Buffett's junior apprentice

Buffett's junior apprenticeDuring the dot-com bubble, companies with high capital expenditures had high valuations. In the AI era, companies with high capital expenditures see their market caps get hammered. The contrast between the two is stark.

At most, valuations are on the high side, but they are far from a bubble. Moreover, all of the "Magnificent 7" except Tesla have solid earnings to back them up.

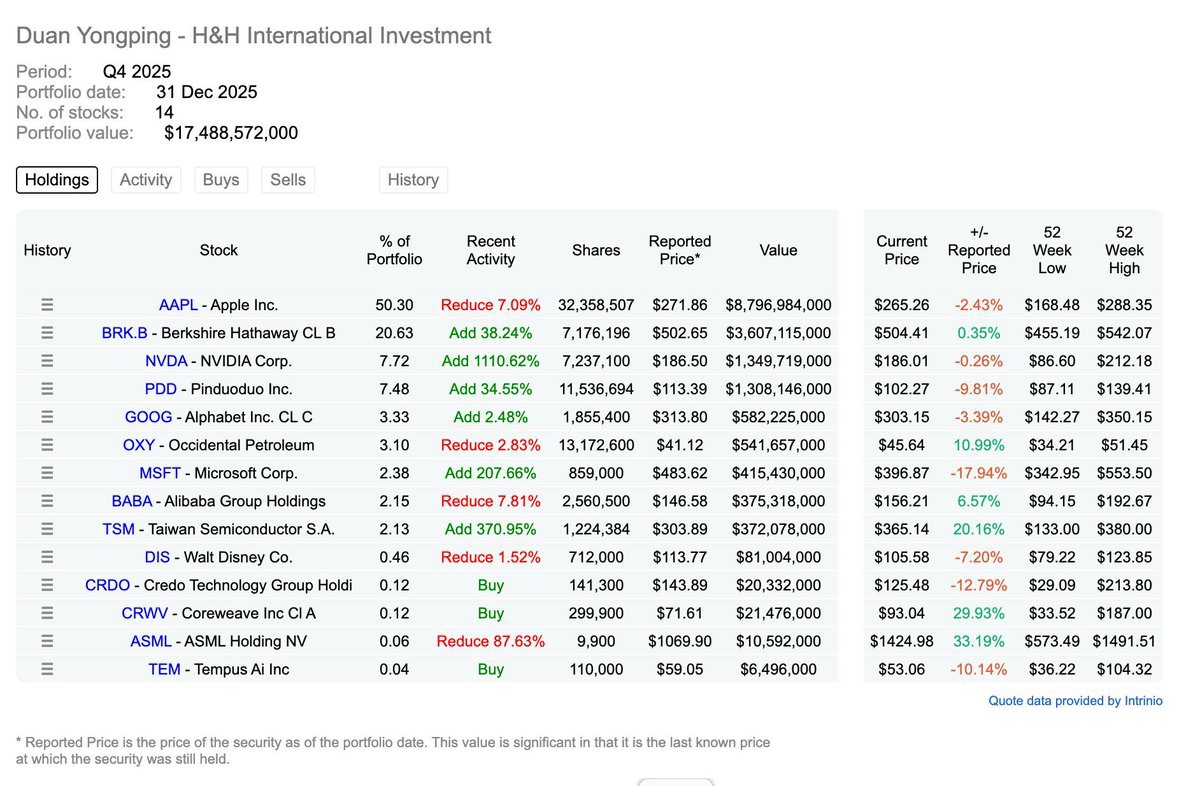

🔥📈 When everyone is shouting about an AI bubble, I see Duan Yongping directly going heavy on $NVIDIA(NVDA.US) $Alphabet - C(GOOG.US) $Taiwan Semiconductor(TSM.US) $BRK.B in Q4.

Last year in Q4, the most popular phrase in the market was — "The AI bubble is about to burst."

But when I looked at Duan Yongping's position changes, I saw the complete opposite action: not reducing positions, not waiting and seeing, but significantly increasing them.

$NVIDIA(NVDA.US)

$Alphabet - C(GOOG.US)

$Taiwan Semiconductor(TSM.US)

$BRK.B

Especially $NVIDIA(NVDA.US), the increase in holdings was astonishing.

This isn't a symbolic purchase of a little bit, but pulling the position into the core range.

When market sentiment is discussing whether valuations are overheated, what is he doing?

He's increasing his position in "computing power infrastructure."

I understand the logic behind this is very simple.

If AI is just sentiment, then the gains rely on stories.

If AI is structural, then the gains rely on capital expenditure.

What's happening now is the latter.

Cloud providers' capital expenditures haven't stopped.

Data centers are expanding.

HBM capacity is being fought over.

Power has become a bottleneck.

These are not the common characteristics of a bubble.

The characteristics of a bubble are:

Many stories, little cash flow, hollow capital investment.

Now:

Chipmakers are expanding production.

Cloud providers are raising guidance.

Semiconductor equipment makers' order books are full.

This is comprehensive synchronization across the entire industrial chain.

What's even more interesting is $Taiwan Semiconductor(TSM.US).

When the most upstream foundry is also heavily weighted, what I see is a bet on the "sustainability of long-term demand."

$Alphabet - C(GOOG.US) represents another layer of logic.

Model + distribution + cloud, a triple structure.

If AI is the productivity tool for the next decade, then platforms that possess the entry points to computing power and data are not cyclical plays, but infrastructure.

As for $BRK.B.

This is more like a risk balancer.

When an investor places high-volatility computing power stocks and stable cash flow assets in the same portfolio, what I see is structural allocation, not blindly chasing highs.

What really concerns me is not the gains, but the direction of the position changes.

While the public is discussing "whether valuations are expensive," big money is asking "whether the trend is just beginning."

I don't deny that volatility will come.

Semiconductors will always be a cyclical industry.

But what I care more about is —

When capital expenditure is still accelerating, when computing power demand is still expanding, when institutional funds are continuously concentrating, whether the so-called "bubble" narrative is just a phased release of sentiment.

In my view, this is not madness, but an early layout at the core nodes of the next industrial cycle.

The market will always argue about bubbles, but the flow of funds is often more honest than the arguments.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.