AMD Return Rate

AMD Return Rate Total Assets

Total Assets$SPDR S&P 500(SPY.US)

Historically, midterm election years are usually the most volatile in the four-year cycle of U.S. stocks. According to data from CFRA Research, since 1945, the average intraday maximum drawdown of the S&P 500 during midterm election years has been about 18%, which is still quite astonishing. This is mainly due to the surge in risk premiums caused by uncertainty in policy outlook.

It should be noted that this data describes the maximum decline of the market from its peak during the year, which is a concept of short-term volatility. Historical data also shows that after experiencing deep corrections, the average return in the year following the bottom of a midterm election year is very impressive, reaching over 30%.

Coupled with the unclear policies of the new Federal Reserve chairman, Trump's occasional shocking remarks, and concerns about high valuations of tech stocks leading to bubbles, the market may become even more unstable.

Therefore, this year, we must prepare in advance, raise risk awareness, control positions well, keep at least 30% cash, avoid chasing highs, avoid full positions, avoid leverage, and avoid greed. Risk and opportunity coexist.

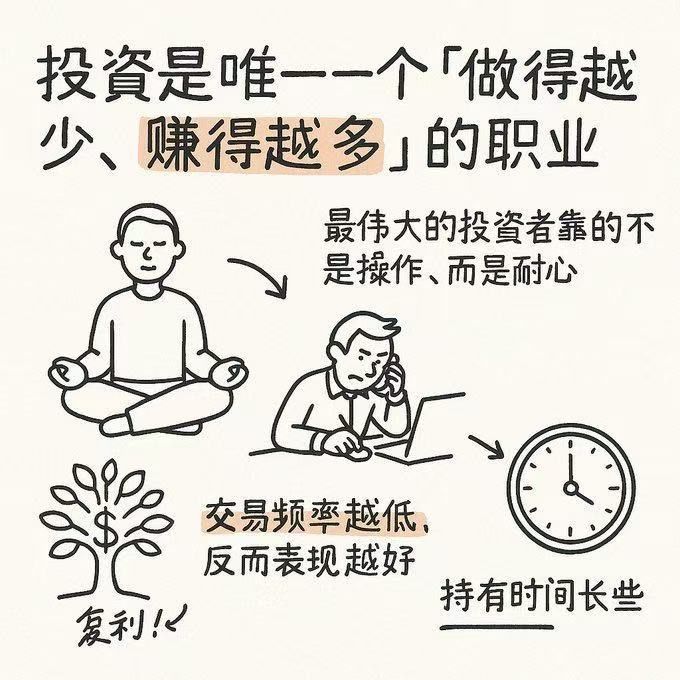

What investment requires is not a lot of action, but a lot of patience. Gaming takes time, and waiting for the results of the game requires patience. Only patience can earn the appreciation of wealth.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.