Rate Of Return

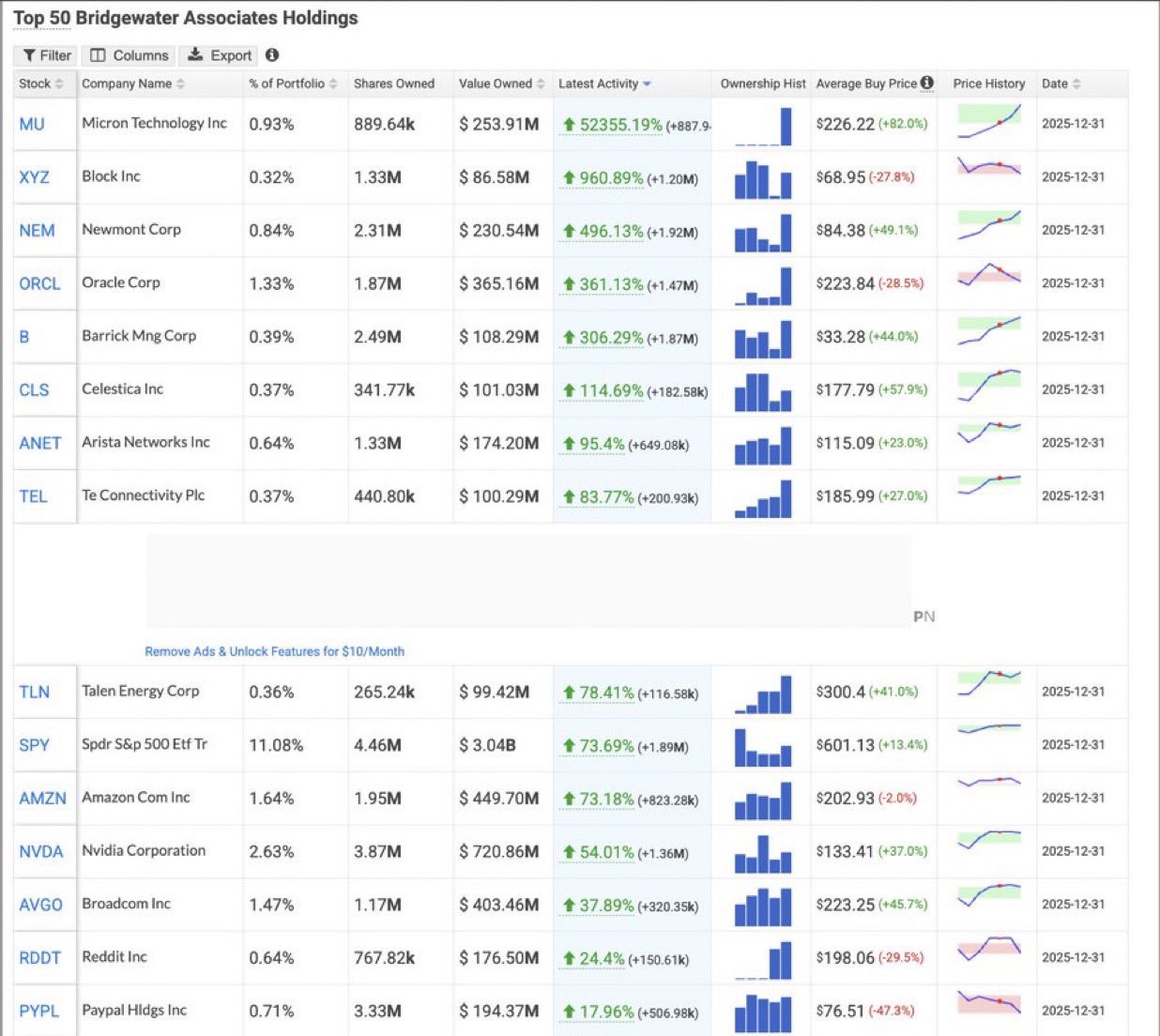

Rate Of Return🔥📊 Bridgewater's 13F Exposed: Heavily Increased Positions in $SPDR S&P 500(SPY.US) and $Micron Tech(MU.US), Slashed Major Holdings $Alphabet(GOOGL.US) $Adobe(ADBE.US)—What is Ray Dalio's Team Betting On?

The market's first reaction when the 13F came out was:

Micron made a killing.

But if you only focus on one stock, you'll miss the real structural signals.

This latest disclosure looks more like a "style rebalancing" than a simple portfolio adjustment.

First, look at the increased positions.

$SPDR S&P 500(SPY.US)

$NVIDIA(NVDA.US)

$Amazon(AMZN.US)

$Micron Tech(MU.US)

$Newmont(NEM.US)

The core logic is clear:

Part is index exposure ($SPDR S&P 500(SPY.US)),

Part is core AI assets ($NVIDIA(NVDA.US), $Micron Tech(MU.US)),

Part is platform leaders ($Amazon(AMZN.US)),

Plus some defensive gold assets ($Newmont(NEM.US)).

This isn't an aggressive bet on a single theme.

It's a combination of "following the trend + maintaining a hedge."

Especially $Micron Tech(MU.US).

If AI training and inference continue to expand, the elasticity of HBM and high-bandwidth memory demand will be directly reflected in the earnings cycle.

When the market reprices the memory sector, adding positions early is equivalent to betting on "Phase Two of the AI hardware chain."

This offers more cyclical leverage than simply chasing $NVIDIA(NVDA.US).

Now look at the new positions.

$Caterpillar(CAT.US)

$Arm(ARM.US)

$Dell Tech(DELL.US)

$Spotify(SPOT.US)

Two signals are worth noting:

First, $Arm(ARM.US) and $Dell Tech(DELL.US) strengthen exposure to the "computing hardware ecosystem."

Second, $Caterpillar(CAT.US) is a typical beneficiary of industrial capital expenditure.

If infrastructure and manufacturing investment rebound, industrial leaders are often the first to show improved cash flow.

This shows Bridgewater isn't just betting on AI, but on "investment cycle expansion."

The really interesting part is the reduction direction.

$Salesforce(CRM.US)

$Alphabet(GOOGL.US)

$Adobe(ADBE.US)

$AMD(AMD.US)

These aren't bad companies.

But they represent:

Mature software + high-valuation tech assets.

When a fund starts withdrawing from some software leaders and shifting towards hardware chains and index exposure,

That looks more like a "risk reallocation."

Completely exiting $AT & T(T.US) and $Annaly Capital Mgmt(NLY.US) releases another layer of meaning:

In a high-interest-rate environment, the appeal of traditional high-dividend and interest-rate-sensitive assets declines.

Capital is moving towards directions with more growth elasticity.

The truly critical question isn't:

What did Bridgewater buy.

But:

What risk are they reducing?

What exposure are they increasing?

Behind these holding changes, I see three main themes:

First, continue embracing AI hardware and computing power expansion.

Second, increase index exposure, reduce single-stock concentration risk.

Third, reduce high-valuation software and some interest-rate-sensitive assets.

Which point are you more focused on?

The cyclical elasticity of $Micron Tech(MU.US)?

The continued dominance of $NVIDIA(NVDA.US)?

Or the macro judgment behind the index exposure?

📬 I will continue tracking the capital migration path of institutional 13Fs, dissecting changes with real structural significance, not just the surface phenomenon of "making a killing." Follow me to understand the real deployment direction of big money together.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.