Jensen Huang stated that the agreement with Intel focuses on custom chips, denying the involvement of the Trump administration, while Ming-Chi Kuo mentioned that the risks at Taiwan Semiconductor are controllable

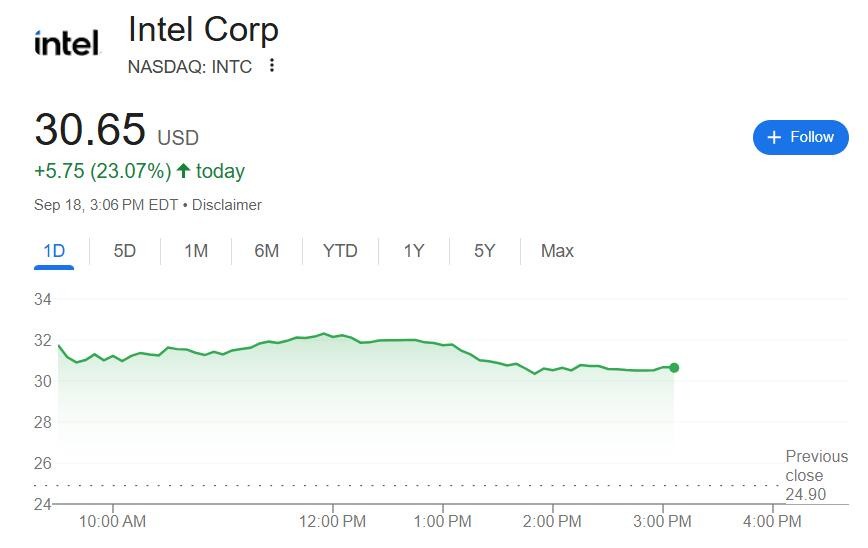

NVIDIA and Intel have reached a historic agreement focused on custom chip development, with Jensen Huang denying the involvement of the Trump administration. The collaboration will make NVIDIA a major customer of Intel's server CPUs, with market opportunities expected to reach $25 billion to $50 billion. Analyst Ming-Chi Kuo believes this collaboration poses controllable risks for Taiwan Semiconductor, and that Taiwan Semiconductor's advantages in advanced processes can be sustained for five years. Intel's stock price surged significantly, marking the largest single-day increase since 1987

On Thursday, the 18th, Eastern Time, after officially announcing a "historic" agreement with Intel, NVIDIA CEO Jensen Huang stated at a joint press conference with Intel CEO Pat Gelsinger that the new agreement focuses on the development of new custom chips, and the Trump administration was not involved in reaching this partnership.

Jensen Huang revealed that the engineering teams of NVIDIA and Intel have been collaborating for a year, and the cooperation agreement will open up new areas in the laptop market for NVIDIA, making NVIDIA a major customer of Intel's server CPUs. He expects the return on investment in Intel to be substantial, and the partnership will address market opportunities worth $25 billion to $50 billion.

According to media reports on the same day, Intel had already been in talks with NVIDIA about potential cooperation before President Trump publicly criticized Pat Gelsinger on social media last month, calling for him to resign as CEO.

Tianfeng International Securities analyst and Apple "prophet" Ming-Chi Kuo commented that the cooperation between NVIDIA and Intel poses controllable overall risks for Taiwan Semiconductor, and TSMC's advantageous position in advanced processes can last at least another five years, with AI chip orders not being affected.

After the announcement of the cooperation between NVIDIA and Intel, Intel's stock price gapped up 27.6%, rising as much as 30% during the day, poised to create the largest single-day gain since October 1987. TSMC's U.S. stock opened down 1.8%, but after turning positive in the morning session, it maintained its upward trend, rising over 2% at midday.

Custom Chips Become the Core of Cooperation, Both Sides Get What They Need

At the joint press conference, Jensen Huang elaborated on the technical aspects of the cooperation. He stated that obtaining the rights to use the x86 architecture will provide NVIDIA with further flexibility to scale supercomputers. In the gaming market, the two companies hope to create a SOC chip that integrates CPU and GPU processors, developing a new generation of integrated laptop chips.

Pat Gelsinger expressed excitement about building a "new era," calling it a "game-changing" moment. He emphasized that this cooperation is based on the core strengths of both companies and will benefit the entire technology industry and customers.

When asked about manufacturing process issues, Gelsinger stated that specific details would be discussed later. Jensen Huang made it clear that the announcement on Thursday was purely about the custom chips that NVIDIA and Intel will produce, involving data center and laptop chips.

$5 Billion Equity Investment, Political Factors Draw Attention

According to NVIDIA's official announcement, the company will invest $5 billion in Intel common stock at a price of $23.28 per share, subject to regulatory approval and other customary closing conditions. This price represents a discount compared to the previous day's closing price.

In the data center sector, Intel will build custom x86 CPUs for NVIDIA, which will integrate them into AI infrastructure platforms and bring them to market. In the personal computing sector, Intel will build and launch x86 system-on-chip solutions integrated with NVIDIA RTX GPU chips to power various PCs Media commented on Thursday that some tech executives view Intel's investment as a way to please Trump. For example, the day before the Trump administration confirmed its stake in Intel last month, SoftBank announced on August 19 that it would invest $2 billion in Intel. SoftBank's CEO Masayoshi Son sees the recent investment in Intel as a way to attract the president. It remains unclear whether NVIDIA's investment and collaboration are more politically motivated or the beginning of broader cooperation.

Chris Caso of Wolfe Research released a report on Thursday stating:

"It is currently unclear whether this is a symbolic collaboration for political purposes or the beginning of a broader partnership that will ultimately benefit Intel itself."

Caso believes the biggest question is whether NVIDIA will produce at Intel's foundries.

At Thursday's press conference, a reporter asked whether NVIDIA would use Intel's foundries. Jensen Huang replied that today's news is about CPUs, not the specific production methods or locations for these chips. NVIDIA stated that as long as they are suppliers of Intel chips, they will become major buyers of Intel chips.

Ming-Chi Kuo: TSMC's risks are controllable, three impacts worth noting

Tianfeng International analyst Ming-Chi Kuo pointed out in a report that the collaboration between NVIDIA and Intel will have significant impacts in three areas.

First is the definition and acceleration of the AI PC ecosystem. For NVIDIA, developing its own Windows-on-ARM processors carries high uncertainty; for Intel, establishing a competitive advantage in the GPU space is fraught with challenges. The combination of CPU and GPU could create strong synergies and advantages in the PC ecosystem.

Second is the significant synergy potential in the x86/mid-range/inference AI server space. Building local x86/mid-range/inference AI servers will become a key trend for enterprises. Intel has a large installed base and distribution channels, while NVIDIA brings technological advantages.

The third aspect is the impact on TSMC. Overall, Kuo believes that the collaboration between NVIDIA and Intel poses controllable risks for TSMC.

He expects that TSMC's advantageous position in advanced processes may last at least until 2030, and the collaboration between NVIDIA and Intel is unlikely to change this status quo. AI chips require leading advanced processes, so TSMC's AI chip orders should not be affected; however, changes in other customer segments (PC, x86 servers, networking) are worth noting.

He believes that while NVIDIA's investment in Intel may change the market shares of their competitors, thereby affecting TSMC's orders, considering that NVIDIA and Intel are expected to remain major customers of TSMC, the overall risk remains controllable.

Arm roadmap unaffected

At Thursday's press conference, reporters repeatedly asked about NVIDIA's chip plans based on the Arm architecture. Jensen Huang repeatedly emphasized that NVIDIA's commitment to Arm will not change. He stated, "The Arm roadmap will continue, and we will keep our promises." This statement aims to dispel market concerns about NVIDIA potentially adjusting its technological direction Jensen Huang also praised TSMC's manufacturing capabilities, stating that "TSMC's capacity is like magic," and that the collaboration agreement between NVIDIA and Intel will not affect the Arm roadmap.

A reporter asked what manufacturing process will be used for the chips developed in collaboration with NVIDIA. Chen Liwu stated that this issue will be discussed later.

White House Deputy Press Secretary Kush Desai stated in a statement that this partnership is "an important milestone for American high-tech manufacturing."

After the announcement of the collaboration between NVIDIA and Intel, NVIDIA's stock price rebounded on Thursday, rising about 3.9% at midday, while its AI chip competitor AMD saw its stock price further decline, dropping over 5.8% at the beginning of Thursday's trading, with the midday decline narrowing to within 1%.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk