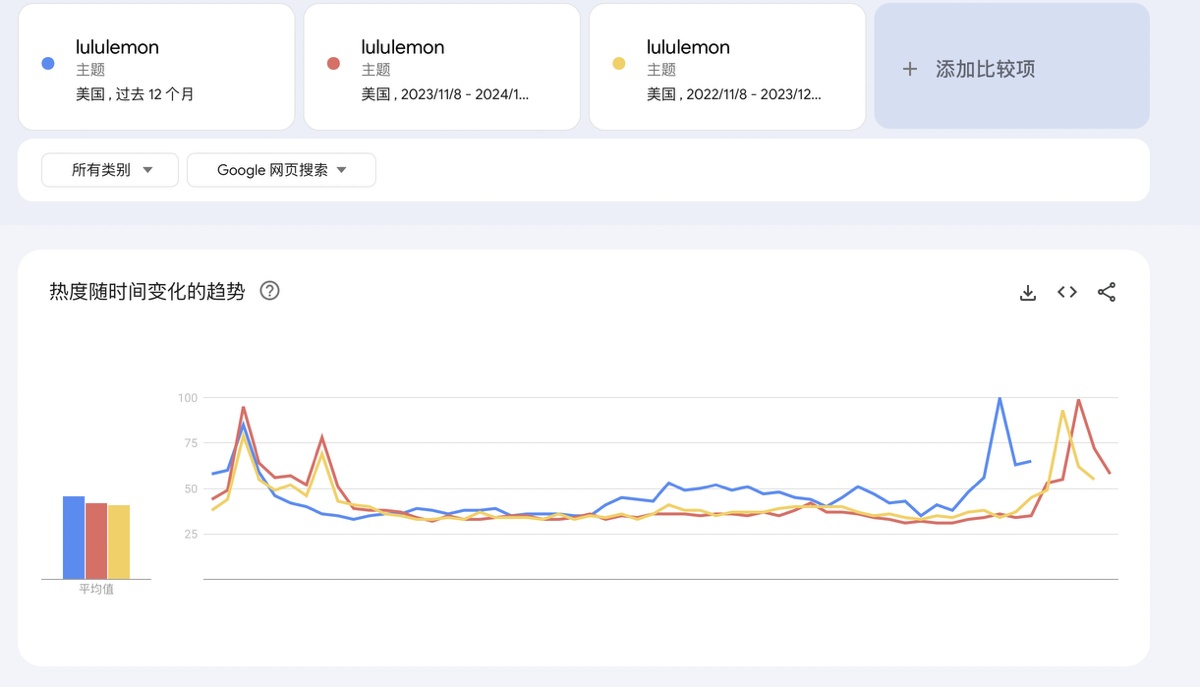

This is Lululemon’s search popularity in the U.S. over the past three years. This year, it hit a new high, with an average annual popularity of 46, compared to 42 and 41 in the previous two years. Not a huge jump, but enough to show that enthusiasm for Lululemon hasn’t waned. I believe this metric is particularly relevant for Lululemon because it’s a massive D2C (direct-to-consumer) company, where traffic can largely reflect its operational performance. Globally, the numbers for the past three years are 53, 44, and 38, showing encouraging growth. Recent Black Friday and Thanksgiving promotions also set new traffic records, creating short-term opportunities.

In summary, Lululemon has very limited downside and significant upside potential.

2. Rock-Solid Fundamentals

This is the biggest reason I’m investing in Lululemon—its fundamentals are incredibly strong.

—Gross Margin: Top-Tier Pricing Power

Lululemon’s gross margin has consistently stayed at a high level of 58-59%, nearing 60%. This is its most formidable moat. While the market claims its moat is shallow due to lack of innovation, this pricing power is its real moat. Core consumers are willing to pay a premium for its fabrics and brand. If you look at its gross margin trends over the years, you’ll see it’s actually increasing.$Nike(NKE.US) and$Adidas(ADDYY.US) have gross margins around 43%, while lower-tier brands like Gap, which claim to be on par with Lululemon, have laughable P/E ratios of 35-40.

Many criticize Lululemon for discounting and inventory issues, but a closer look at its earnings shows that even under inventory pressure (which isn’t actually severe—the high inventory in the latest report was for Black Friday and Christmas promotions), its gross margin remains at an impressive 58%. This demonstrates its control over the supply chain and pricing power with consumers, placing it at the top of the industry pyramid.

—Terrifyingly High but Stable ROE

Lululemon’s return on equity (ROE) has consistently stayed in the ultra-high range of 30-40%. Over the long term, a stock’s return tends to converge with its ROE, and Lululemon is a top-tier stock that achieves this without leverage. In the A-share or U.S. markets, the only companies that consistently achieve this are$Apple(AAPL.US) and$Moutai(600519.SH) —companies of that caliber. If the market is selling you a company with a 30% ROE at a P/E of 12, that’s a classic case of emotional mispricing.

—Excellent Balance Sheet and a “Cash Cow”

In today’s volatile environment, this provides immense safety and room for error.

Lululemon has $1.1-1.2 billion in cash and equivalents on its books, with zero interest-bearing debt. This means all its expansion comes from its own cash flow. This situation gives it unlimited confidence to repurchase shares during downturns or expand into new markets.

—Net Margin Crushes Competitors

Lululemon’s net margin typically hovers around 15-17%, while traditional apparel retailers usually have net margins of 5-8%. Famous giants like$Nike(NKE.US) (6-10%),$Adidas(ADDYY.US) (3-5%), and$GAP(GAP.US) (4-6%) can’t compare. In other words, after accounting for rent, labor, and marketing, Lululemon still makes a net profit of $17 for every $100 in revenue. This extreme operational efficiency stems from its unique D2C model—it doesn’t share profits with middlemen or distributors, making it a highly efficient business model.

3. Miscellaneous Positives:

-Famous short-seller Michael Burry, who shorted the housing bubble and recently shorted$NVIDIA(NVDA.US) and$Palantir Tech(PLTR.US) , has Lululemon as his second-largest long position. He’s a man who only pulls the trigger when the odds are overwhelmingly in his favor. Although he’s missed the mark in recent years (e.g.,$Tesla(TSLA.US) ), his calls have still been validated by the market to some extent. For his long positions, we can at least expect thatLululemon’s bottom is in.

-Lululemon rose over 3% abruptly last Friday, hitting a post-earnings high. Combined with the upcoming earnings report this Thursday and the record Black Friday traffic data, I believe some funds are already betting on Lululemon’s latest earnings. This is a positive, but potential buyers should be cautious—if too much money is front-running the report, there’s a risk of a “sell the news” reaction post-earnings. Of course, based on my and Michael’s analysis, $160 should be the bottom barring any negative surprises. So, at the right odds, buying isn’t a bad idea.

-Lululemon’s management is quite the character, constantly crying wolf. Over the past 20 quarters, Lululemon’s management has consistently beaten their own guidance. You heard that right—100% of the time. In other words, their guidance isn’t a ceiling but a floor. This year is different, though. With North America saturated and consumer sentiment weak, management has been unusually conservative, perhaps too much so. The market reacted like a startled bird, pricing Lululemon as if it were in decline. So, as long as Q3 and Q4 earnings are even remotely normal, that’s a positive. Think of it as a student who usually scores 90 suddenly saying they’ll get 60—the market panics, but they’ll likely still score 75. Add in management’s aggressive buyback strategy (3.7% of shares retired in 2024, with even more buybacks due to the low stock price), and you see them happily buying while the market panics.

Conclusion:

Lululemon’s current price is very attractive, with both short- and long-term investment theses. If Q3 earnings guidance is decent, a valuation rebound to $250 would be normal. Long-term investors have even more to look forward to—if Asia-Pacific growth accelerates, Lululemon could easily be repriced as a growth stock again. I think this is why Michael Burry says Lululemon is a 3-4 year hold. With limited downside (around $160), Lululemon is a great choice. (The author’s strategy is quite aggressive, mostly long-term options. For those seeking just double-digit returns, the stock is a safer bet.)

$Invesco QQQ Trust(QQQ.US) $SPDR S&P 500(SPY.US) $Alphabet - C(GOOG.US) $Meta Platforms(META.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.