BMNR extreme value derivation 12.09

After the Japanese interest rate hike sell-off last Monday, cryptocurrencies rebounded quickly within 2 days, with ETH returning to the 3100 level. Expectations of a December rate cut and the new Fed chair's loose monetary policy have also made crypto a leading indicator of the rebound. BMNR's mNAV has also rebounded to 1.1+ after hitting bottom for 3 weeks. Recently, many comments mentioned the four-year cycle, and I’d like to share my perspective for reference:

1. I don’t agree with the four-year cycle theory. The core logic is that after entering 2025, the proportion of institutional holdings of both BTC and ETH has grown rapidly. From the launch in January 2024 to December 2025, U.S. spot Bitcoin ETFs have seen cumulative net inflows of $57 billion; BlackRock’s ETHA has also become its highest-earning ETF product this year. Institutional holdings will be more long-term, which will hedge against retail and traditional crypto panic selling. On this point, we can wait for the SEC’s 13f update in February 2026 to see whether institutions (JPMorgan, Goldman Sachs, Vanguard, BlackRock, etc.) that aggressively built BMNR positions in Q3 exited or added in Q4.

2. I believe ETH’s ecosystem position in traditional financial on-chain applications will lead it to an independent trend different from BTC, which has nothing to do with the four-year cycle.

Next, we’ll continue tracking mNAV for extreme value projections, with the next scheduled update on 12.15.

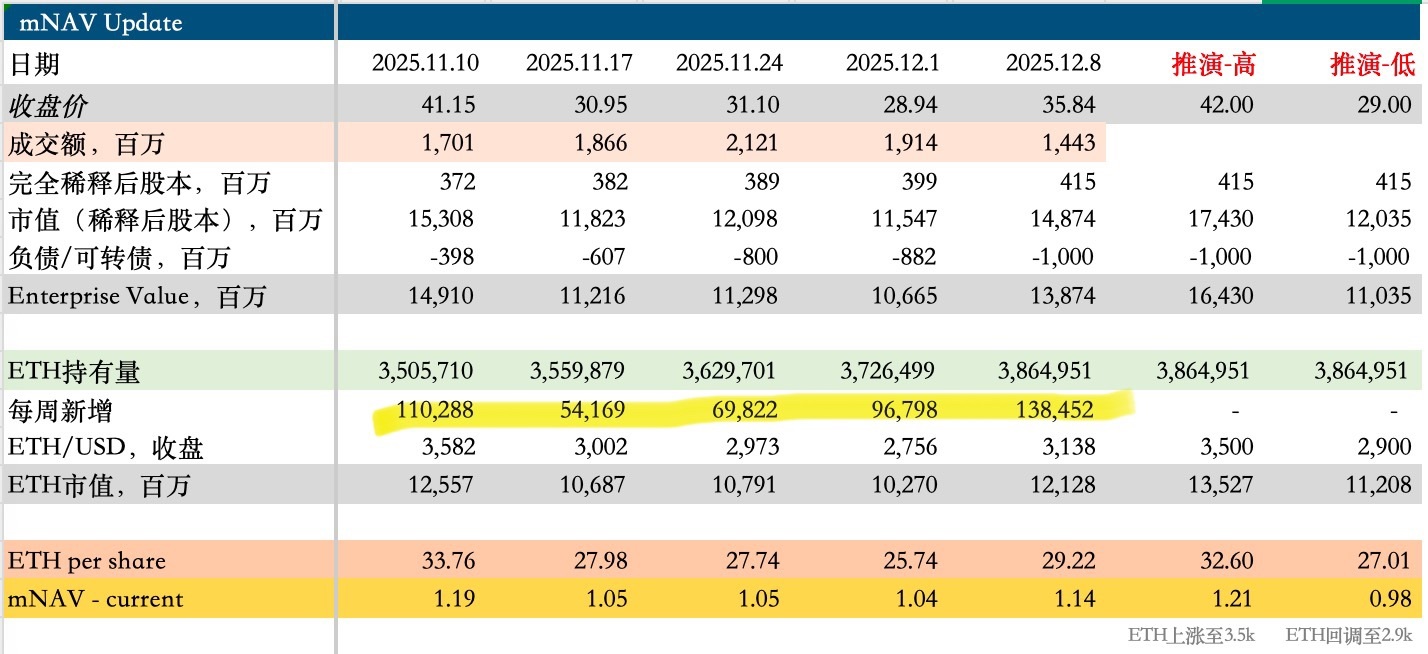

Core assumptions: This Monday, BMNR updated its coin accumulation progress, holding 3.86 million coins, with 138,000 added last week. mNAV rebounded to 1.14, and cash on hand grew to a record high of $1 billion. Last week, Tom Lee mentioned BMNR’s ETH accumulation strategy at a Binance forum. In early November, BMNR hired Tom DeMark as an advisor. DeMark predicted ETH would bottom in November and advised BMNR to slow its accumulation. As a result, BMNR’s accumulation dropped to 50,000 on 11.17, half of the previous week, but cash positions doubled. As ETH rebounded from the 2600 bottom, BMNR also accelerated accumulation, rising to 100,000 on 12.1 and nearly 140,000 last week. BMNR’s consistency in action will also boost confidence in the crypto market, and market participants influencing sentiment through their own impact.

Conclusion: If ETH rebounds to 3.5k, mNAV will rise to 1.2, corresponding to a stock price of 42; if ETH falls to 2.9k, mNAV will drop below 1, corresponding to a stock price of 29. The extreme range is 29~42.

Not investment advice.

$BitMine Immersion Tech(BMNR.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.