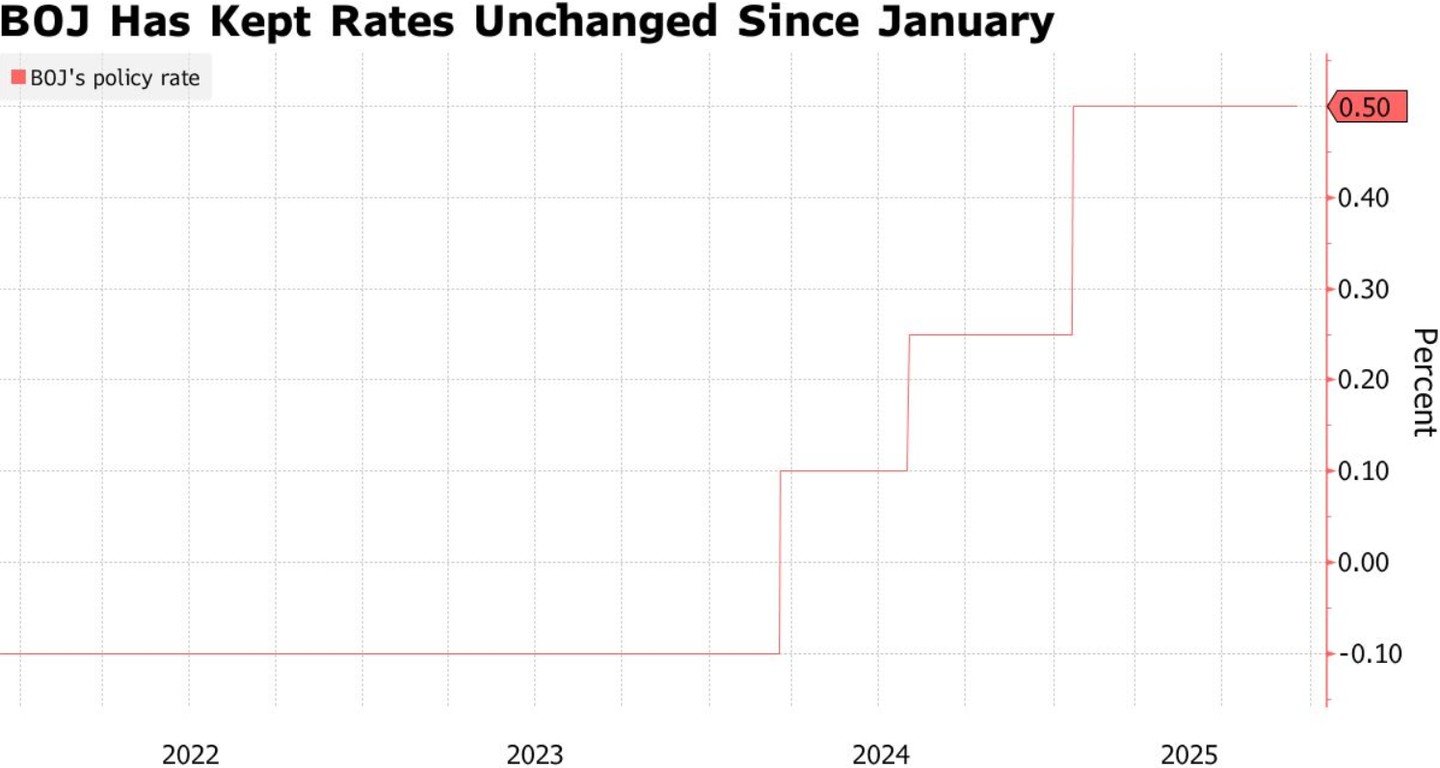

The Bank of Japan maintains interest rates as scheduled, but the rate hike camp is rising! Major announcement on ETF selling plan

The Bank of Japan maintained its benchmark interest rate at 0.5% and announced that it would begin selling its held ETF products, marking the rise of the rate hike camp. The decision was passed with a vote of 7 to 2, indicating internal divisions. The Bank of Japan plans to sell approximately 6.2 trillion yen worth of ETFs and real estate investment trusts annually based on market value. Following this announcement, the yen exchange rate rose, the 10-year government bond yield slightly increased, while the Japanese stock market experienced a decline

According to Zhitong Finance APP, in light of the persistent global economic and domestic political uncertainties in Japan, the Bank of Japan has decided to maintain its benchmark interest rate unchanged while announcing the start of selling exchange-traded funds (ETFs). Additionally, a significant detail of this rate decision is that the announcement was delayed considerably compared to usual due to internal voting disagreements. The Bank of Japan maintained the interest rate unchanged with a voting result of 7 to 2, with Monetary Policy Committee members Takeda Hajime and Tamura Naoki dissenting. Both committee members believe that the rate should be raised by 25 basis points to 0.75%, as the risks of rising prices are increasingly skewed to the upside, and the central bank should bring the policy rate slightly closer to the neutral rate.

According to its rate decision statement, the Bank of Japan maintained the policy rate at 0.5% during the two-day monetary policy meeting that concluded in Tokyo on Friday. All 50 economists surveyed by institutions expected the outcome of this rate decision to keep the benchmark rate unchanged. The voting result was 7 votes to 2, marking the first time since Bank of Japan Governor Ueda Kazuo took office that he faced two dissenters on the issue of maintaining the interest rate, which is seen by the market as an important sign of the rise of the "rate hike faction" within the Bank of Japan's Monetary Policy Committee.

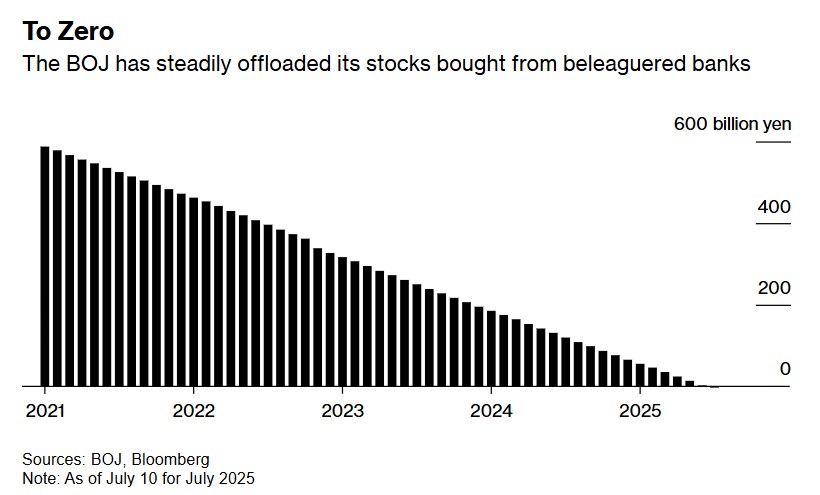

The Bank of Japan stated that it will begin selling its held ETF products and Japanese real estate investment trusts (J-REITs) at a scale roughly equivalent to what it sold after purchasing stocks from banks around the year 2000. The Bank of Japan indicated that it would start disposing of related assets after completing the necessary operational preparations, with a disposal pace of approximately 620 billion yen (about 4.2 billion USD) per year based on market value.

Before the statement was released, the yen had strengthened against the dollar, and it continued to rise after the announcement. The yield on 10-year Japanese government bonds rose slightly. However, the yield on 5-year Japanese government bonds climbed to its highest point since 2008.

The Japanese stock market entered a weak downward trajectory after hearing about the Bank of Japan's ETF sales. As of the time of writing, the Nikkei 225 index continued to decline, with the drop widening to 1.8%, reporting 44,496.74 points.

This is the first time the Bank of Japan has mentioned plans to sell its ETF holdings, which are valued at approximately 37 trillion yen (about 251 billion USD) at book value, and more than double that amount at market value. During its large-scale negative interest rate monetary easing program (which ended last year), the central bank became the largest single holder in the Japanese stock market around 2020.

In July of this year, the Bank of Japan essentially completed the sale of all the stocks it had purchased from struggling banks during the financial crisis of the 2000s. Bank of Japan Governor Ueda Kazuo stated that the central bank could use this experience as a reference for considering how to dispose of ETFs Earlier this month, Bank of Japan Vice Governor Noriyuki Nishimura also expressed similar views.

Statistics show that it is noteworthy that since the Bank of Japan began selling bank stock shares in October 2007, it took nearly 18 years for the Bank of Japan to completely divest its bank shares.

Goldman Sachs economists pointed out in a report in July that a reasonable expectation is that the central bank will gradually start selling ETF assets in the fiscal year 2026 to minimize potential losses and impacts on the Japanese stock market.

This Friday, the decision by the Bank of Japan not to take any monetary policy action was widely anticipated in the interest rate futures market, following Prime Minister Shigeru Ishiba's announcement of his resignation, which triggered fierce competition for succession, and about a year after the last leadership election. From an economic perspective, media reports previously cited informed sources stating that even though Japan has managed to solidify its trade agreement with the United States, members of the Bank of Japan's committee are still assessing the impact of U.S. tariffs both domestically and internationally.

An important sign of the rise of hawkish forces?

Ben Bennett, head of Asian investment strategy at LGIM, pointed out that although the Bank of Japan maintained interest rates, the announcement of the ETF asset sale plan, combined with the hawkish votes of two monetary policy committee members in favor of interest rate hikes, raised market concerns about a gradual shift towards a hawkish stance within the Bank of Japan; especially in the context of the Federal Reserve's interest rate cut this week, this move could lead to a continued strengthening of the yen in the short term.

Charu Chanana, chief investment strategist at Saxo Bank, stated that the dissent of committee members Takeda Hajime and Tamura Naoki highlights the increasing hawkish pressure within the Bank of Japan. Although most committee members still prefer a steady approach, the votes against today's decision by these two members indicate that policy discussions are leaning towards a faster normalization.

“Their positions reflect a gradual shift in the dynamics of the policy committee, which could support the yen, especially following the decline after the Federal Reserve's decision. The Bank of Japan's plan to reduce its ETF/J-REIT holdings indicates that support for asset purchases is weakening. This poses structural resistance to broad indices such as the TOPIX and Nikkei 225, although the specific impact depends on the pace of sales and the signals released. However, for the Japanese banking sector, as long as economic momentum remains stable, policy normalization through a steepening yield curve and improved net interest margins could actually become a tailwind,” Chanana stated after the Bank of Japan's interest rate decision was announced.

When will interest rate hikes resume?

Under the uncertainty of U.S. tariff policies and the political risks brought about by Prime Minister Shigeru Ishiba's announcement of his resignation plan, the economic outlook for Japan is becoming complex. However, informed sources revealed that some internal officials of the Bank of Japan believe that despite the instability in the political situation, given that economic development is in line with expectations, there is still a possibility of raising the benchmark interest rate again before the end of this year.

Bloomberg economist Taro Kimura stated: “The Bank of Japan needs to reduce stimulus measures because real interest rates are severely negative, inflation rates are above target levels, and there is stable wage growth to support it However, the next step may have to wait until October. For now, the turbulent political situation will keep the Bank of Japan temporarily on hold."

Japanese financial giant Nomura recently released a research report stating that there will be considerable uncertainty in the expectations of all financial institutions until the new government takes office and officially begins to formulate policies. If the Bank of Japan decides to incorporate the significant uncertainty brought by this new ruling coalition into its monetary policy model, the likelihood of the Bank of Japan restarting interest rate hikes in October will decrease. Nomura's baseline scenario is that the next interest rate hike by the central bank will be in January 2026.

It is understood that the latest policy statement released by the Bank of Japan on Friday reiterated its forecast—that the inflation rate may align with its target in the latter half of its three-year forecast period, indicating that the central bank is continuing to move towards another interest rate hike. Observers of the Bank of Japan expect that the central bank will raise borrowing costs again in the coming months, with the main focus currently being on when the central bank will make this decision. According to insiders, some officials within the Bank of Japan have indicated that regardless of the uncertainty in domestic politics, there is a possibility of another interest rate hike this year.

A survey conducted by an institution shows that more than one-third of observers of the Bank of Japan expect an increase in borrowing costs in October, while as many as 90% of respondents believe that the Bank of Japan will restart the interest rate hike process in January next year