Rate Of Return

Rate Of ReturnSK Hynix this stock,

if listed in the US market, would rise at least 3 times more.

Unfortunately, it's in the Korean market,

small market size, poor liquidity,

limited capacity severely restricts valuation imagination.

The reality is:

Many people want to buy the stock but can't,

only passively buying ETFs.

The only real trigger point:

When will SK Hynix launch US ADRs.

Once the market capacity expands,

that's when the real valuation frenzy begins.

Currently available ETFs for "SK Hynix + Samsung":

1️⃣ A-shares: China-Korea Semiconductor ETF

2️⃣ US stocks: FLXK

3️⃣ HK stocks: 2x Long SK Hynix / Samsung

❌ Not recommended the third one,

leverage products suffer too much from sideways grinding.

The first two have underlying stocks as backup,

no fear of grinding.

Of course, you can buy all,

adults don't need to choose.

In the memory sector,

the only obviously undervalued one now,

is SK Hynix.

Monopoly business,

can raise prices freely,

shortage at least until 2028.

The China-Korea Semiconductor ETF holds Samsung + SK Hynix,

I plan to hold until Q3 before reviewing.

Far from the end.

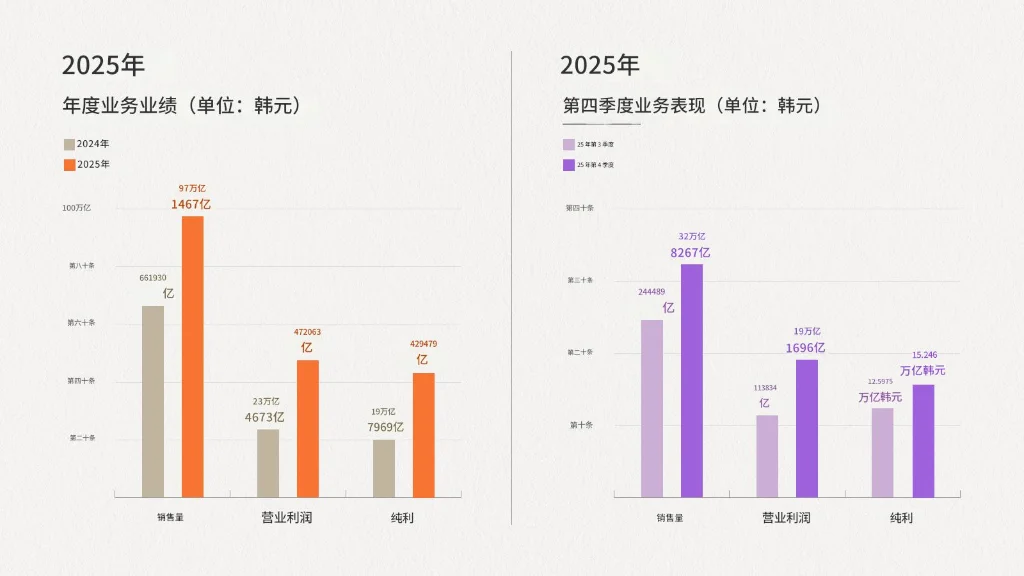

🚨 SK 海力士炸裂财报!2025 年 Q4 创史上最强季度业绩🔥

Q4 营收 32.83 万亿韩元(环比 +34%)

营业利润 19.17 万亿韩元(环比 +68%,利润率 58%)

大幅超市场预期 16.7 万亿!

全年营收 97.15 万亿韩元、营业利润 47.21 万亿韩元、净利润 42.95 万亿韩元

三项指标全部创历史新高!📈

HBM 成最大增长引擎:

• 全年 HBM 营收增长超 2 倍

• 率先量产 HBM4,已按客户需求稳定供应

• 独供微软 Maia 200 的 HBM3E

AI 时代内存需求持续爆棚,从训练转向推理,分布式架构将进一步推高 HBM、服务器 DRAM 和 NAND 需求。

公司加速高端转型:

• 推进 1c 纳米 DDR5

• 开发 256GB DDR5 RDIMM(业界最大容量)

• NAND 完成 321 层 QLC,创年度营收纪录

全球扩产全力冲刺:清州 M15X、龙仁工厂、美国印第安纳先进封装厂全面推进。

花旗大幅上调目标价 56%,预计 2026 年 DRAM 均价涨 120%、NAND 涨 90%。

股价盘后已涨超 6%!南方两倍做多海力士 (07709.HK) 单日暴涨 20.95%🚀

AI 内存霸主地位稳固,2026 年继续起飞!

#SK 海力士 #HBM #AI #半导体 #财报

(数据来源:SK 海力士官方财报,2026.1.28 发布)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.