Traded Value

Traded Value Likes Received

Likes ReceivedThe US released poor employment data, but the market is still worried about Wash

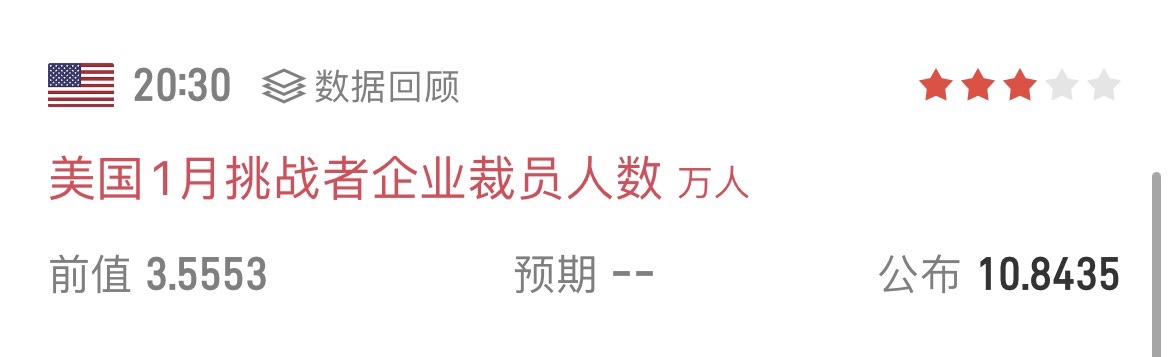

The US released two poor employment data tonight. First, their January layoff data was 108,000, the highest January record since the global economic recession in 09.

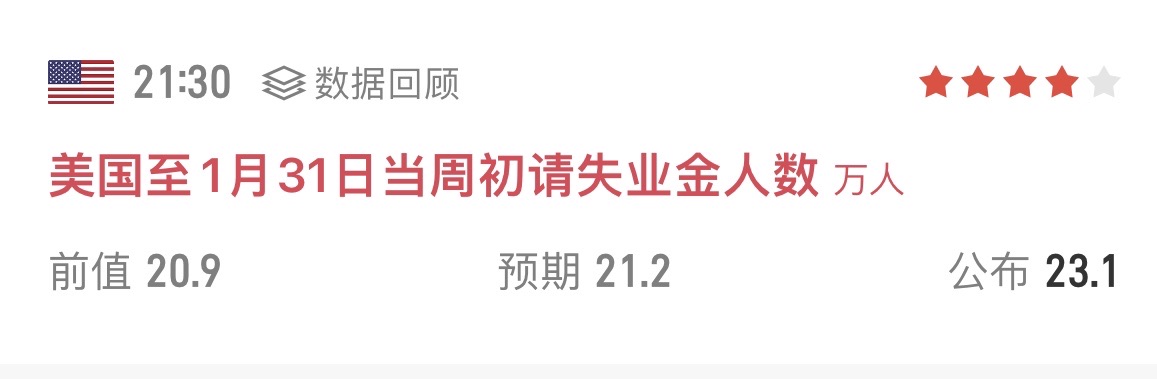

Second, the number of people claiming unemployment benefits last week was 231,000, also exceeding market expectations.

These two poor employment data will definitely increase the probability of the Fed cutting interest rates later. We can also see that US Treasury yields fell after the data was released.

But even if the market believes the Fed will cut interest rates now, due to concerns that Wash will use QT to coordinate as before, there will still be speculation about liquidity tightening. This is also the biggest reason for the current poor market performance.

$iShares barclays 20+ Yr Treasury Bd(TLT.US)$SPDR Gold Shares(GLD.US)$Invesco QQQ Trust(QQQ.US)$AMD(AMD.US)$Alphabet - C(GOOG.US)$NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.