Rocket Lab Gain Hunter

Rocket Lab Gain Hunter NVO Option Return Rate

NVO Option Return RateCompared to Duan Lang's portfolio analysis, I found that the biggest reason I'm not making money is the lack of a systematic investment logic:

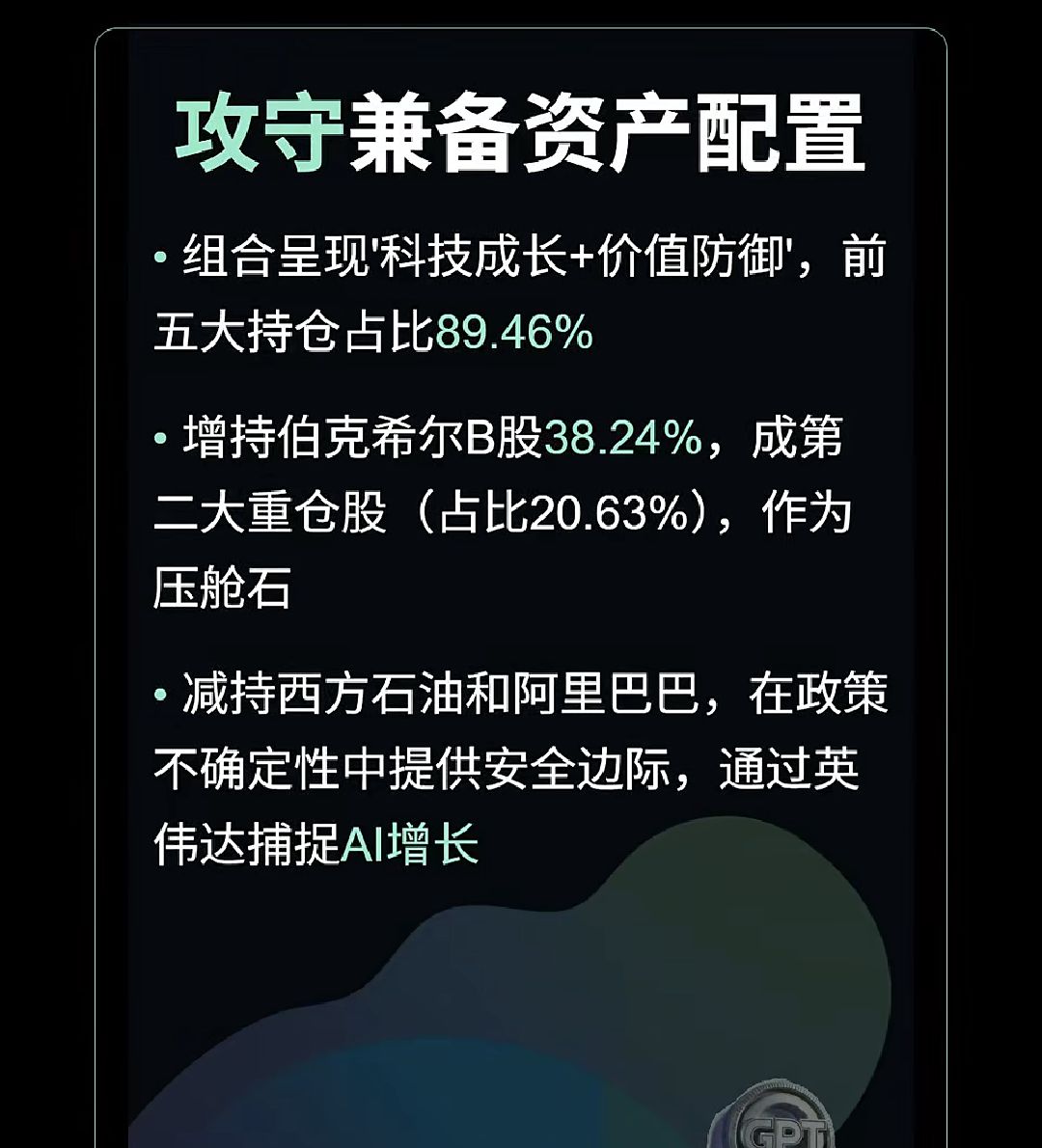

1. No solid core holdings. For example, I have almost no long-term holdings in $Coca Cola(KO.US)$Berkshire Hathaway B(BRK.B.US). Instead, I treat them as volatile sector asset allocations. I ended up buying $Unitedhealth(UNH.US) as my largest holding.

2. Too high risk assets. More than half of my positions are allocated to $BitMine Immersion Tech(BMNR.US)$Circle(CRCL.US)$Robinhood(HOOD.US)$Daily Target 2X Long MSTR ETF(MSTX.US), and I even use long-term leverage and options on MSTR.

3. Continuously chasing hot trends (copying homework). This is reflected in stocks like $Recursion Pharmaceuticals(RXRX.US)$Netflix(NFLX.US).

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.