Asian auto market | Vietnam November 2025: Vinfast drives EV dominance

Produced by Zhineng Auto

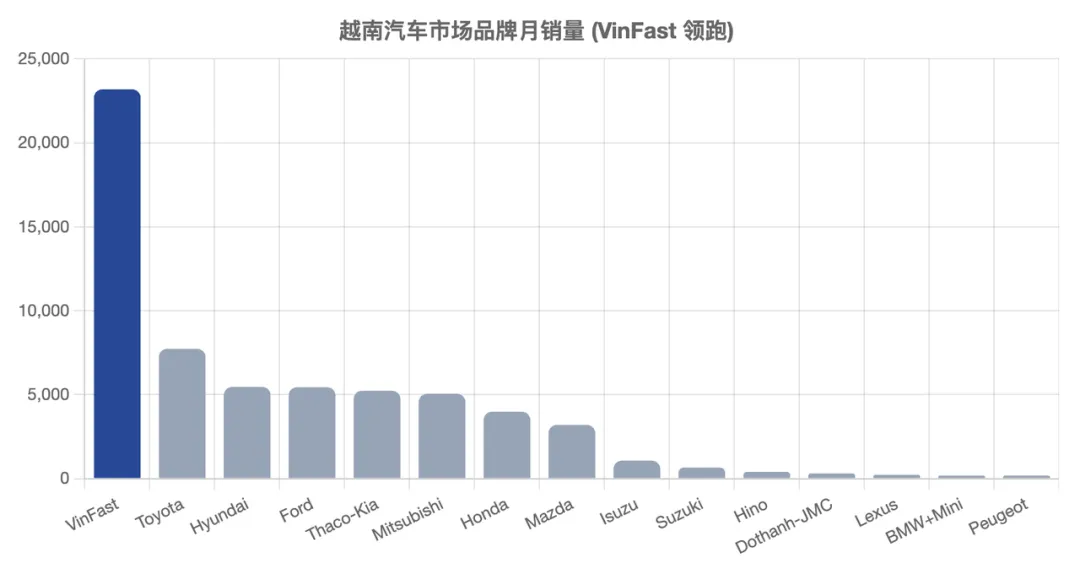

According to the data, the total sales in November were 67,987 units, with a total of 522,634 units from January to November.

If VinFast is excluded, the Vietnamese market has almost stagnated; the "growth" in the market is mainly driven by VinFast alone.

The Vietnamese auto market is highly price-sensitive, with the main sales models concentrated in the 100,000–200,000 RMB range. Small SUVs, MPVs, and pickup trucks are very popular, while the presence of sedans is declining.

Brand loyalty is not stable, but "local identity" is very important. Vietnamese consumers do not reject foreign brands but are highly sensitive to "local manufacturing, local employment, and local services." Vietnam's new energy sector is not strongly pushed by policies but is driven by VinFast's products and channels.

To summarize the Vietnamese market in 2025, it is a market completely rewritten by VinFast.

◎ November sales: 23,186 units, market share: 34.1%

◎ January–November cumulative: 147,450 units, accounting for 28.2%

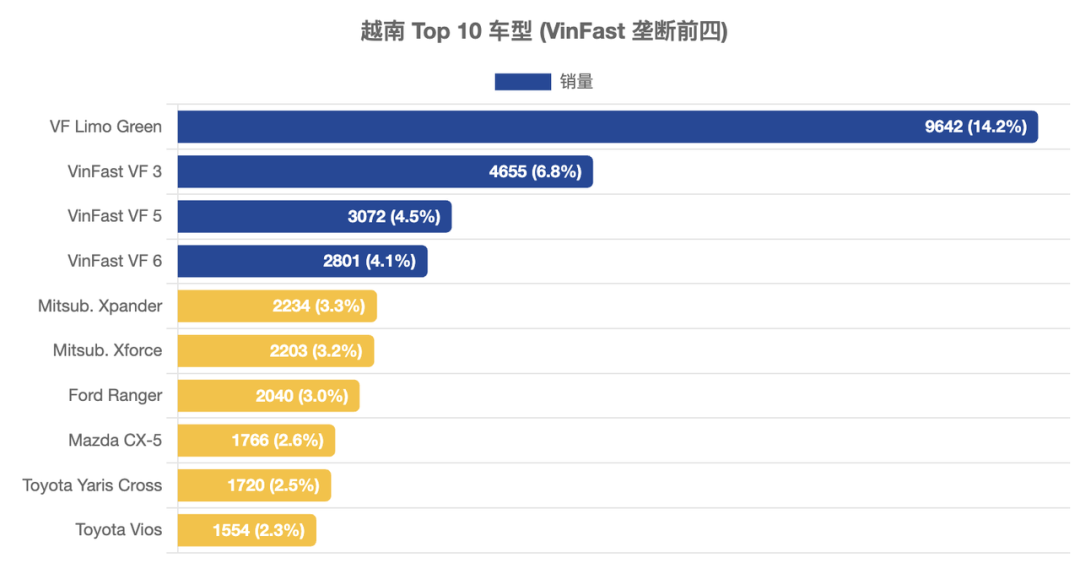

The key model structure is the VinFast Limo Green, with 9,642 units sold in November, accounting for 14.2% of the market share for a single model. The VF 3 / VF 5 / VF 6 all ranked among the top models for the year, and the Vietnamese market has seen new energy models directly dominating the overall sales rankings.

Under the strong pressure from VinFast, the state of traditional brands varies greatly:

◎ Toyota: Still firmly in second place, with 7,731 units sold in November, a year-on-year decrease of 11.1%, making it the "most stable" foreign brand.

◎ Hyundai: Sales plummeted by 47% in November, and its annual position has dropped from first to fourth, making it the most impacted traditional player.

◎ Ford and Mitsubishi: Relying on "hardcore models" such as the Ranger and Xpander, their performance is relatively stable.

◎ Kia, Mazda, and Honda: Under pressure across the board, with their market share continuously being eroded.

The presence of Chinese brands in Vietnam remains very weak.

Summary

The Vietnamese auto market is expected to grow from the 600,000 level to the million level gradually. Due to the presence of VinFast, Chinese new energy vehicles have long-term opportunities in the past, but there is not much possibility in the short term.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.