The real bull market has not yet begun

The Federal Reserve's "preemptive rate cuts" may trigger a global expansion in physical demand, with expectations for the U.S. economy to achieve a "soft landing," an upward adjustment in GDP growth, and a decrease in the unemployment rate. Rate cuts will alleviate the depreciation pressure on emerging market currencies and promote economic stimulus policies. As a net exporter, China may benefit from overseas capital expenditures and the recovery of emerging markets. The domestic economy is weakening under the influence of "anti-involution," but new price increase factors in the PPI have shown a turning point, which may be driven by external demand

Abstract

The Scene After "Preventive Rate Cuts": A New Round of Global Physical Demand Expansion

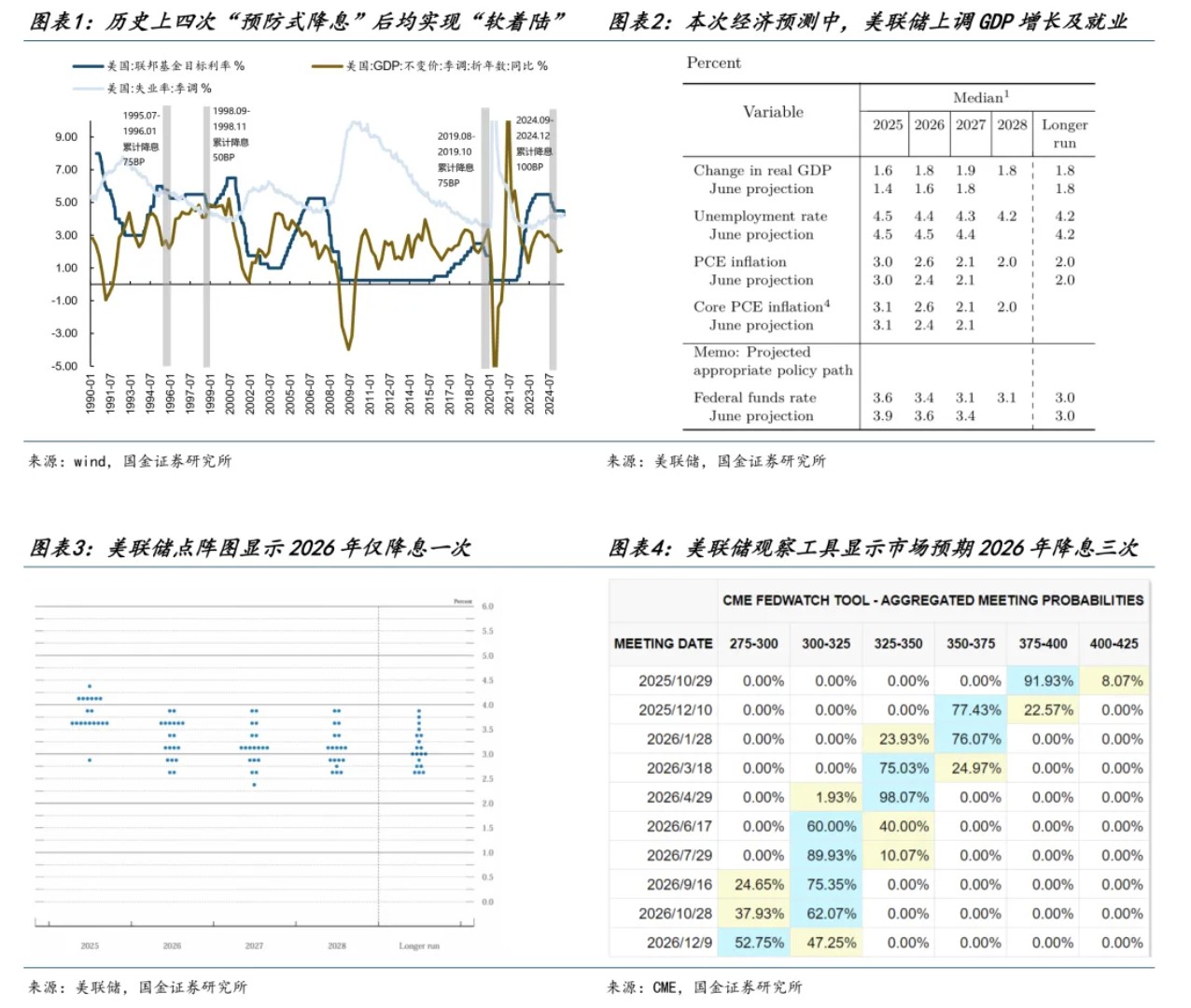

In the past 30 years, the Federal Reserve has implemented preventive rate cuts in 1995, 1998, 2019, and 2024, after which the U.S. economy generally achieved a "soft landing," meaning that GDP growth reversed its downward trend and the unemployment rate slightly declined. In this round, a "soft landing" may be the baseline scenario set by the Federal Reserve: the Fed has slightly raised its real GDP growth forecast for 2025-2027 and lowered its unemployment rate forecast for 2026-2027. The Federal Reserve's "preventive rate cuts" imply increased liquidity and a higher probability of economic stabilization for U.S. stocks, which have often performed well after previous "preventive rate cuts"; for emerging markets, the impact of the Fed's rate cuts mainly operates through two pathways: (1) Rate cuts relieve the depreciation pressure on emerging market currencies, providing greater policy space for domestic monetary policy. Recently, several important emerging economies (including multiple ASEAN countries, as well as Mexico, Brazil, and South Africa) have left room for potential domestic economic stimulus policies due to the strengthening of the U.S. dollar; if economic growth stabilizes, their capital markets may benefit from the spillover of the dollar; (2) If the U.S. achieves a "soft landing" after the rate cuts, emerging markets will also experience some demand spillover from the U.S. on the fundamental level. For net export countries like China, a "soft landing" after preventive rate cuts means that external demand driven by overseas capital expenditure and the recovery of emerging markets will further increase.

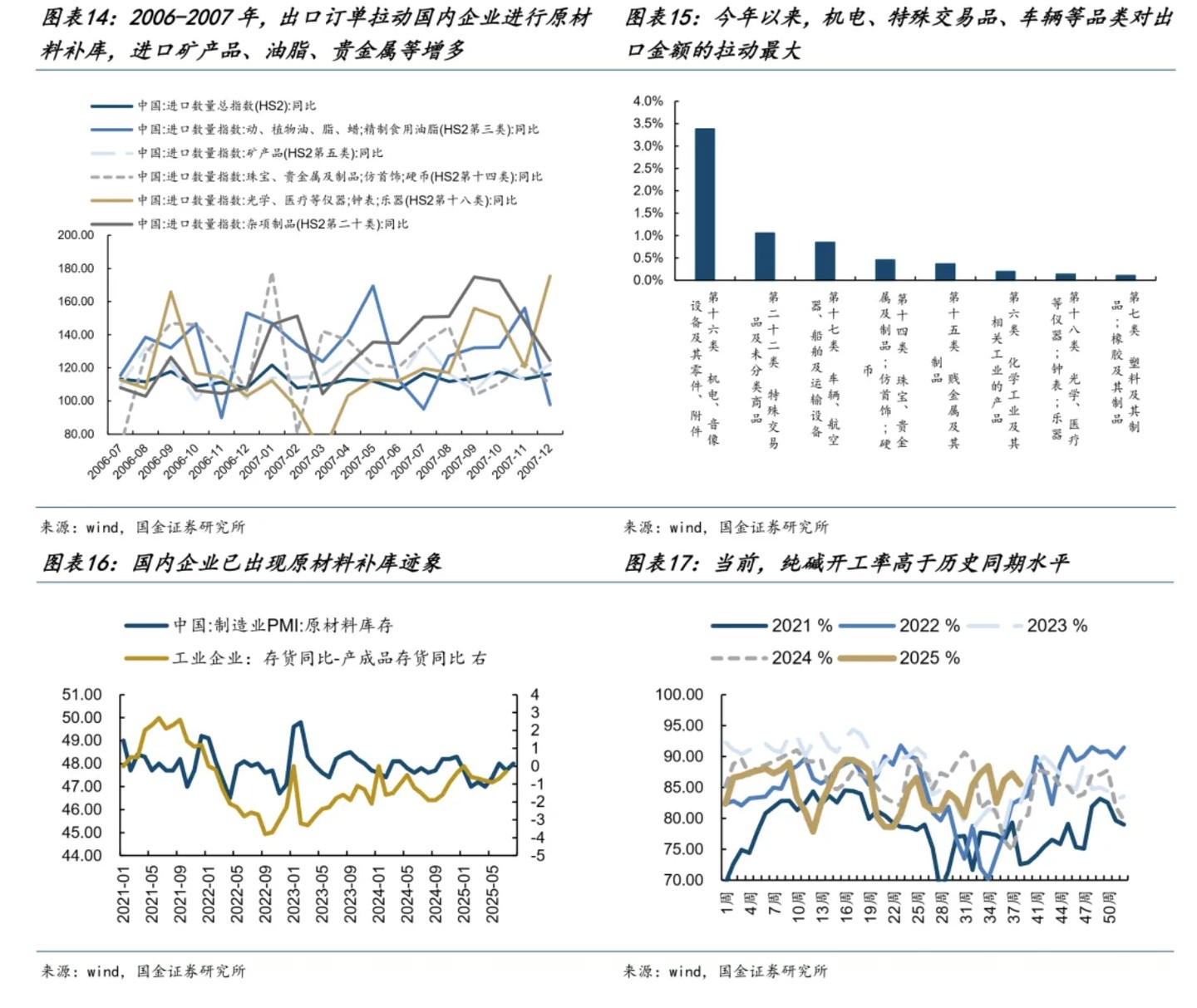

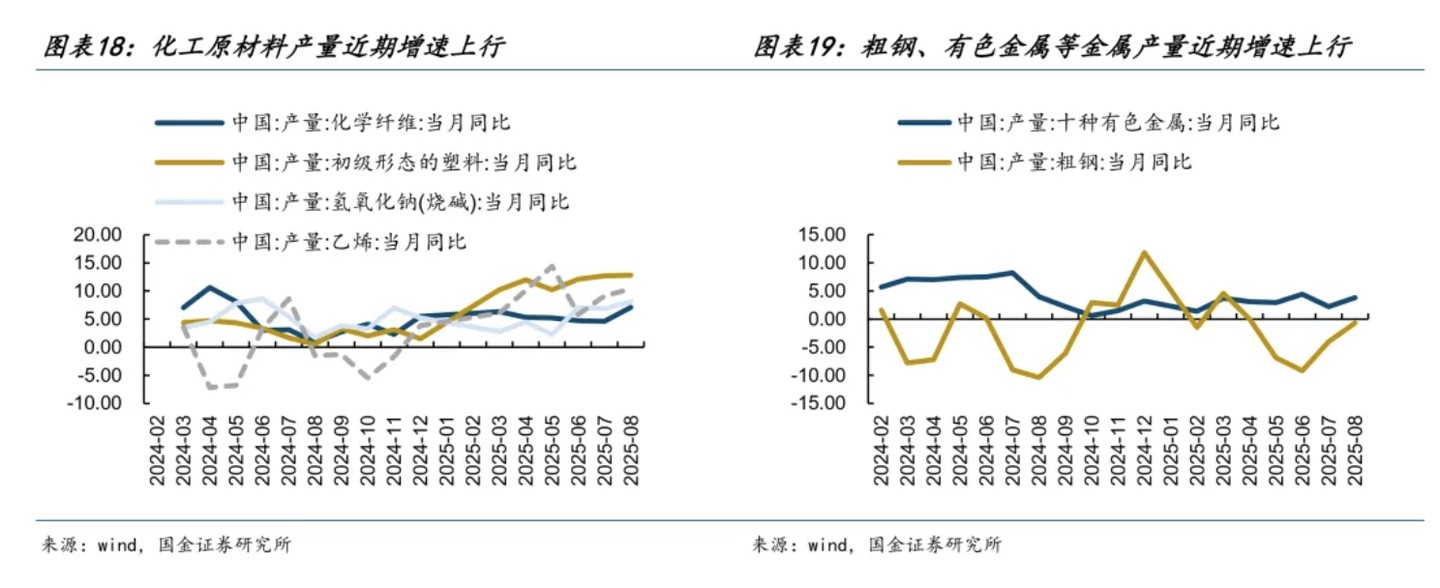

The Essence of Domestic Economic "Weakness" and the Impact of "De-involution": Export Prices May Become a Leading Indicator for PPI

On September 15, domestic economic data for August was released, continuing to show a downward trend under the influence of "de-involution": the decline in real estate investment continued to widen, the growth rates of infrastructure investment and manufacturing investment decreased, and the growth rate of industrial added value declined. However, beyond the purely weak data, some positive factors should also be noted: (1) The new price increase factors in the PPI are stronger than in July, marking the first inflection point of the year. The upstream "de-involution" production restrictions have driven coal and black metal prices to turn positive month-on-month. Currently, PPI may stabilize due to external demand, similar to the situation in 2005-2006, when: overseas retail restocking → export order prices increased → exporters replenished raw materials → domestic bulk commodities and PPI rebounded with a lag. This "demand abroad, inventory first" transmission sequence makes export prices a leading indicator for the entire chain; (2) High value-added products in exports remain strong: electromechanical products continue to be the main driver of exports, and these order-based products have strong pricing power; (3) There have already been signs of raw material restocking domestically: since March this year, the raw material inventory component in the manufacturing PMI has risen, and the inventory growth rate of large-scale industrial enterprises - the growth rate of finished goods inventory has also increased, indicating that domestic enterprises may have begun to restock due to external demand. Specifically, the production growth rates of chemical products such as synthetic fibers, plastics, caustic soda, and ethylene, as well as metal materials like crude steel and ten non-ferrous metals, have all recently increased The domestic economic model has shifted from strong "supply-driven" to "supply clearing + recovery in overseas commodity demand," which means that under the same nominal GDP growth, corporate profitability levels will begin to recover.

Standing at the Next Windfall: Exporting Overseas

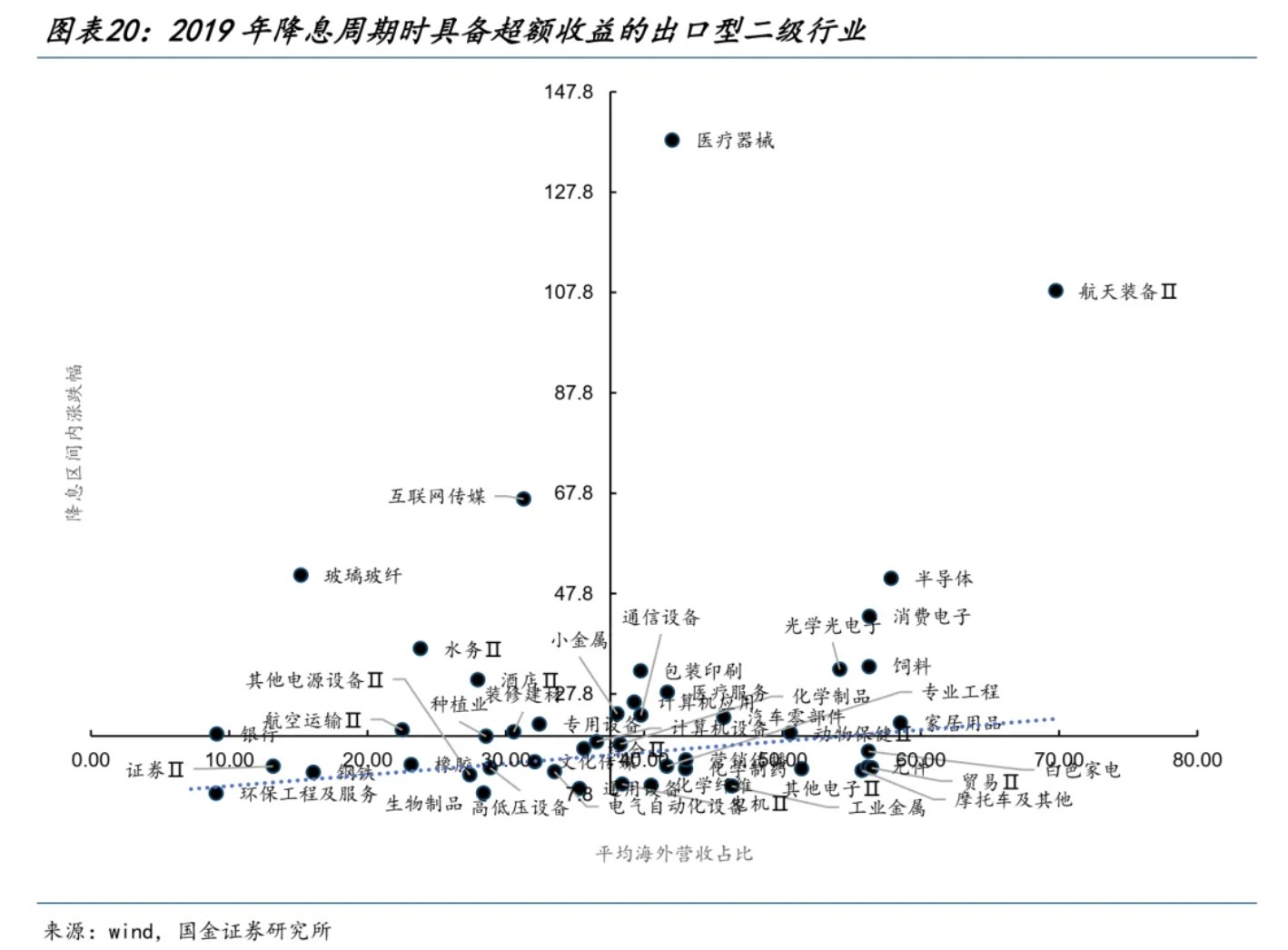

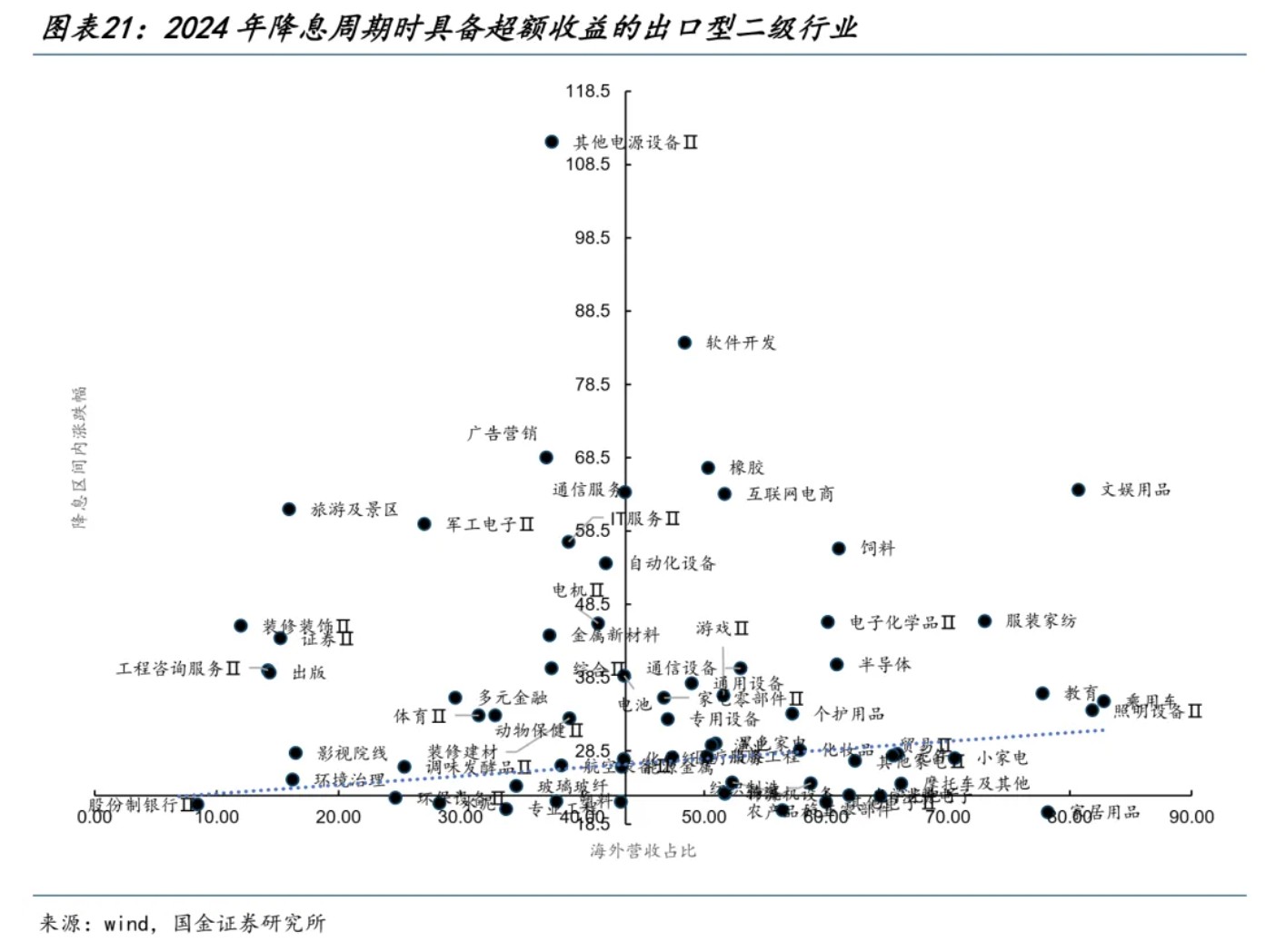

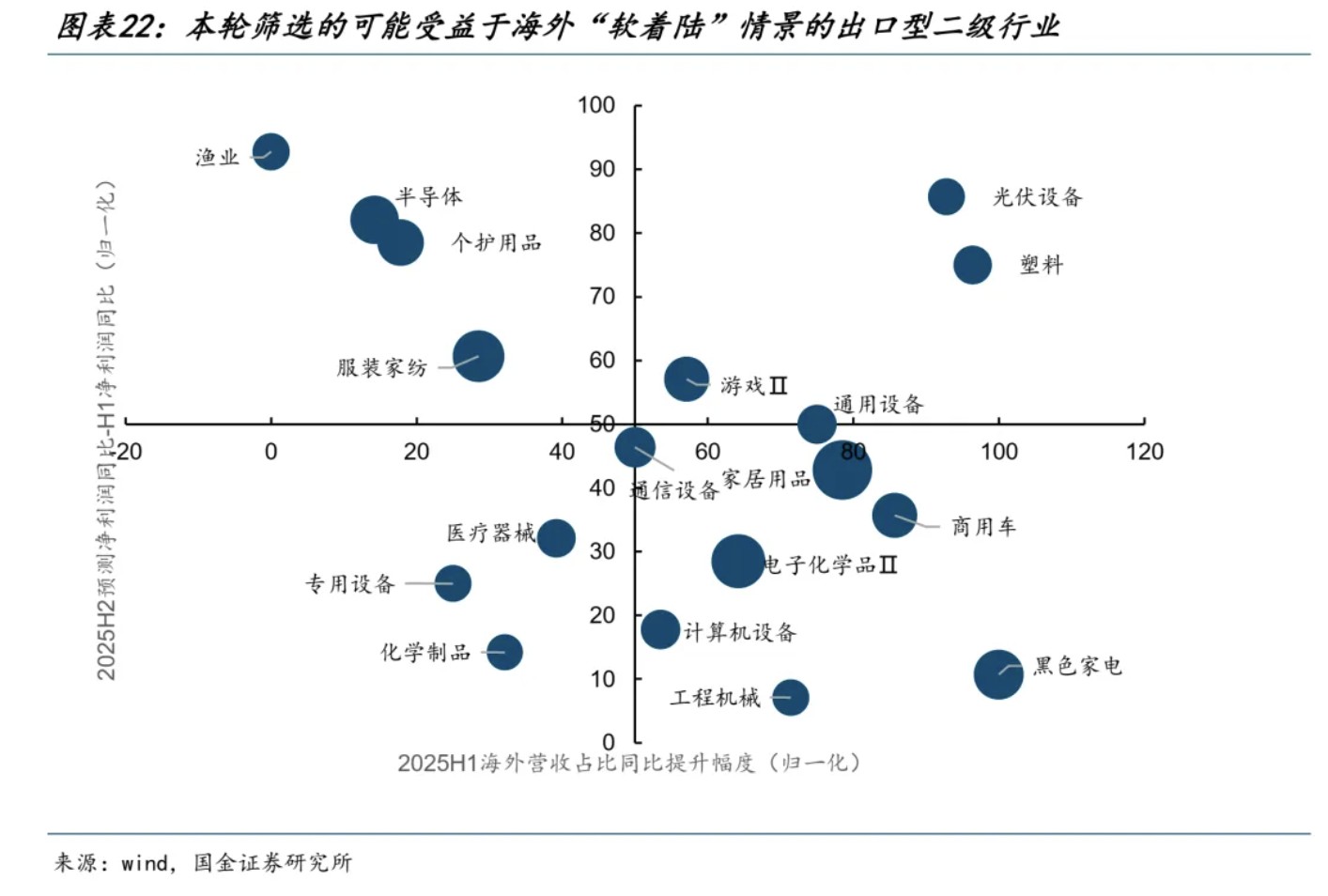

From past experience, during the interest rate cut cycles of 2019 and 2024, A-share export-oriented listed companies (those with overseas revenue accounting for the top 30% in various industries) have outperformed the CSI 300. From the perspective of industry distribution, this does not solely exist in so-called "interest rate-sensitive" growth industries, but depends on the specific supply and demand conditions of the industry at that time. We have screened a total of 18 sub-sectors that will benefit from this round of "preventive interest rate cuts." These industries can be divided into three categories: (1) Investment-related capital goods: photovoltaics, general equipment, semiconductors, communication equipment, commercial vehicles, etc.; (2) Intermediate goods related to the recovery of manufacturing prosperity: plastics, electronic chemicals, chemical products, etc.; (3) Consumer and pharmaceutical sectors with their own industry trends: gaming, personal care products, clothing and home textiles, medical devices, etc.

A Bull Market in Profits May Be About to Begin

Contrary to market investors' perceptions, we believe that a bull market driven by the recovery of China's profit fundamentals may be in the making. Currently, after the interest rate cuts, a new scene transition is beginning, and two types of opportunities can be focused on: on one hand, after the liquidity suppression is lifted, the Hong Kong stocks that have stagnated from June to August may have a rebound; on the other hand, growth investment will gradually shift from technology-driven to exporting overseas. Our mid-term recommendations remain unchanged: First, benefiting from the improvement in operating conditions brought about by domestic anti-involution, the recovery of manufacturing activities after overseas interest rate cuts, and accelerated investment in physical assets: upstream resources (copper, aluminum, oil, gold), capital goods (engineering machinery, heavy trucks, lithium batteries, wind power equipment), and raw materials (basic chemicals, fiberglass, paper, steel); Second, after profit recovery, opportunities will gradually emerge in domestic demand-related fields: food and beverages, pork, tourism, and scenic spots; Third, the long-term asset side of insurance will benefit from the bottoming and recovery of capital returns, followed by securities firms.

Main Text

1. The Scene After "Preventive Interest Rate Cuts": A New Round of Global Physical Demand Expansion

1.1 Expectations of "Soft Landing" Often Rise

The most notable event this week may be the Federal Reserve's announcement on September 17 of a 25 basis point interest rate cut in September, along with its economic forecast. From the Federal Reserve's monetary policy statement, this round of interest rate cuts appears more like a "preventive interest rate cut," as GDP growth has not significantly declined or turned negative, but "the downside risk to employment has increased." Additionally, historically, every instance of "preventive interest rate cuts" has been characterized by small single-rate cuts, and there may be pauses in between to observe the effects, which aligns with this 25 basis point small cut.

In the past 30 years, the Federal Reserve has conducted preventive interest rate cuts in 1995, 1998, 2019, and 2024, after which the U.S. economy generally achieved a "soft landing," meaning GDP growth reversed its downward trend, and the unemployment rate slightly declined. In this round, "soft landing" may be the baseline scenario set by the Federal Reserve: in its economic forecast, the Federal Reserve slightly raised its real GDP growth forecast for 2025-2027 (1.4%/1.6%/1.8% → 1.6%/1.8%/1.9%) The Federal Reserve has also lowered its unemployment rate forecast for 2026-2027 (4.5%/4.4% → 4.4%/4.3%), showing confidence in a "soft landing" for the U.S. economy. Nevertheless, the Fed has raised its PCE inflation forecast for 2026 from the previous 2.4% to 2.6%, indicating that inflation risks have not yet dissipated. Therefore, it is not difficult to understand why, in the September dot plot, voting officials believe there will only be one rate cut in 2026, which is lower than the current expectation of three rate cuts priced in by the CME futures market.

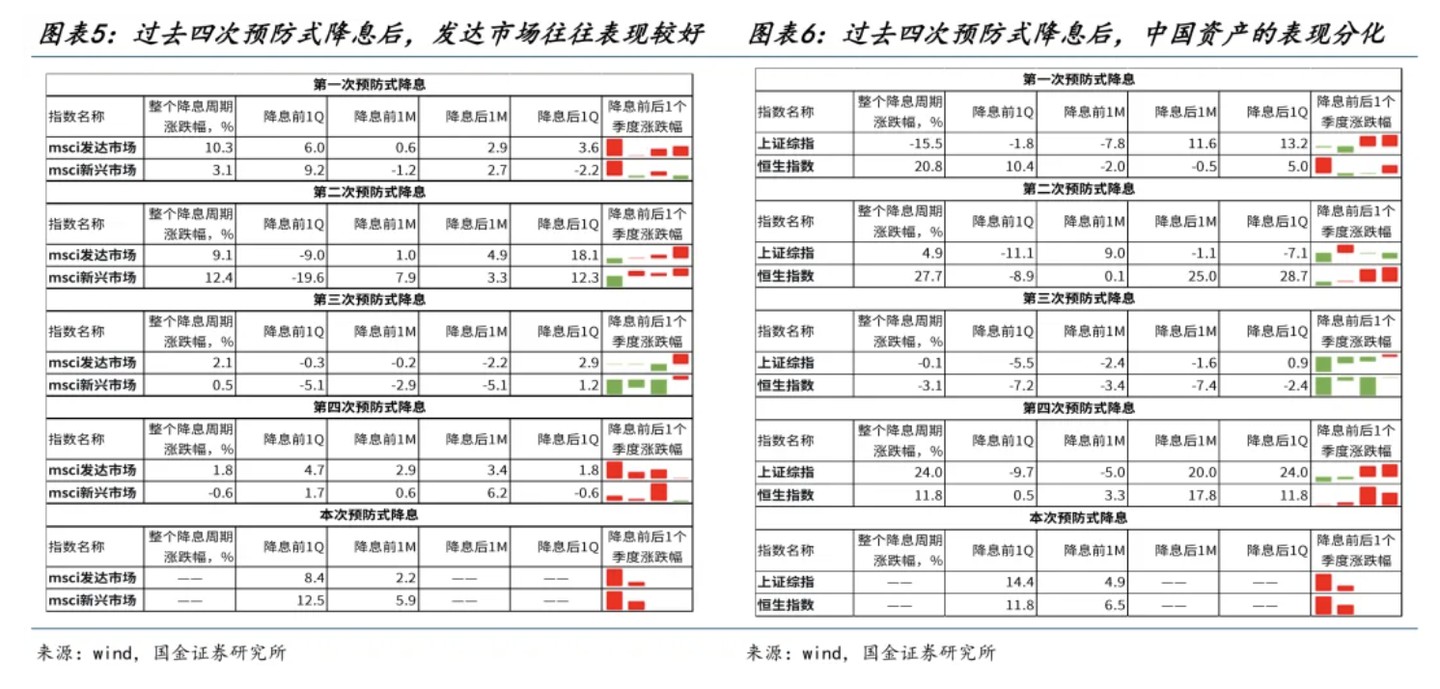

1.2 After rate cuts, developed markets often perform better, while emerging markets show divergence

The Fed's "preemptive rate cuts" mean increased liquidity and a higher probability of economic stabilization for U.S. stocks. Therefore, U.S. stocks have often performed well after past "preemptive rate cuts." The S&P 500 achieved gains of 16.2%, 8.6%, 1.9%, and 4.4% in the four historical rate cut periods mentioned above, while the MSCI Developed Markets Index recorded gains of 10.3%, 9.1%, 2.1%, and 1.8% in the same four periods. However, the performance of emerging markets during the "preemptive rate cut" periods has shown divergence, with the MSCI Emerging Markets Index recording fluctuations of 3.1%, 12.4%, 0.5%, and -0.6%. The Shanghai Composite Index and the Hang Seng Index, representing Chinese assets, experienced declines during the rate cut cycle from August to October 2019.

For emerging markets, the impact of the Fed's rate cuts mainly occurs through two paths: (1) Rate cuts alleviate the depreciation pressure on emerging market currencies, providing greater policy space for domestic monetary policy. If economic growth stabilizes, they may benefit from the spillover effects of the U.S. dollar; (2) If the U.S. achieves a "soft landing" after the rate cuts, emerging markets will also be supported by a certain degree of demand spillover from the U.S. Recently, several important emerging economies (including multiple ASEAN countries, Mexico, Brazil, South Africa, etc.) have left room for potential domestic economic stimulus policies due to the strengthening of the U.S. dollar. For a net-exporting country like China, a "soft landing" after preemptive rate cuts means that external demand supported by overseas capital expenditure will become more solid. In the comparison between the Hong Kong stock market and A-shares, due to the Hong Kong dollar triggering the weak-side convertibility guarantee against the U.S. dollar from early June to mid-August, the Hong Kong Monetary Authority bought Hong Kong dollars and sold U.S. dollars, which suppressed liquidity in the Hong Kong stock market. During this period, the Hang Seng Index consistently underperformed the Wind All A Index. After the Jackson Hole meeting on August 22, which heightened expectations for rate cuts, the Hong Kong dollar strengthened against the U.S. dollar, and the Hang Seng Index began to catch up with the gains of the Wind All A Index. Looking ahead, the Hong Kong stock market may benefit more from the spillover of the U.S. dollar after the Fed's rate cuts

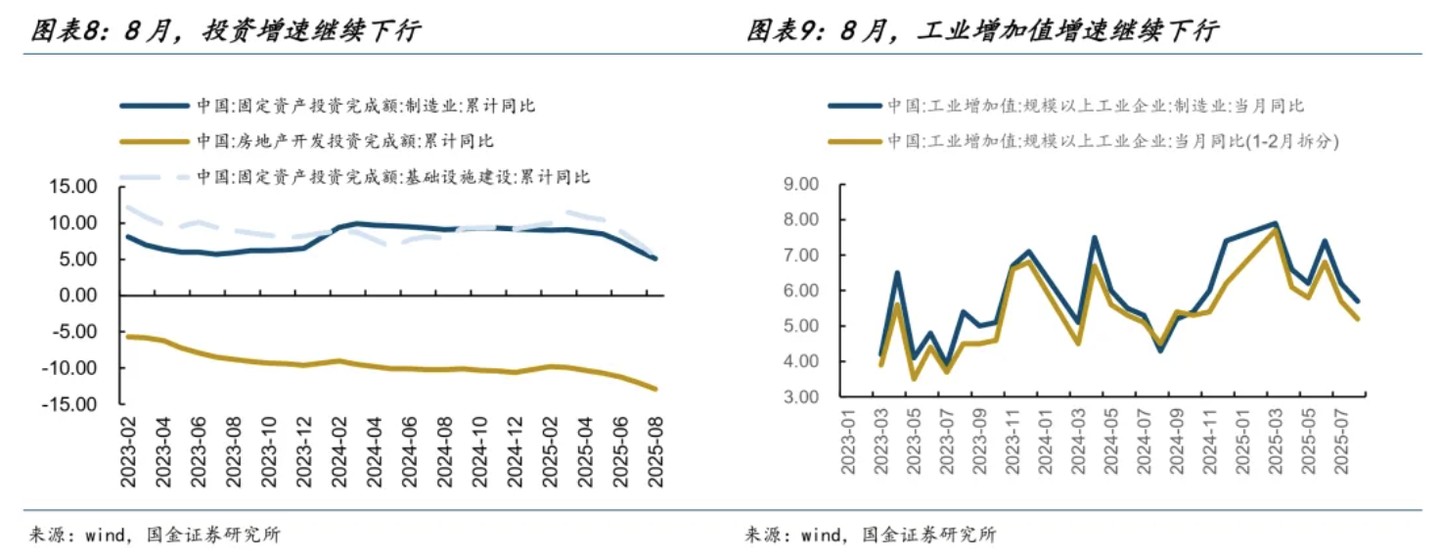

2. The Essence of the "Weakening" Domestic Economy and the Impact of "Anti-Inflation"

On September 15, the domestic economic data for August was released, continuing to show a downward trend: the decline in real estate investment within fixed asset investment continued to widen, the growth rate of infrastructure investment and manufacturing investment decreased, and the growth rate of industrial enterprises' added value declined. This weakening data, in the context of "anti-inflation," may also be a normal phenomenon. "Anti-inflation" means that the sequence of economic improvement benefits from a reduction in supply leading to "price increases first," followed by a rebound in demand driving "production expansion later." Therefore, in the current situation where the Producer Price Index (PPI) has not yet turned positive, the decline in investment and production data reflects a dual drag on prices and volume, where the drag on "volume" is an inevitable path of "anti-inflation."

However, beyond the purely demand data, some positive factors should also be noted: (1) The new price increase factors in the PPI are stronger than in July, marking the first inflection point of the year. The upstream "anti-inflation" production restrictions have driven coal and black metal prices to turn positive month-on-month. Currently, the PPI may stabilize similarly to 2005-2006, driven by external demand. At that time: overseas retail restocking → export order prices rise → exporters replenish raw materials → domestic bulk commodities and PPI lag behind and recover. This "demand is external, inventory leads" transmission sequence makes export prices a leading indicator for the entire chain; (2) High value-added products in exports remain strong: electromechanical products continue to be the main driver of exports, and these order-produced products have strong bargaining power; (3) Some restocking of raw materials has begun to appear domestically: since March this year, the raw material inventory component in the manufacturing PMI has risen, and the inventory growth rate of large-scale industrial enterprises - the growth rate of finished product inventory has also increased, indicating that domestic enterprises may have begun to restock driven by external demand. Specifically, the production growth rates of chemical products such as synthetic fibers, plastics, caustic soda, ethylene, and metal materials such as crude steel and ten non-ferrous metals have all recently increased.

3. Standing at the Next Windfall: Exporting Overseas

From past experience, during the interest rate cut cycles of 2019 and 2024, A-share export-oriented listed companies (those with overseas revenue accounting for the top 30% in their respective industries) have outperformed the CSI 300, with excess returns of 11.5% and 3.1%, respectively. In 2019, the secondary industries with high excess returns mainly included medical devices, aerospace equipment, semiconductors, consumer electronics, internet media, glass fiber, and others; in 2024, the secondary industries with high excess returns mainly included other power equipment, software development, advertising and marketing, rubber, and others. From the perspective of industry distribution, these are not solely confined to so-called "interest rate-sensitive" growth industries, but rather depend on the specific supply and demand conditions of the industry at that time.

In this round of preventive interest rate cuts, with internal product prices temporarily unstable and weakened investment demand under the advocacy of "anti-involution," export-oriented companies actively participating in global competition can avoid domestic price pressure through product exports and benefit from incremental demand as the probability of a "soft landing" in overseas economies increases. This represents a relatively scarce high-growth main line in the current market. We have screened a total of 18 sub-sectors, which share common characteristics: overseas revenue accounting for more than 50%, overseas gross margins higher than domestic gross margins, and overseas revenue growth in H1 2025 exceeding domestic revenue growth, indicating that exports positively contribute to their profit margins. Additionally, according to analysts' consensus expectations, the net profit growth in H2 2025 is expected to be higher than in H1 2025, indicating marginal improvement within the year. These industries can be divided into three categories: (1) Capital goods related to investment: photovoltaics, general equipment, semiconductors, communication equipment, commercial vehicles, etc.; (2) Intermediate goods related to the recovery of the manufacturing industry: plastics, electronic chemicals, chemical products, etc.; (3) Consumer and pharmaceutical sectors with their own industry trends: gaming, personal care products, clothing and home textiles, medical devices, etc.

4. A Profitable Bull Market May Be About to Begin

This week, the market experienced a slight pullback, but the trend continues to spread during the pullback. In addition to TMT, various manufacturing, consumption, and resource sectors have shown good performance in specific sub-industries. This characteristic arises from: on one hand, the Federal Reserve's interest rate cut has materialized this week, leading to a "buy the expectation, sell the fact" pullback in some industries that had previously anticipated "anti-involution" and "interest rate cuts"; on the other hand, the domestic economic data released this week had few highlights, with fundamentals deviating from expectations, resulting in a market rebalancing Looking to the future, we believe that the realization of fundamentals is an important driver for the next phase of market upward movement, and it is brewing: on one hand, historical experience and the current economic forecasts of the Federal Reserve indicate that after the interest rate cut in September, the probability of an overseas "soft landing" has increased, which provides strong support for the external demand formed by capital expenditure that we have continuously emphasized; on the other hand, although domestic "volume" and "price" have not yet stabilized, positive factors are already brewing, including the reduction of drag from tail factors in PPI and CPI, the strengthening of new price increase factors, and the behavior of domestic companies replenishing raw materials, all of which are similar to the experience of stabilizing domestic prices driven by external demand in 2006-2007. At this stage, two dimensions of opportunities can be focused on: on one hand, after the release of liquidity suppression, the Hong Kong stocks that have stagnated from June to August may have a rebound; on the other hand, we can look for a group of companies that have gone overseas for exports and are the first to benefit from the recovery of external demand. We have screened 18 corresponding secondary industries, mainly concentrated in capital goods (photovoltaics, general equipment, semiconductors, communication equipment, commercial vehicles, etc.), intermediate goods (plastics, electronic chemicals, chemical products, etc.), and consumer and pharmaceutical fields (games, personal care products, clothing and home textiles, medical devices, etc.).

Our mid-term recommendations remain unchanged:

First, physical assets that benefit from the improvement in operating conditions brought about by domestic anti-involution, the recovery of manufacturing activities after overseas interest rate cuts, and accelerated investment: upstream resources (copper, aluminum, oil, gold), capital goods (engineering machinery, heavy trucks, lithium batteries, wind power equipment), and raw materials (basic chemicals, fiberglass, paper, steel);

Second, after profit recovery, opportunities will gradually emerge in domestic demand-related fields: food and beverages, pork, tourism, and scenic spots;

Third, the long-term asset side of insurance will benefit from the rebound in capital returns, followed by securities firms.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk