Morgan Stanley: Apple's business diversification, strong demand for iPhone 17 series, service business growth slows down

Morgan Stanley's report shows that Apple's core business is experiencing divergence: demand for the iPhone 17 series is strong, while service business growth is slowing. The delivery cycle for the iPhone 17 has been extended, particularly in the Chinese market, indicating strong initial demand. Supply chain sources indicate that production of the iPhone 17 base model will increase by 30% to 40%. This trend may lead to an upward adjustment of iPhone shipments for the fiscal year 2026

According to the Zhitong Finance APP, Morgan Stanley's monthly data tracking report shows that Apple's (AAPL.US) core business is exhibiting a significant divergence trend: the iPhone 17 series shows strong demand, while service business growth is slowing.

iPhone 17 demand exceeds expectations, supply improvements fail to curb extended delivery times

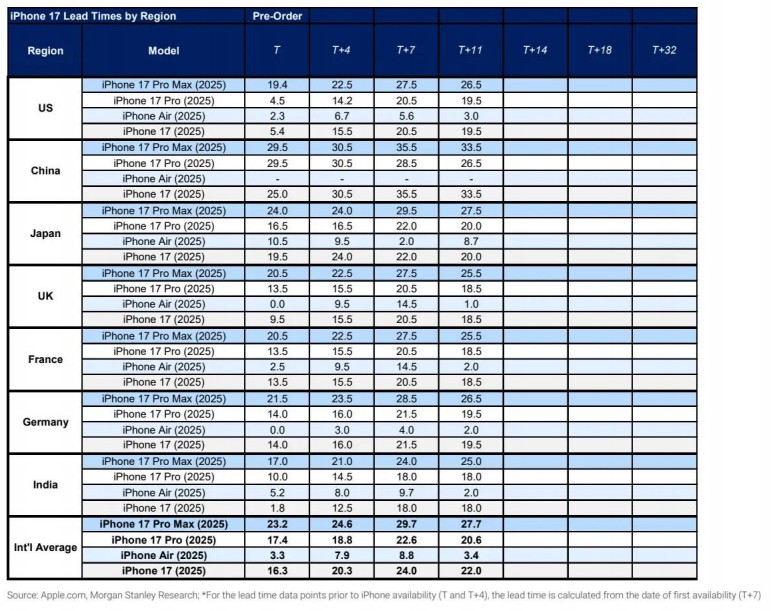

Since the pre-order launch, the iPhone 17 series has demonstrated strong demand momentum. As of September 23, the 11th day after the official pre-order started, the average delivery time for the iPhone 17 in global markets has lengthened year-on-year. In both the U.S. and international markets, the delivery times have increased by 2 days compared to the same period last year.

Specifically, except for the iPhone Air, which has a shorter delivery time than last year's iPhone 16 Plus, the delivery times for the other three new models are all longer than their predecessors. This trend is particularly evident in the base model iPhone 17, where the average delivery time has increased by 11 days across the tracked countries, with the Chinese market seeing a significant extension of 19.5 days. Considering that the Chinese market had promotions and subsidies in the second quarter, this performance is actually better than previous market concerns.

Extended delivery times are a key indicator of initial demand. Despite improvements in supply conditions compared to last year, the year-on-year increase in delivery times sends a positive early signal regarding iPhone demand. Additionally, supply chain sources indicate that production of the base model iPhone 17 will significantly increase by 30% to 40%. These factors combined may exert upward pressure on the current supply chain team's forecast of 86 million units for the total production of the iPhone 17 series in the second half of 2025.

This strong early demand trend may also indicate potential upward adjustments for iPhone shipments in fiscal year 2026. Currently, market consensus and analyst expectations are relatively conservative, predicting shipments between 235 million and 236 million units, roughly flat compared to the previous fiscal year. However, if the demand for the iPhone 17 remains this strong, it may pose slight resistance to the average selling price but more accurately reflects the product's strong appeal in the market.

App Store revenue growth diverges, gaming category drags down overall growth rate

In terms of service business, the App Store's performance is also impressive, bringing surprises for this fiscal quarter. As of September 21, the net revenue from the App Store has increased by 10.3% year-on-year for the current quarter, exceeding market expectations by 140 basis points. If the quarter were to end on September 21, this growth would raise the service revenue growth forecast by 40 basis points to 13.3%.

Regionally, growth rates in the U.S. (+7.9%), Japan (-4.3%), and China (-0.6%) have all slowed compared to August, while other regions maintain a strong growth rate of 16.8% The net income from the gaming category decreased by 2.2% year-on-year, while the non-gaming category grew by 16.4%, mainly driven by productivity, photo and video, and entertainment applications.

As a key monetization capability indicator, the year-on-year growth rate of net income per download in the U.S. market has been 3% from September to date. Although it has slowed compared to July, the degree of slowdown is generally consistent with the changes in this indicator on the global App Store.

It has been over four months since the related litigation ruling took effect, and there is currently no conclusive evidence indicating that Apple's monetization capability in the U.S. App Store has been significantly impacted, which has somewhat alleviated market concerns about the impact of the "external links" policy.

Comprehensive data shows that the demand for Apple hardware remains resilient, especially with the iPhone 17 series expected to drive shipments beyond expectations; while the growth of the services business has slowed, the structure is shifting towards high-value non-gaming categories