Traded Value

Traded ValueGreat point, thanks for sharing

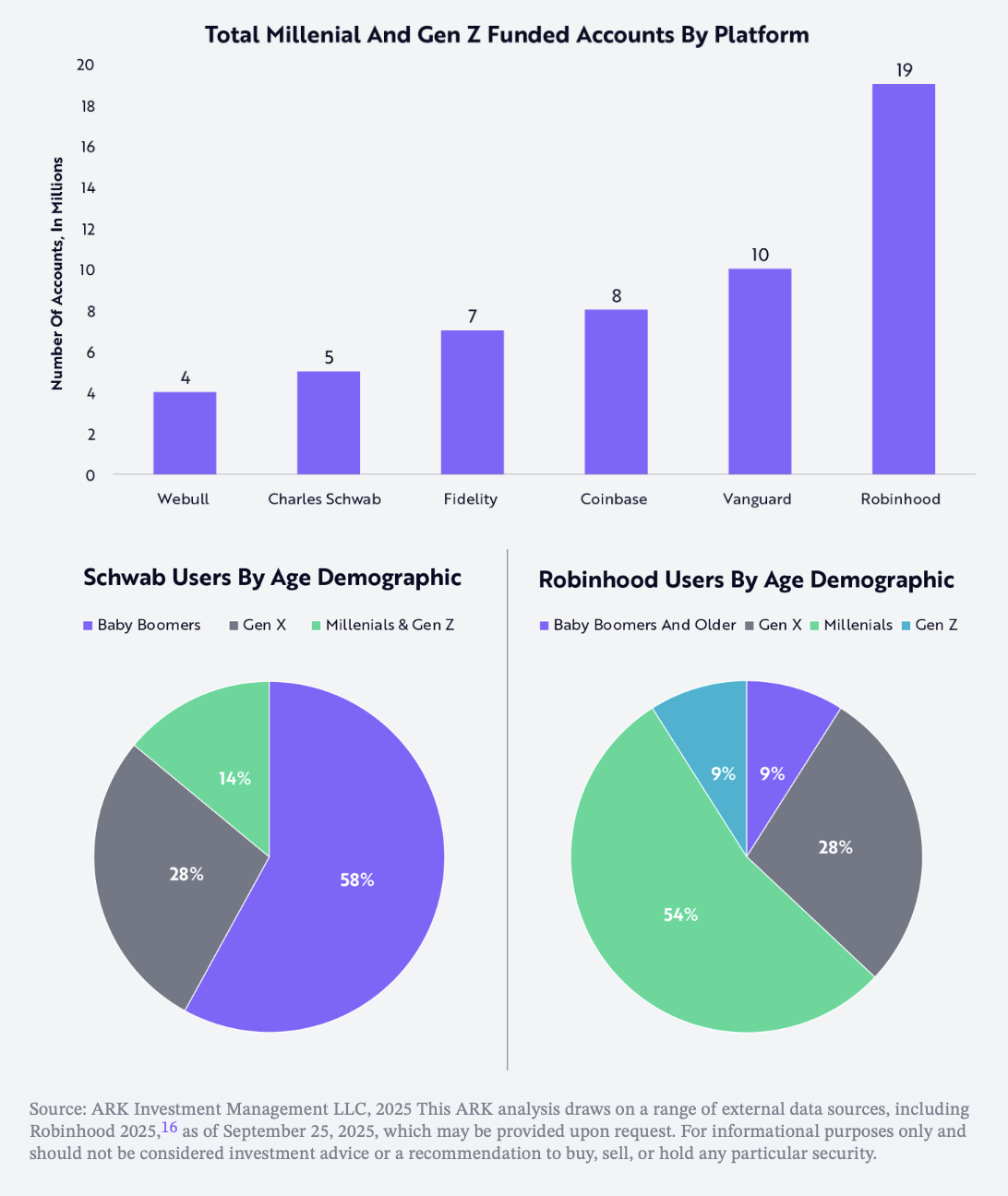

ARK's data on $Robinhood(HOOD.US) is quite interesting, let's talk about Hood in detail.

American society is about each generation having its own accounts. For example, the baby boomers over 60 use Schwab. Hood's average user age is in their 30s, representing the accounts of the new generation of middle-aged and young Americans. This model can be imagined as a funnel—as long as money flows in, it can generate revenue by facilitating a series of transactions.

So the most important thing is to increase the average assets per user. Hood users have about $10,000 in assets on average, while Schwab or IBKR users have over $150,000. But Hood's average user age is 34, which is crucial because 35 is a significant wealth milestone in the U.S. Between 35 and 40, people typically see a threefold increase in average wealth compared to the previous five years, peaking at 55. So even if Robinhood does nothing today, it will naturally see asset growth.

Trading accounts are just the beginning. As these users enter middle age and start accumulating savings, they will naturally seek wealth management services. For example, over 60% of Schwab's revenue comes from wealth management.

After absorbing these assets through this funnel, the key is to keep the money moving. Hood is also very savvy about internet marketing and caters to young people's enthusiasm for Crypto.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.