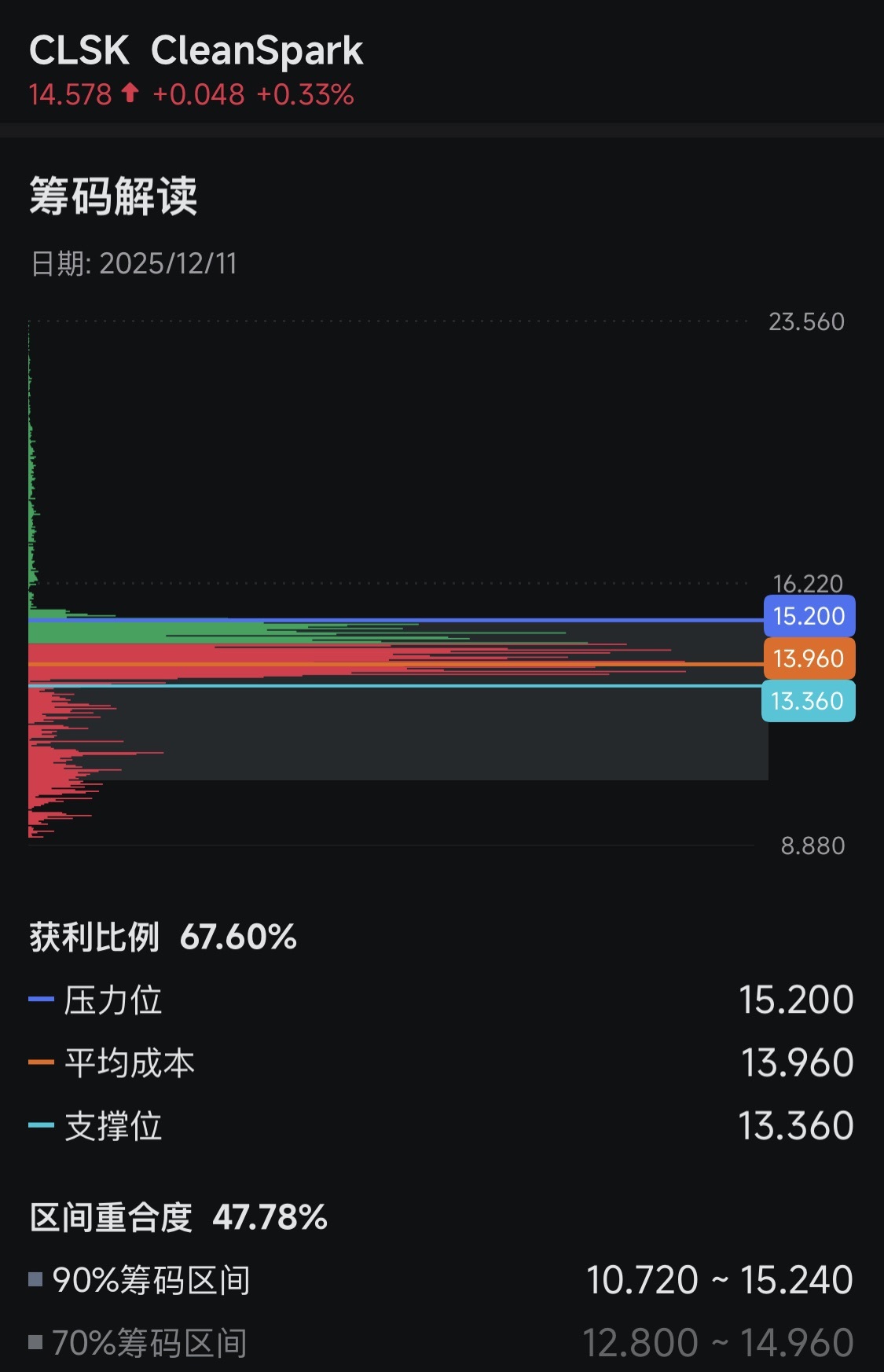

[82/100] Main force accumulation: The more concentrated the cost, the higher the control level

A key but often overlooked logic in chip theory: the more concentrated retail investors' costs are, the higher the degree of control by the main force.

Why does "concentrated retail costs = high control by the main force"?

1. The nature of retail investors: costs are inherently scattered

Retail investors lack discipline in trading:

- Some chase highs

- Some bottom-fish

- Some panic-sell

- Some hold long-term

- Some jump in midway

Thus, the chip structure formed by retail investors is inevitably "messy and scattered" and won’t concentrate in one cost zone.

If you see chips suddenly highly concentrated, it’s definitely not caused by retail investors themselves.

2. Chips can only concentrate under one condition: someone is "cleaning" and "locking" chips → the main force is in control

For chips to go from scattered → concentrated, two conditions must be met:

1. Low-frequency trading (chips don’t move around)

For chips to concentrate, holders must "stay stable."

Retail investors can’t do this; only institutions/the main force can repeatedly accumulate and hold at a certain price zone.

2. Price stability (the main force suppresses prices to accumulate chips)

The main force will, at a certain price zone:

- Absorb retail selling pressure

- Take back chips

- Prevent large price fluctuations

Gradually forming a chip peak.

This behavior is the so-called building positions → washing chips → locking positions.

Retail investors won’t "intentionally suppress prices" like this; only the main force will do this to acquire more chips.

3. A simple example to make it clear

Assume a stock’s price stays around $10,

And chips increasingly concentrate at $10.

Ask yourself:

Will retail investors repeatedly buy and lock positions at $10 in large quantities?

→ Impossible.

Retail investors’ buy and sell points are all over the place; they can’t all "be on the same page."

So the only force that can concentrate chips at a certain price zone is:

👉 Someone steadily and massively accumulating and locking positions at this price.

This is the classic main force accumulating chips and controlling the market.

4. Why does chip concentration mean "high control"?

The more chips the main force collects, the fewer chips circulate in the market,

- Main force control ↑

- Circulating chips ↓

- Trading volume lightens

- Prices become easier for the main force to control

When the main force has high control, stock prices are more likely to:

- Rise

- Break away from the cost zone

- Form a trend market

Thus, chip concentration becomes a crucial signal for judging the start of a trend.

5. Simplified into one sentence:

Retail investors are inherently scattered; chip concentration must be the work of the main force;

The more concentrated the chips, the more the main force locks positions, and the higher the degree of control.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.