Treasure Hunter

Treasure HunterThe scent of bottom-fishing🧐

Viewpoint from Zhihu @水又三人禾

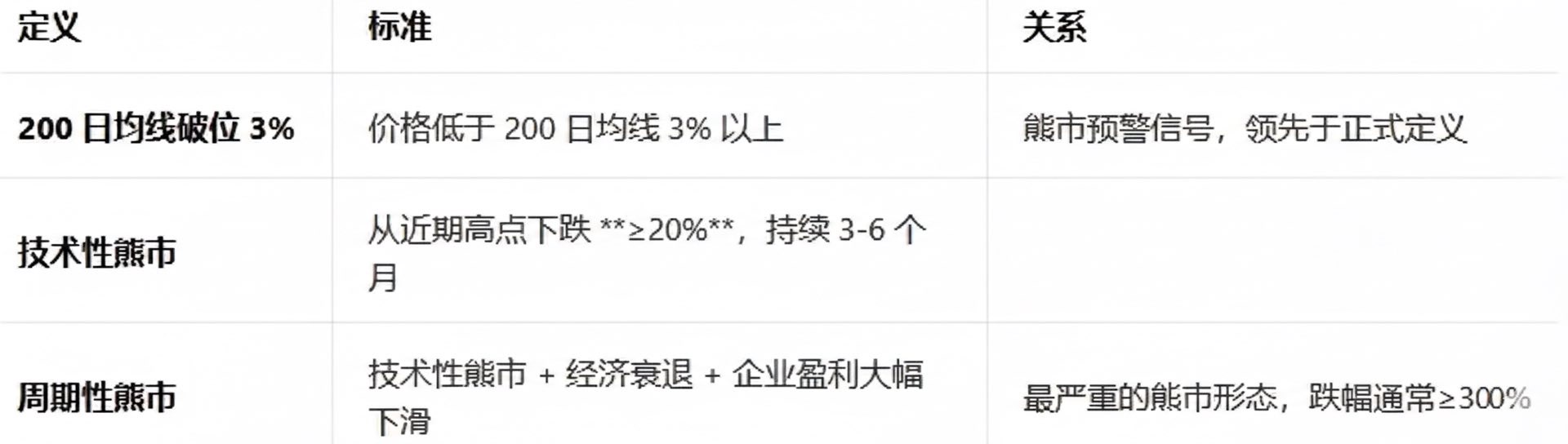

From the daily K-line chart, the Nasdaq has already fallen below the 5-day, 10-day, 20-day,

60-day, and 120-day moving averages. The next support level is the 250-day moving average.

Among these, the Nasdaq's 120-day moving average was just breached in recent days.

Breaking below the 250-day or 200-day moving average is a sign that the Nasdaq is officially entering a bear market.

From the current price to breaking below the 200-day moving average (21,778 points), the Nasdaq only needs to fall about 4%.

According to the theory that a further 3% drop below the 200-day moving average triggers a bear market signal, in the most pessimistic scenario, we could see US tech stocks enter a bear market after the Spring Festival holiday.

Currently, the 120-day line hasn't been completely breached (less than 2% below), but Friday's CPI data was a big positive yet the rebound was weak, which is a bit frustrating. Hope it doesn't play out like this script 🙃🙃

$Invesco QQQ Trust(QQQ.US)$Tesla(TSLA.US)$NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.