Options

Options Traded Value

Traded Value$SPDR S&P 500(SPY.US)

02/03/2026

Today's opening price is $696.210,

The options to be opened are $SPY 260203 697 Put(SPY260203P697000.US)

and $SPY 260203 696 Call(SPY260203C696000.US)

$SPY 260203 697 Put(SPY260203P697000.US) opened at $1.39,

$SPY 260203 696 Call(SPY260203C696000.US) opened at $1.66;

At market open, Longbridge's options calculator showed Put/Call IV at 11.20%/10.80%,

12:50 pm at 25.50%/15.40%;

Amplitude ranged from 0.30% at 09:46 am to 1.38% at 12:50 pm;

$SPY 260203 697 Put(SPY260203P697000.US)

Opening IV returned to normal with low slope,

Unable to determine direction temporarily,

$Pro Ultr Cvix Shrt Futures(UVXY.US)

Intraday amplitude was small, suggesting limited downside,

Continued decline after 12:12 am exceeded expectations,

$Invesco QQQ Trust(QQQ.US)

Opened with clear downward trend,

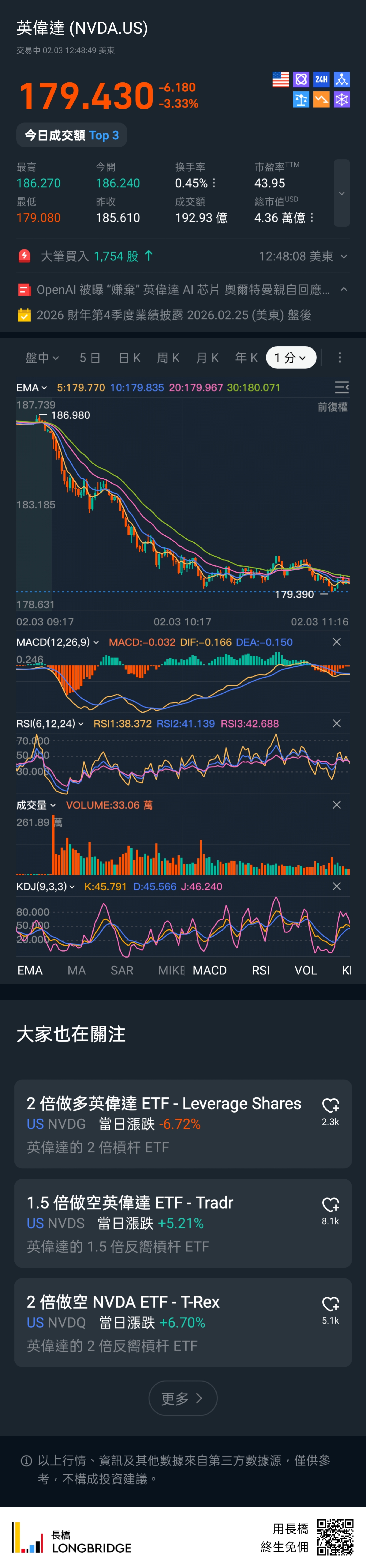

Driven by $NVIDIA(NVDA.US)'s decline,

$SPY 260203 695 Put(SPY260203P695000.US)

09:54 am $1.25 => 10:03 am $2.98,

The main issue was failing to identify the direction,

Missing a good shorting opportunity,

$SPY 260203 692 Put(SPY260203P692000.US)

11:00 am $0.90 => 11:32 am $1.98,

Double top couldn't break through at this level,

Triggering second round of decline,

$Direxion Daily TSLA Bull 2X Shares(TSLL.US)

Performed slightly stronger than $NVIDIA(NVDA.US),

Could attempt long position with stop-loss if $16.300 holds at 10:24 am,

After three rebounds, finally hit bottom at 11:25 am, attempting long position.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.