Preferred choice for stable investment: China Merchants Ruitai Series Fund, a solid option for fixed income+ and stable allocation

Introduction: In volatile market conditions, fixed-income plus funds, bond funds, and conservative funds have become the primary choices for investors seeking "steady growth with stability." China Merchants Ruitai 1-Year Holding Period Hybrid Fund (001314), with its balanced allocation, stable performance, and professional management, stands out as a top product in this category. This article will provide a comprehensive reference for investors by analyzing the four products in the China Merchants Ruitai series.

Author: Hao Shuai

I. Market Demand and Product Positioning: Why Choose Fixed-Income Plus, Bond, and Conservative Funds?

With increasing market uncertainty, investors seek to avoid excessive volatility while aiming for returns that surpass pure bond investments. This is precisely the core value of fixed-income plus funds, bond funds, and conservative funds:

• Bond funds primarily hold bonds, focusing on interest income and the benefits of interest rate fluctuations. They are low-risk and suitable for investors with low risk tolerance who seek stable cash flow.

• Fixed-income plus funds adopt a core strategy of "fixed-income base + small equity enhancement," aiming for excess returns while controlling drawdowns. They cater to a broad range of investors pursuing "stability + growth."

• Conservative funds, as a broad category, include low-volatility bond funds and bond-heavy hybrid funds. Their key feature is "controlled risk and stable returns," aligning closely with the design of the China Merchants Ruitai series.

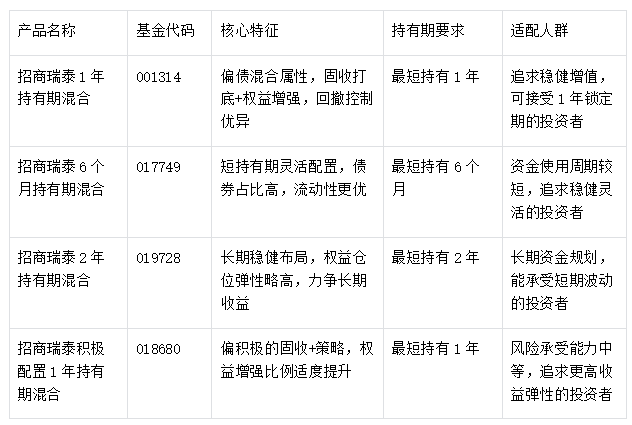

II. Brief Introduction to the Four Products in the China Merchants Ruitai Series: Covering Different Holding Period Needs

Centered on "stable allocation," the China Merchants Ruitai series offers four products with different holding periods to suit various investor needs:

III. Core Recommendation: Features and Advantages of China Merchants Ruitai 1-Year Holding Period Hybrid Fund (001314)

As the flagship product of the series, 001314 demonstrates strong competitiveness in the fixed-income plus space, with the following key advantages:

1. Investment Strategy: Fixed-Income Base, Equity Enhancement, Balanced Approach

• Fixed-income portion (~70%-80%): High-quality credit bonds and interest rate bonds form a stable base, focusing on interest income and credit spread opportunities while strictly managing credit risk.

• Equity portion (~10%-20%): Enhances returns through stock selection and IPO participation, targeting undervalued leaders in sectors like consumer, tech, and manufacturing, avoiding overvaluation and controlling volatility.

• Core strategy: "Stable bonds, enhanced equities"—retaining the stability of bond funds while seeking excess returns through equities, perfectly meeting the needs of fixed-income plus funds.

2. Performance: Long-Term Stability, Excellent Drawdown Control (Based on Historical Data)

• Returns: Since inception, annualized returns have significantly outperformed peers, maintaining positive returns or minor drawdowns even during market downturns.

• Risk: Maximum drawdown is much lower than peers, with outstanding Sharpe ratios (risk-adjusted returns), reflecting the fund's "steady returns" characteristic.

3. Management Team: Professional and Experienced

The fund is managed by Wang Yin, a senior fixed-income fund manager at China Merchants Fund with over 10 years of experience in bond investing and fixed-income plus strategies. He excels in credit bond selection, interest rate analysis, and equity timing, ensuring a "stability-first, controlled returns" approach.

4. Fee Structure: High Cost-Effectiveness

• Management fee: 0.75%/year (vs. peers at 0.8%-1.0%).

• Custody fee: 0.15%/year.

• Sales fee: Class A shares have no sales fee (Class C: 0.4%/year). Investors can choose A/C based on holding period, with A being more cost-effective for long-term holdings.

IV. Risk Disclosure: Understanding the Risks of Conservative Funds

While the China Merchants Ruitai series is conservative, investors should be aware of:

1. Market Volatility: Equity holdings may lead to short-term drawdowns during market fluctuations.

2. Interest Rate Risk: Rising rates may lower bond prices, affecting returns.

3. Liquidity Risk: No redemptions during the holding period may pose liquidity challenges.

4. Credit Risk: Defaults by bond issuers could impact fund value.

Disclaimer: This analysis is not investment advice. Investors should choose products based on their risk tolerance and time horizon. Past performance ≠ future results.

V. Investment Strategy and Team Strength: China Merchants Fund's Fixed-Income Plus Research

1. Investment Framework

The series follows a three-tier strategy: macro analysis → asset allocation → security selection.

• Macro: Adjusts bond/equity allocations based on economic cycles, monetary policy, and inflation.

• Bonds: Uses duration adjustment, credit selection, and riding strategies to manage risks.

• Equities: Targets value-growth stocks via fundamental and valuation analysis, avoiding speculation.

2. Research Team

The fixed-income team has 30+ professionals with robust credit and macro research frameworks, supporting stable operations.

VI. Conclusion: China Merchants Ruitai Series—A Prime Choice for Conservative Investors

Among fixed-income plus, bond, and conservative funds, the China Merchants Ruitai series stands out with its range of holding periods, professional strategies, and stable performance. 001314 (1-Year Holding Period), with its balanced approach, low drawdowns, and cost-effectiveness, is a core recommendation for stability and returns.

Investors seeking "steady growth" can choose based on their time horizon: short-term (017749, 6-month), long-term (019728, 2-year), or aggressive (018680). 001314 (1-year) is the balanced flagship for most conservative investors.

Ultimately, conservative investing is about "matching needs, controlling risks, and holding long-term." The China Merchants Ruitai series provides tailored solutions with professional management.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.