AMD Commentator

AMD Commentator Options

OptionsThe indicators still make sense,

combined with positive news,

targeting 270.

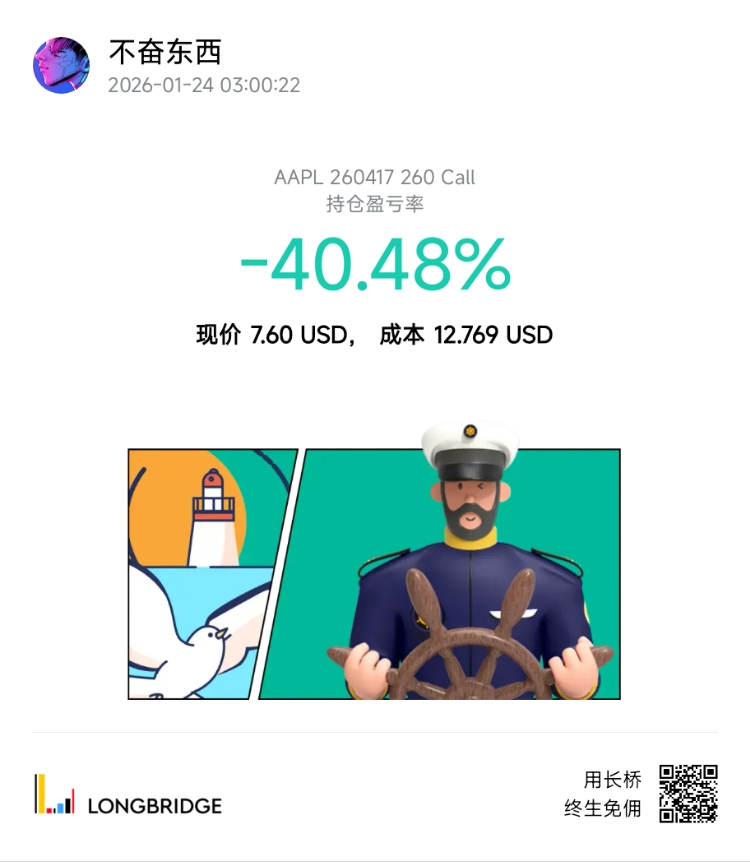

$Apple(AAPL.US)

Then sell the April ones,

and keep the June options.

$Apple(AAPL.US)

It should be about to rebound.

The official earnings report should be worth looking forward to.

$Amazon(AMZN.US)

It has officially started.

1. Latest K-line technical analysis: The darkness before dawn?

Signs of price stabilization: The stock price is currently fluctuating around $247.26, having rebounded from the previous trading day's low of $243.42, and has left a clear lower shadow near $243, indicating strong buying support at this level.

Bollinger Band (BOLL) support: The stock price is near the lower Bollinger Band (LOWER: 243.30). Technically, it is difficult for the stock price to remain outside the lower band for long, and there is usually a gravitational pull back to the middle band (MID: 261.51).

RSI indicator: RSI(6) is currently around 15.58. Although it has rebounded from the previous 8.8, it is still in the extreme oversold zone (below 20), which means the short-selling power is almost exhausted, and the momentum for a technical rebound is building.

Pattern characteristics: After several consecutive days of bearish candles, a small doji/small bullish candle has appeared, which is a potential signal of a slowdown in the downtrend.

2. Earnings report expectation analysis

Earnings reports are usually a "catalyst" for stock prices. Combined with the current stock price level, the following three feedback scenarios may occur:

Feedback A: Better-than-expected good news (high probability event)

Performance: Both revenue and profit exceed expectations of $138.4 billion and $2.67 EPS, with strong AI service subscriptions and iPhone 17 sales guidance.

Consequence: The stock price is highly likely to experience a "revenge rebound," with the target directly looking at the gap above or the middle Bollinger Band in the $261 - $270 range. This is most favorable for your $260 strike price options.

Feedback B: Meets expectations, but guidance is mediocre

Performance: Data meets expectations, but the outlook for the next quarter is conservative.

Consequence: The stock price may rise first and then fall, or the option price may still fall despite a slight rise in the stock price due to IV Crush (volatility crush).

Feedback C: Falls short of expectations (low probability, but highly damaging)

Performance: A significant decline in market share in China or severe delays in AI progress.

Consequence: The stock price may break below the $240 support level and seek support at $230.

The official earnings forecast is set as "record high," and the market expects "record-breaking."

1. Official guidance (Apple) | Cook clearly stated at the last quarter's earnings call that he expects revenue for the first quarter of fiscal year 2026 (covering the Christmas shopping season) to hit a record high. Revenue estimate (Market) | $138.3 billion - $138.5 billion | A year-on-year increase of about 11.4%. If this value is achieved, it will be Apple's most profitable quarter in history.

|EPS estimate (Market) | $2.65 - $2.67 | Around $2.18 in the same period last year, a significant increase.

2. Why is the estimate so good, but the stock price has caused you to lose $10,000+?

This is a very typical trap of divergence between sentiment and fundamentals.

* Macro sell-off: The Nasdaq index has been weak recently, and the "blood loss" of the broader market has dragged down all heavyweight stocks, including Apple.

* Expectations digested in advance: Apple's stock price surged above $280 at the end of 2025, already pricing in some of the earnings report benefits in advance. The current decline is more like "extreme washing" before the earnings report benefits are realized.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.