Although I don't understand it, it sounds very reasonable. Holding this stock will keep switching between getting margin called and striking it rich.

$Rocket Lab(RKLB.US) RKLB Notes - Just jotting down some thoughts to organize my ideas

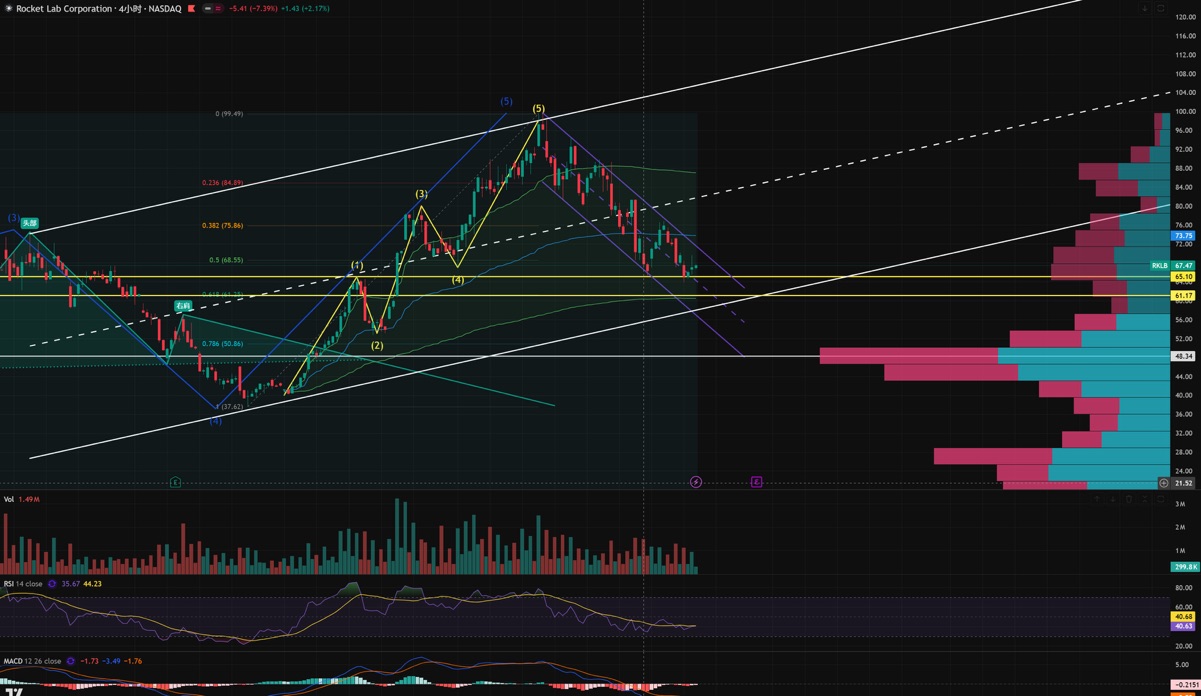

Based on data calculations, there are only two scenarios: 1. Looking at the large-scale weekly K-chart, the journey from $5 to the $100 high can be seen as a complete five-wave pattern. If so, the subsequent correction depth will likely touch near the lowest point of the previous fourth-wave retracement, around $37.82. In terms of time cycles, the first wave lasted 180 days, the second wave 40 days, the third wave 180 days, and the fourth wave also 40 days. However, the fifth wave here has only lasted 73 days, which is relatively short. Although the fifth wave is complete, such a deep correction happening so early, I think the probability of this scenario is relatively low.

2. We are still within the operating cycle of the large fifth wave. The current 61.8% retracement, as the second wave of the large fifth wave's impulse wave, also happens to be near the lower edge of the VWAP, in a chip vacancy zone, i.e., the chip position around 61-65 as shown in the chart. This is also near the high point of the first wave and the low point of the fourth wave of the large fifth wave, providing strong support. Therefore, I believe it's highly likely that the current large fifth wave will complete. This would also be appropriate in terms of the time cycle, and there would be ample room for subsequent retracement. Based on the current situation, it's too fast and too rushed. The final calculated target point is around $130. Ideally, the final news flow would coincide with SpaceX's IPO, completing the release of sentiment at the tail end of the final main rising wave. The depth of the current correction wave is sufficient, but given RKLB's stock character, it won't shoot up instantly. It will likely consolidate and fluctuate around 61. If it breaks above the upper edge of the descending channel, that might just be a B-wave correction. Without a quick departure from the downtrend, it cannot be considered a reversal. There will still be a C-wave retracement, possibly testing the chip zone around 61 again.

The worst-case scenario would test the super chip zone around 50, which is also the starting point of the last earnings report rally and the lowest point of the small second-wave retracement within the large fifth wave. If it touches $37 again, it will be considered a complete five-wave pattern turning bearish, and the subsequent adjustment would be unpredictable. Therefore, the key level around 61 here is very important, and coordination with the broader market is also crucial. Bitcoin might rebound at low levels, but the Nasdaq is lingering at high levels without coming down, still oscillating. We still need to focus on the broader market. I estimate the main rising wave to 130 won't arrive that quickly. A 100-day adjustment period is certainly sufficient. As a small cap stock, unless the broader market remains high and sideways without falling, there might be an outbreak for small caps. However, there are no such signs at present. The overall trend has been bearish in the past two months, mainly oscillating. I hope to see the broader market later cooperate with RKLB to stand at a new high of 130.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.