Rate Of Return

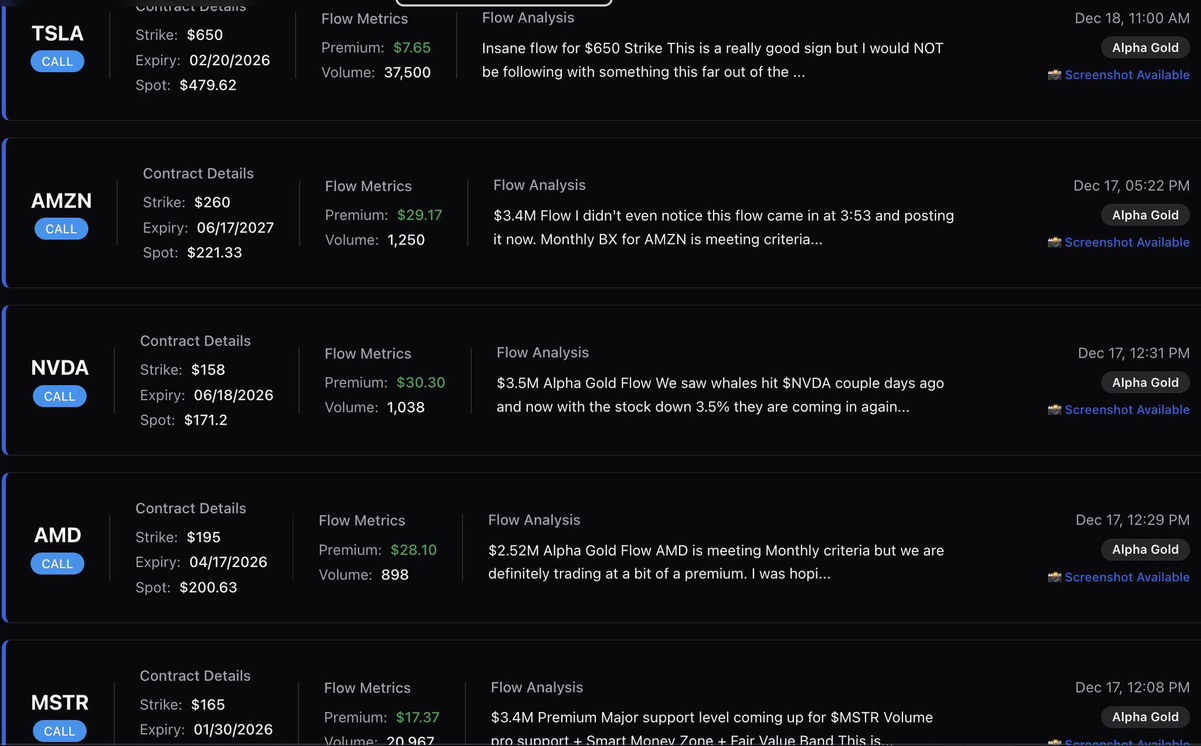

Rate Of Return🌐📊💎 Over the past week, large funds have been concentrating on increasing positions in the same group of assets:

$Tesla(TSLA.US) $Amazon(AMZN.US) $AMD(AMD.US)(AMD.US)(AMD.US) $NVIDIA(NVDA.US) $Strategy(MSTR.US)

This is not a random "bottom-fishing" move but a very typical year-end portfolio adjustment signal.

First, look at the structure:

This basket almost covers the three most critical market themes currently—

• AI computing power and semiconductors: $NVIDIA(NVDA.US), $AMD(AMD.US)(AMD.US)(AMD.US)

• Platform-type cash flow giants: $Amazon(AMZN.US)

• High Beta + sentiment and narrative elasticity: $Tesla(TSLA.US)

• Liquidity and Bitcoin proxy: $Strategy(MSTR.US) (directly tied to #Bitcoin)

Next, the timing:

This kind of capital inflow often occurs during the year-end performance ranking and the pre-layout phase for Q1 next year, not when the market is already extremely euphoric.

It’s more like institutions positioning early for the Santa Rally + January Effect rather than chasing rallies.

Finally, the key signal:

When funds flow into high-growth + high-volatility assets simultaneously, it usually means the market is betting on:

• The liquidity environment won’t worsen further

• Risk appetite is starting to rebound

• There’s an upward "passive push" at year-end

Of course, this doesn’t mean a straight-line rally.

Volatility and shakeouts will still happen, but the directional positioning is becoming clearer.

What’s truly worth watching next:

👉 Once sentiment strengthens, who will the first wave of incremental funds rush to?

Trend leaders like $NVIDIA(NVDA.US) or more elastic narrative plays like $Tesla(TSLA.US)?

📬 I’ll periodically share insights and analyses on 10x potential trading opportunities and key trends in hot stocks. Subscribe now so you don’t miss the next pre-breakout positioning window.

$Tesla(TSLA.US) $Amazon(AMZN.US) $AMD(AMD.US)(AMD.US)(AMD.US) $NVIDIA(NVDA.US) $Strategy(MSTR.US) #StockMarket #Investing #Stocks #Trading #WallStreet #NASDAQ #SP500 #AI #Bitcoin #Tesla #NVIDIA #Amazon

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.