$Amazon(AMZN.US)

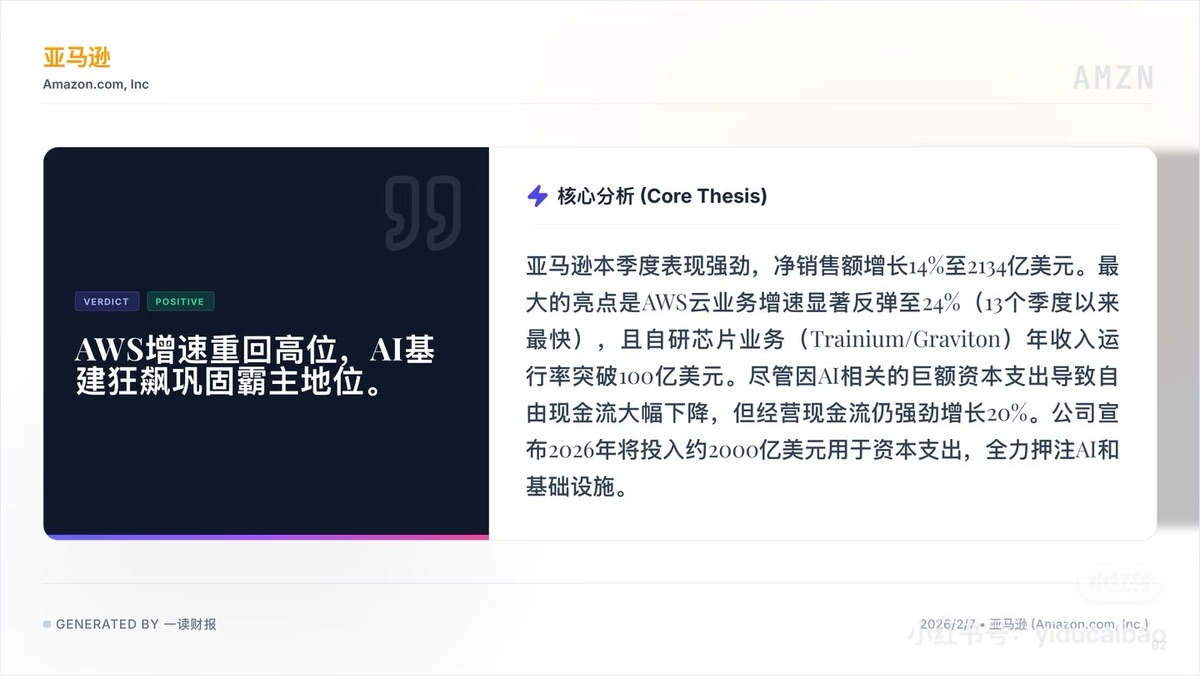

Amazon's earnings report directly ignited the surge in the AI infrastructure sector last night. Investors have reached a consensus: big companies are all spending money on AI construction, so why should I be afraid to buy? From the perspective of the earnings report, what other data is worth paying attention to?

1. The Culprit of the Plunge: The "Massive Bleeding" of Free Cash Flow

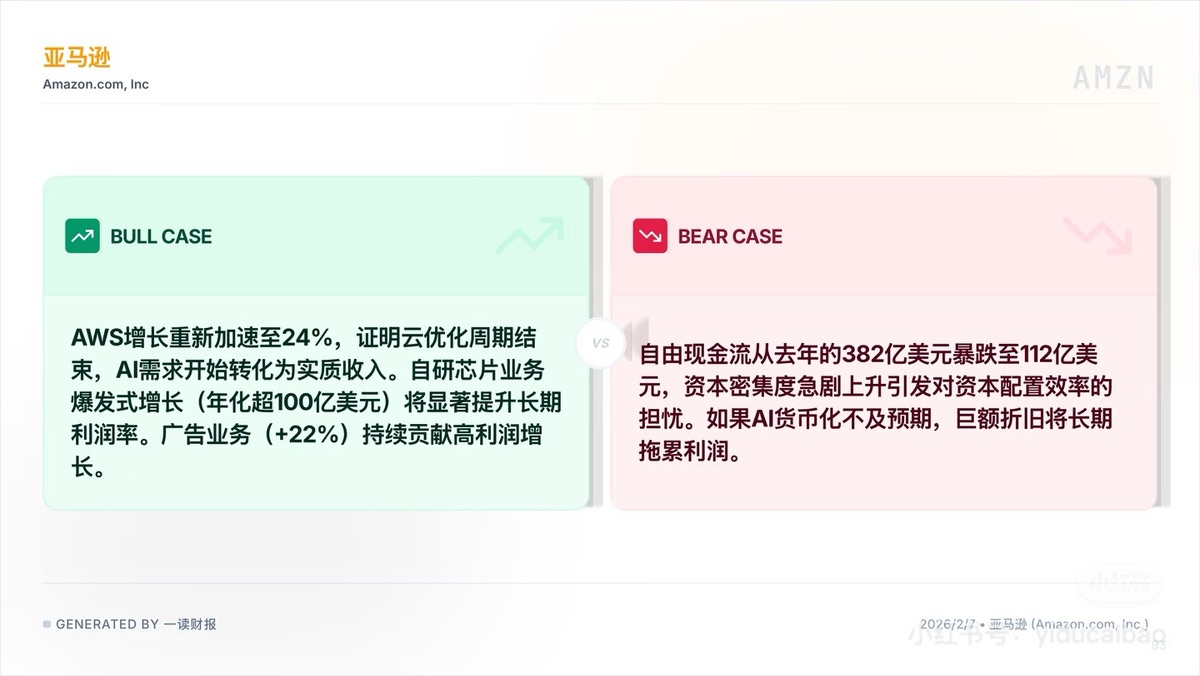

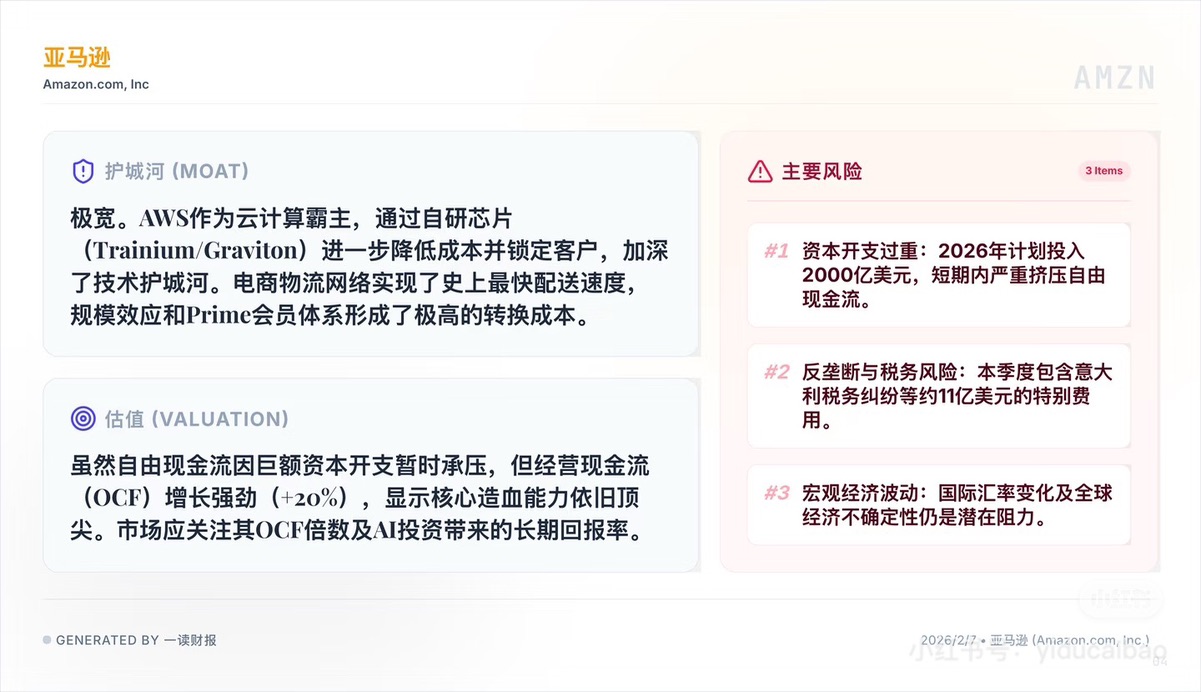

Free cash flow plummeted from $38.2 billion last year to $11.2 billion. For a mature tech giant, such a drastic shrinkage in cash flow is extremely rare.

• Reason: Capital expenditures (CapEx) are completely out of control. The report shows that Amazon plans to invest approximately $200 billion in capital expenditures by 2026.

The reason Wall Street gave Amazon a high valuation was because it proved over the past two years that it could make insane money through layoffs and efficiency improvements. Now, it has suddenly reverted to a "big-spending" investment phase. This drastic switch in investment logic directly scared away funds seeking stable returns.

2. The Misunderstood Highlight: AWS Has Really "Woken Up"

If we ignore the cash burn, the business itself is actually very solid. AWS revenue growth accelerated to 24%. This is the fastest growth rate in the past 13 quarters.

• Quality: This 24% wasn't achieved through price cuts; it was driven by strong, genuine AI demand.

• In-house Chips: The annualized revenue of Trainium and Graviton has already exceeded $10 billion. Amazon has built its own "backup" in computing power, not being completely strangled by Jensen Huang. If it hadn't fallen, this should have been the biggest positive.

3. An Overlooked "Honest" Detail: Shortened Depreciation Period

Another technical reason for the stock price drop is a change in accounting standards. Amazon shortened the depreciation period for servers from 6 years to 5 years.

• Cost: This directly added a $1.4 billion depreciation expense, eating into current profits.

Although this makes the current earnings report look bad, it's very honest. It acknowledges that in the AI era, chip iteration is too fast, and hardware depreciation is accelerating. Daring to proactively shorten the depreciation period shows that management has absolute confidence in its future earning power and disdains using accounting tricks to whitewash the situation.

Summary: The stock price fell because the market was terrified by that $200 billion gamble. Amazon's investment logic is changing:

• If you're in it for "safety, cash flow, buybacks," then you should indeed run, because for the next two to three years, its money will be spent on buying GPUs and building data centers.

• But if you believe AI is the next industrial revolution, then the current drop is an opportunity. Because with that $200 billion investment, Amazon is building the roads for the future AI world. AWS's 24% growth proves that this road has already started collecting tolls.

Source: Yidu Caibao

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.