Rate Of Return

Rate Of Return Total Assets

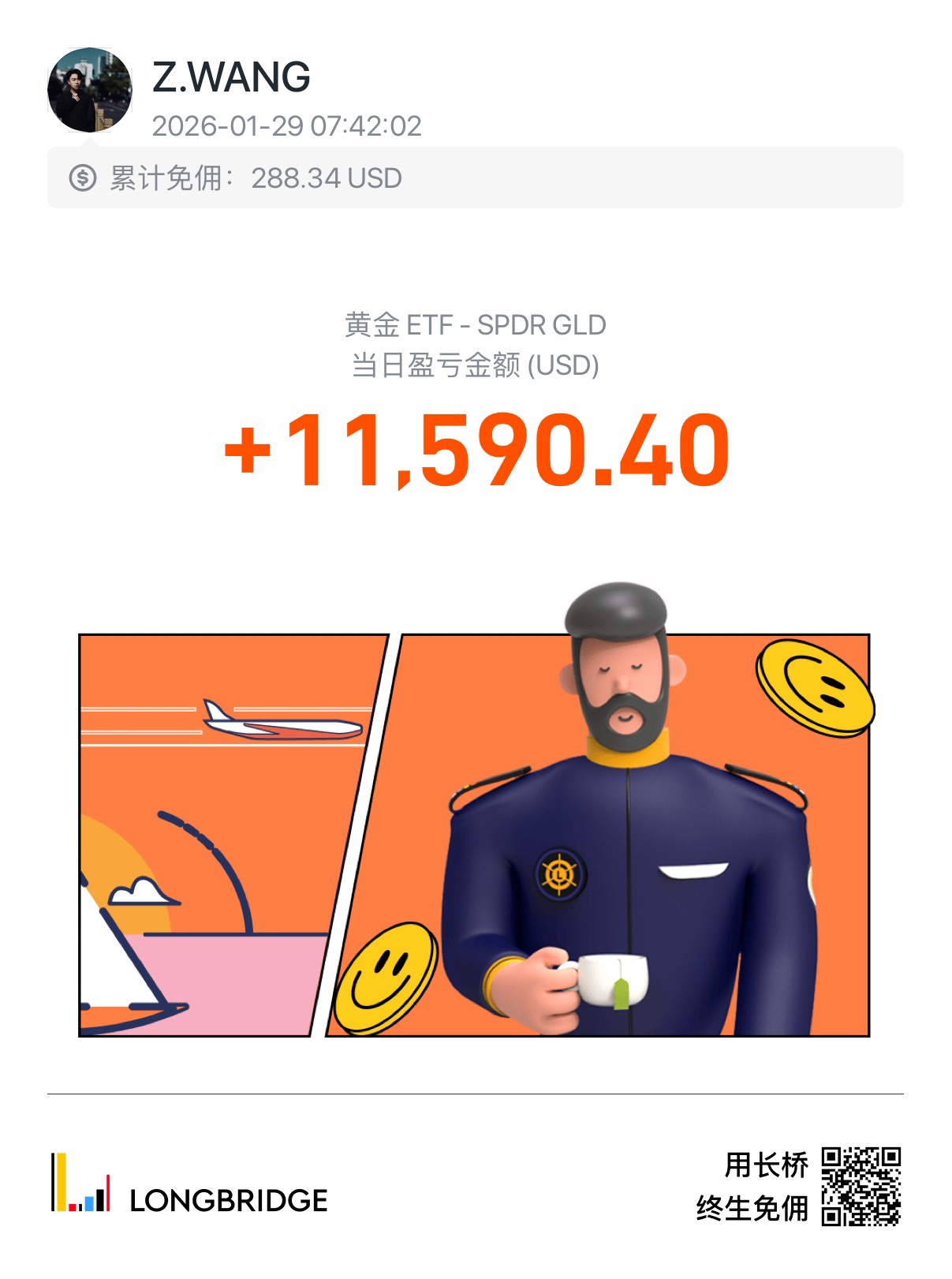

Total AssetsGold records the biggest gain of the day

During today's post-market review, the most eye-catching wasn't the Nasdaq or the "Magnificent Seven," but gold ETFs becoming the star of the day's gainers list.

In a market where macro narratives can shift at any moment, gold—this "old asset"—suddenly stepping into the spotlight usually isn't because it's become sexy, but because capital is repricing risk.

In trading terms, a gold ETF rally typically signals three things: falling real interest rates, a weaker dollar, and rising safe-haven demand. In the current environment, these three aren't mutually exclusive.

Market interpretations of economic data are becoming increasingly "binary": strong data raises fears of continued tight policy; weak data sparks growth slowdown concerns. So capital is choosing a smarter way to express views—buy certainty first, then consider offense. Gold ETF's leadership looks more like "reinforcing defense first."

What I focus on more is the logic behind its capital flows: If gold's rise is just short-term news-driven, it's usually a big bullish candle that fades; but if it's asset reallocation, it shows as steady uptrends, shallow pullbacks, and amplified but calm volume. Today's strength looks more like the latter: the market isn't betting on an event but preemptively buying insurance against "uncertainty."

In my framework, gold is never for chasing rallies—it's more like a portfolio's "volatility adjuster." When equities are in high valuation zones and volatility could spike anytime, gold's value isn't outperformance but preventing portfolios from spiraling when mistakes happen. Especially when stock-bond correlations turn unstable again, this "third asset" gets remembered.

Of course, gold's surge could also be a reminder: the market is tagging the future—inflation isn't dead, rate-cut expectations waver, geopolitical risk premiums return. These tags may not materialize immediately, but once capital pays for them, prices move first.

Tomorrow's key watchpoints are clear:

1) Whether gold holds today's gains without giving them back;

2) Whether the dollar and Treasury yields move in sync;

3) Whether risk assets show structural fatigue—"struggling to rise but quick to fall."

If gold stays strong while equities hesitate, it's not "gold rising" but the market saying: "I'm uncertain, so I'm defending first." That speaks louder than any news.

$SPDR Gold Shares(GLD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.