Total Assets

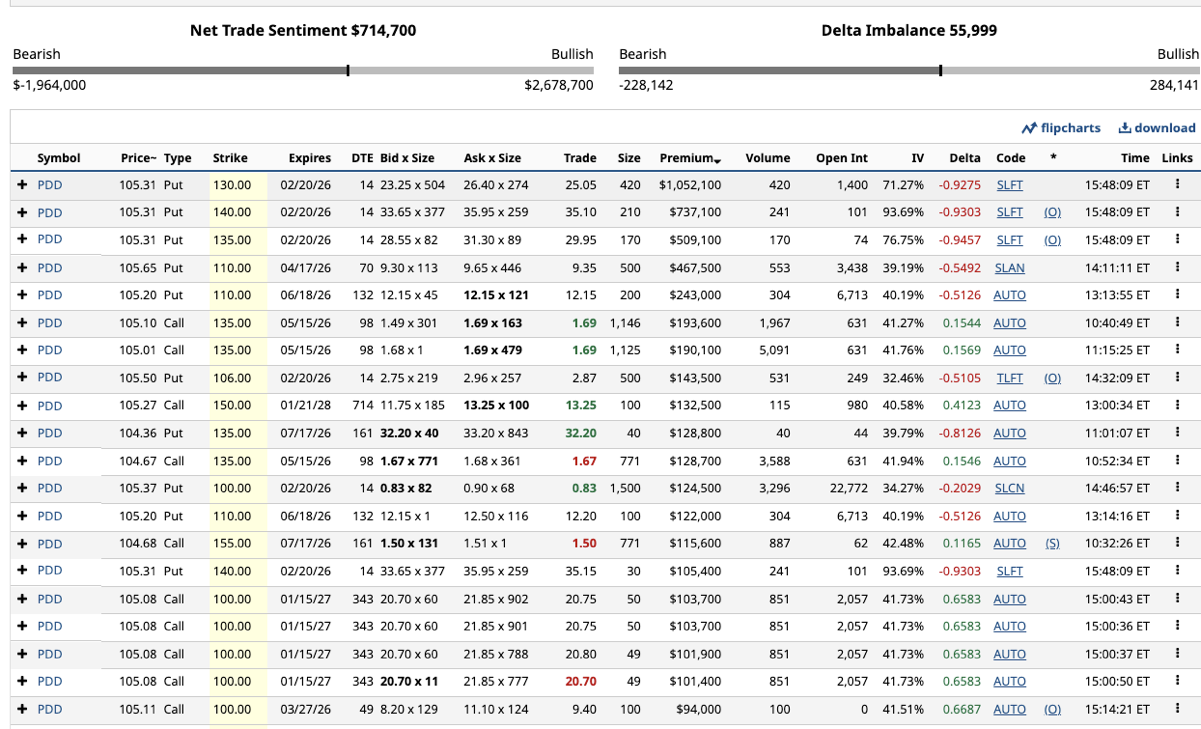

Total Assets$PDD(PDD.US) On February 9th, the PDD options market overall showed characteristics of increased trading volume on the Put side, but with a structure leaning towards arbitrage and volatility trading. Looking at the distribution of large orders, there were multiple high nominal value trades in near-month Puts around the 125–140 strike range, with IV generally between 70%–90%. These Put orders were mostly multi-leg structures (TLFT / MLFT), not single-leg naked buys. Combined with the relatively high implied volatility levels, they more closely resemble spread structures (Put Spread), one leg of straddles/strangles, or synthetic structures in inventory hedging, rather than one-sided bearish sentiment.

At the same time, there are still signs of continued position building on the Call side in the far months (2027 LEAPs), especially long-term Calls around the 100–110 strike range, with IV in a reasonable range, indicating that medium-to-long-term long funds have not retreated. Overall, the current options structure appears more like a phase of active risk management and arbitrage in a high-volatility environment, rather than a trend reversal to bearishness. If IV subsequently declines and the Put trading structure shifts from multi-leg to single-leg active buying, then caution is warranted for a genuine weakening of sentiment; otherwise, it leans more towards a phased game of repositioning within a volatile range.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.