Total Assets

Total Assets$PDD(PDD.US)PDD Options Market Daily (2026-02-06)

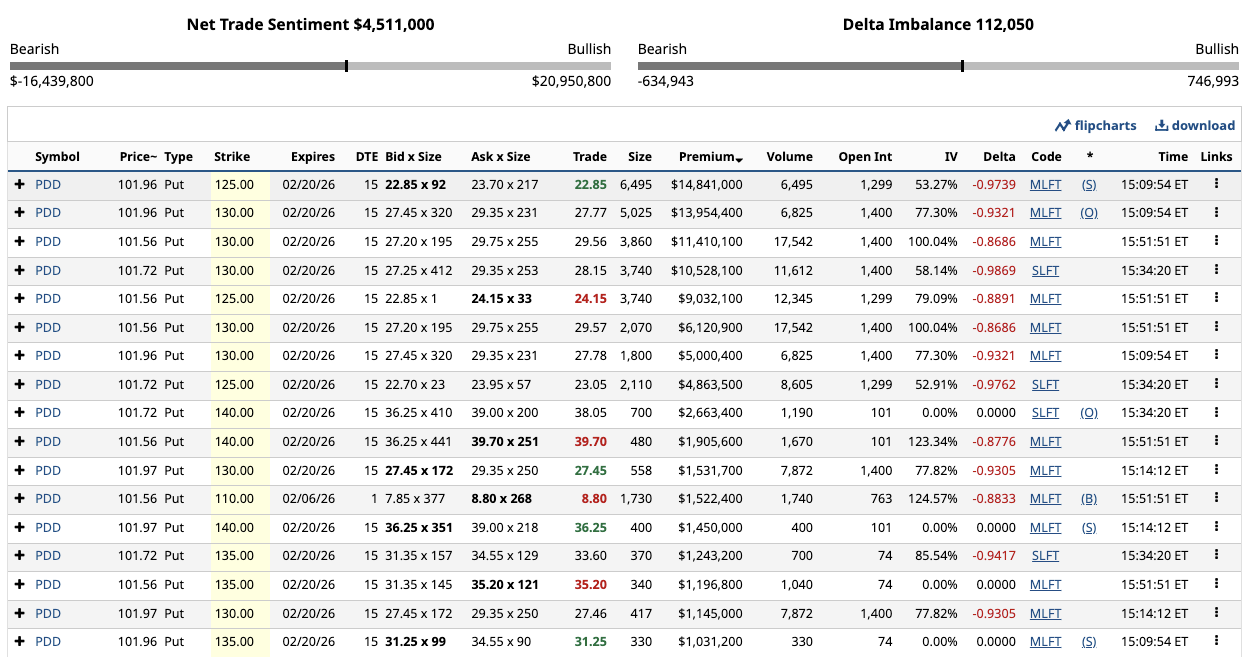

The PDD options market showed a clear "defensive structure with confirmed downtrend." The Net Trade Sentiment for the day was +$4.51 million, superficially bullish. However, a structural breakdown reveals that funds were highly concentrated in deep in-the-money Puts expiring on 2/20 with strike prices between 125–135. Single-trade premiums frequently reached $5–14 million, with most Deltas around -0.90, clearly indicating high-Delta downside exposure positioning or protective hedging.

Meanwhile, the Call side lacked aggressive buying of comparable scale, with notably weak positioning in short-term high-strike Calls. Although the Delta Imbalance was positive (+112k), compared to the absolute size of large deep in-the-money Put trades, it exhibited a "superficially balanced but defensively skewed" characteristic. This structure typically appears during trend continuation phases rather than on the eve of a rebound.

In summary, the current options market signals suggest institutions are either locking in downside risks or betting on short-term accelerated declines; no reversal signals like "short-term Call buying sprees" have emerged yet.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.