Options

Options Traded Value

Traded Value$SPDR S&P 500(SPY.US)

12/23/2025

Today's opening price was $683.920,

The options ready to open are $SPY 251223 683 Call(SPY251223C683000.US)

and $SPY 251223 684 Put(SPY251223P684000.US)

$SPY 251223 683 Call(SPY251223C683000.US) opened at $1.73,

$SPY 251223 684 Put(SPY251223P684000.US) opened at $1.24;

At market open, Longbridge's options calculator showed Put/Call IV at 10.90%/10.90%,

11:42 am at 7.90%/8.20%;

Volatility ranged from 0.35% at 10:04 am to 0.43% at 11:42 am;

$SPY 251223 683 Call(SPY251223C683000.US)

had a single candle surge of 0.20% at open,

judged likely to decline,

but started surging at 09:36 am,

$SPY 251223 684 Call(SPY251223C684000.US)

10:16 am $1.57 => 11:28 am $2.75,

considered opening a position at 10:16 am,

but failed due to device issues,

missing subsequent gains,

$SPY 251223 685 Call(SPY251223C685000.US)

10:40:13 am $1.36 => 10:43:46 am $1.39,

opened position relatively late,

a FOMO move,

exited early fearing trend reversal,

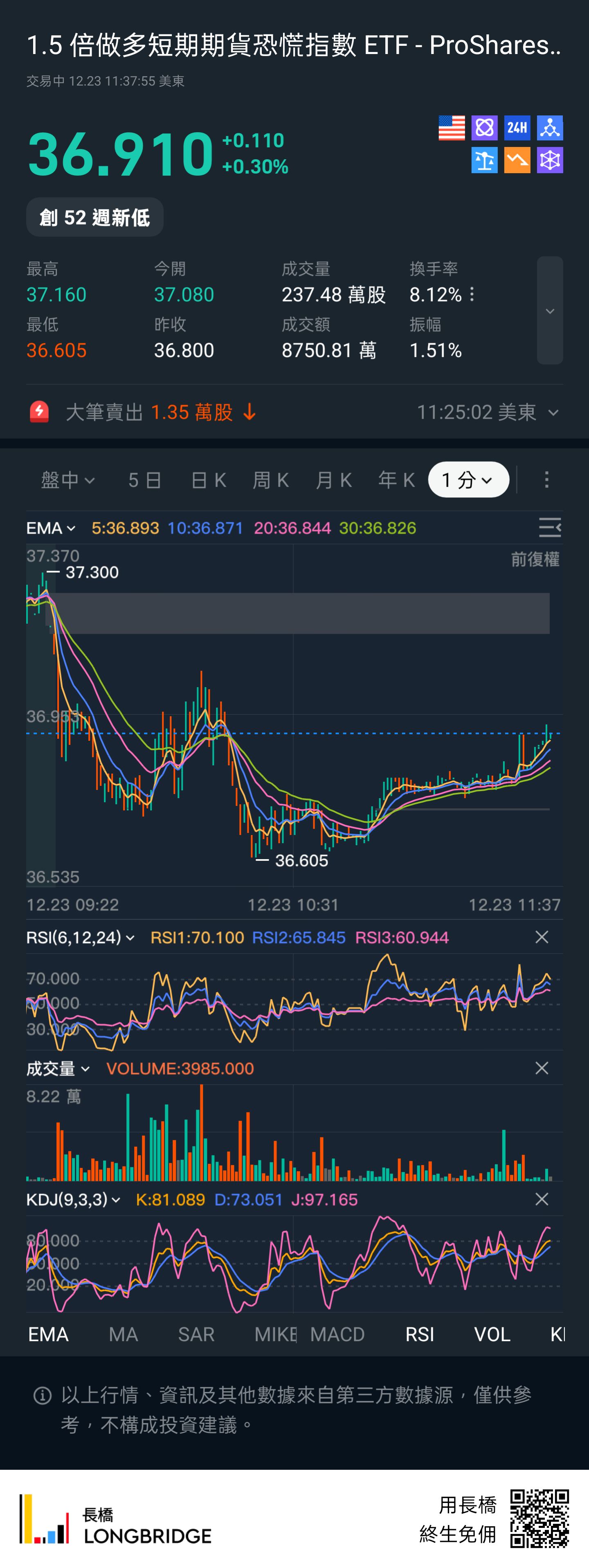

$Pro Ultr Cvix Shrt Futures(UVXY.US)

movement uncorrelated with $SPDR S&P 500(SPY.US),

$Direxion Daily TSLA Bull 2X Shares(TSLL.US)

10:20:27 am $22.6350 => 10:28:49 am $22.5016,

not today's main play,

$GraniteShares 2x Long NVDA Daily ETF(NVDL.US)

11:15:38 am $88.7700 => 11:30:19 am $89.5912,

was about to sleep,

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.