Rate Of Return

Rate Of Return🚨🔥 "This is not a conspiracy, it's a liquidation!" — Have we really seen the truth behind this Bitcoin crash?

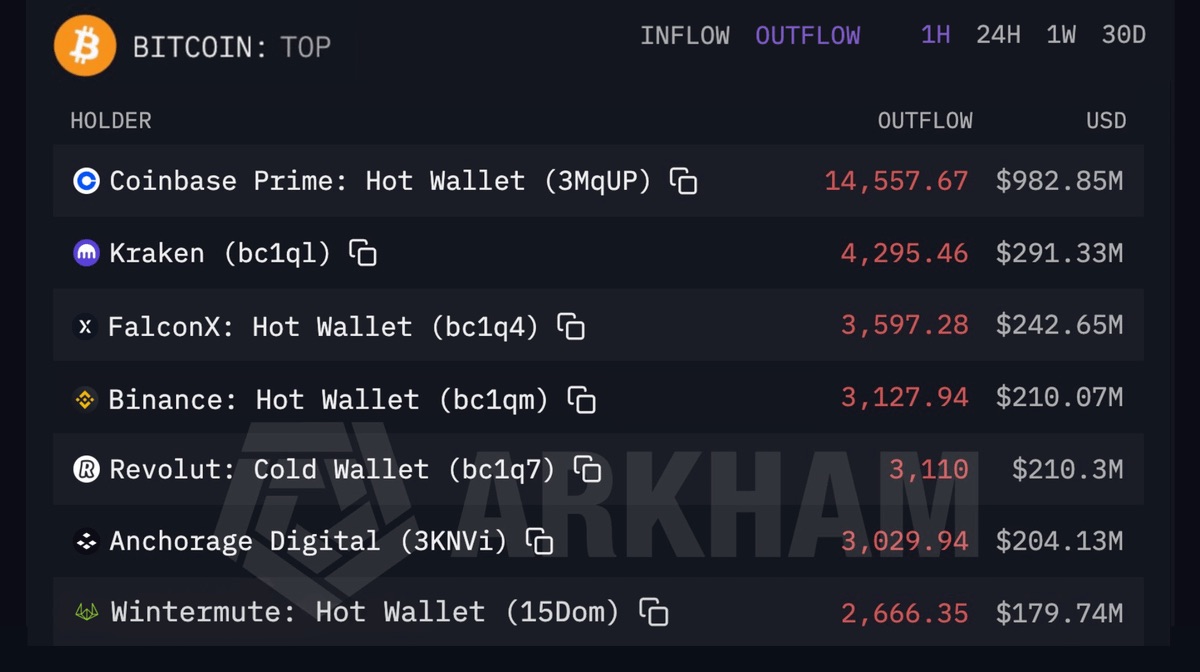

When the market takes a sharp dive, the first thing we see is a list of names:

$Grayscale Bitcoin Mini Trust ETF(BTC.US)

Coinbase

Kraken

Binance

FalconX

Revolut

Anchorage Digital

Wintermute

Then the community instantly jumps to a conclusion —

"This is a coordinated, premeditated sell-off!"

But if we calm down for three minutes, we might find the situation is completely different.

First, what we see are on-chain outflows, not "active dumping."

These institutions are essentially:

Exchanges

Market makers

Custodian banks

Institutional brokers

More often than not, they are handling client funds, not using their own capital to take directional short positions.

On-chain outflows could represent:

Client withdrawals

OTC settlements

Internal wallet adjustments

Market maker hedging

Asset transfers after liquidations

We cannot equate "outflow" directly with "dumping."

Second, what truly crashes a market is usually not sell orders, but leverage.

The question we should ask is not "who sold," but:

Was open interest at a high level?

Were funding rates overheated?

Were long positions overly crowded?

In a high-leverage environment, all it takes is a trigger —

Price drop → Liquidations → More selling → Triggers more liquidations.

This is called a liquidity cascade.

Not a conspiracy, but a mechanism.

Third, if it really was a "coordinated dump," what would be the cost?

Multiple globally compliant platforms manipulating prices simultaneously carries extremely high risks.

Legal liability, regulatory risk, brand damage —

These costs far outweigh the gains from short-term volatility.

We have to admit one thing:

When the market falls, our brains automatically look for a "single culprit."

Because that feels more comfortable.

But what often causes severe market volatility are:

Futures market liquidations

ETF fund outflows

Synchronized pullbacks in macro risk assets

Market maker Gamma hedging

These structural factors are more explanatory than a list of addresses.

If we only focus on "who transferred how much BTC," we miss the bigger variables:

U.S. Treasury yields

Dollar index

Equity market risk appetite

Liquidity contraction

The crypto market has never been an island.

Finally, we need to ask ourselves one question:

Do we want a dramatic story,

or do we want to truly understand market mechanisms?

If it's the latter, then this looks more like a typical deleveraging event, not a secret meeting.

The real question is —

When leverage climbs back to high levels, will we experience the same script all over again?

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.