Experience US Stock Short Selling with Longbridge!

Dear Longbridge friends, we have officially fully launched the US stock short selling (margin trading) trading service, providing you with more diversified investment opportunities in the volatile market!

Securities financing is one of the most basic ways of short selling in the US stock market, which is the opposite to the long position. When you believe that the price of a stock will fall but does not own the stock, you can borrow shares of the stock from Longbridge using a certain amount of funds (margin) in your securities account as collateral and sell it. If the future stock price falls, you can buy back the same amount of the stock at a lower price and earn the price difference between higher selling price and lower buying price.

What are the requirements for short selling (securities financing) in US stocks?

Short selling (securities financing) of U.S. Stocks have the following requirements:

- Ensure that you have opened a Longbridge Integrated A/C (margin account);

- Your account has enough buying power (account assets > initial margin required for securities financing);

- The stock is eligible for short selling through Longbridge.

Note:

- Short selling (securities financing) in US stocks is a type of margin trading. Margin trading can only be conducted if the total assets in the account are greater than or equal to the initial margin required for borrowing an individual stock. If the total assets in the account are less than the margin requirement, it is not possible to conduct short selling (securities financing).

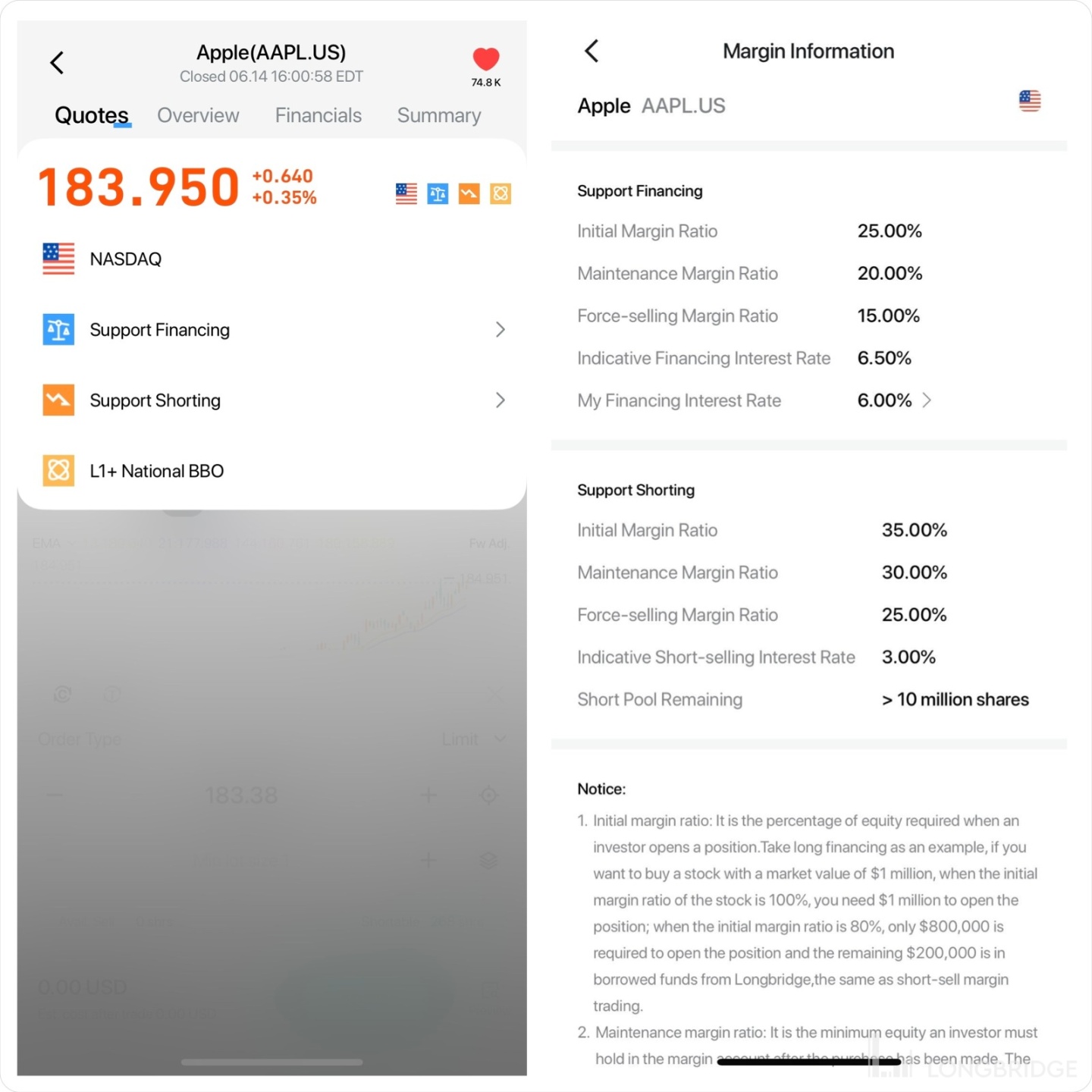

- Each stock that supports short selling has different initial margin requirements due to different margin ratios. The specific margin ratio can be viewed on the details page of the individual stock that supports short selling (securities financing).

- Buying power can be increased by depositing cash or stocks that can be used as collateral.

- During margin trading operations, Longbridge calculates the risk management value of the account in a certain way. When the overall risk management value of the account is too low, it may result in forced liquidation of some positions.

How do I know which stocks can be shorted?

You can go to the individual stock details page and check the supplementary information in the upper right corner. If it includes "Support Shorting", it means that the stock can be sold short. After tapping into the “Margin Information” page, you can also view specific information such as the required margin for shorting, interest rates, short pool quotas, etc. The list of stocks that support short selling may be adjusted from time to time depending on company policies and market risks.

What are the fees for short selling (securities financing)?

There are two types of fees that can be incurred during a short-selling operation.

- The first is the commission, platform fees, and third-party fees incurred when buying and selling stocks. These fees are the same as the trading fees for long positions in the same market.

- The second is the margin interest that needs to be paid if the borrowed stocks are sold but not bought back to close the position within the same trading day. The margin interest rate may vary for different stocks, and the specific rate can be viewed on the margin information page which can be accessed by tapping on the stock details page.

How do I short sell US stocks?

You can go to the trading interface, select "Sell", and you will see how many shares that are "Shortable" below the input quantity. Then you can enter the short selling quantity according to the shortable amount and submit your order directly.

For other common questions about US stock short selling trading, please visit: FAQ about Short Selling (Securities Financing) in US Stocks - Longbridge (HK) - Help Center. You are also welcome to contact Longbridge customer service through "Me" - "Help and Customer Service".

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.