Total Assets

Total Assets$Tesla(TSLA.US) TSLA Options Market Daily Report (2026-02-09)

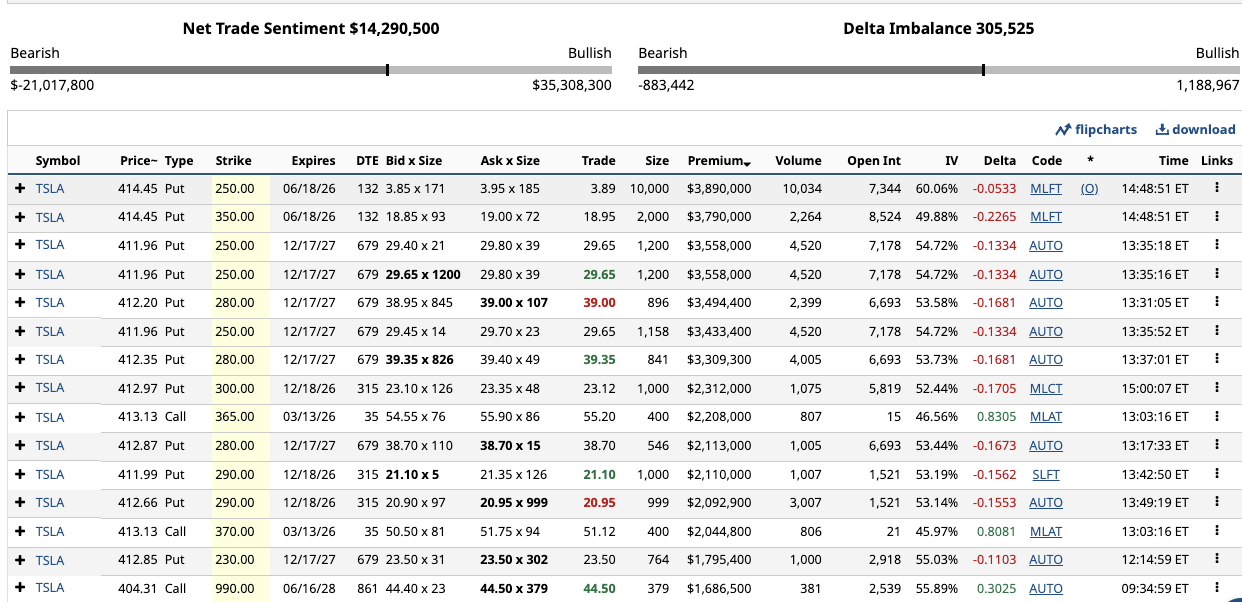

The Tesla options market on the day exhibited a clearly bullish structure overall. Net Trade Sentiment reached +$14.29M, and Delta Imbalance was +305,525, indicating directional funds actively taking long positions. Trading focus was concentrated on near-month and medium-term high-Delta Calls (e.g., the 365C, 370C line). These contracts, close to a "substitute for the underlying stock" long expression, suggest market funds at the current price level are inclined to bet on a phased rebound or continuation of the uptrend, rather than merely engaging in volatility plays.

Meanwhile, there were still many large long-term orders on the Put side, particularly concentrated in the 2027–2028 long-dated contracts, with IV maintained above 50%, resembling portfolio protection or tail hedging more than a trend-based short. The overall structure reflects the coexistence of aggressive long positions and long-term defensive insurance: short-term sentiment is warm, but the market still retains pricing for high volatility and tail risks, not yet forming a completely one-sided optimistic pattern.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.