A-shares fluctuated and fell, non-ferrous metals rose again, pharmaceutical stocks adjusted, the Hang Seng Index fell by 1%, tech stocks broadly declined, government bonds rebounded, and commodities fell

In the morning session, the storage chip concept strengthened again, with Unisoc hitting the daily limit, and Giantec Semiconductor, Baiwei Storage, Tailong Co., Ltd., Jingzhida, and Wanrun Technology also rising. Automotive stocks surged, with Seres strongly hitting the limit, and the stock price reaching a historical high; WXQC, TQM, and YUELING also hit the limit, while BYD rose over 3%. Pharmaceutical stocks weakened in the morning, with Guangshengtang and Aosaikang falling over 8%, and Jimin Health, Hanyu Pharmaceutical, Wanbangde, Hengrui Pharmaceutical, and Huiyu Pharmaceutical all declining

On September 26, the A-shares fluctuated lower, with all three major indices collectively declining. The non-ferrous metal sector rose again, the storage chip concept was active, while CRO and innovative drugs collectively fell. The Hong Kong stock market opened lower in the morning, with both the Hang Seng Index and the Hang Seng Tech Index declining. Tech stocks generally adjusted, and pharmaceutical stocks also fell. In the bond market, government bond futures rebounded. In terms of commodities, most domestic commodity futures fell, with coking coal and coke futures leading the declines. Core market trends:

A-shares: As of the time of writing, the Shanghai Composite Index fell by 0.18%, the Shenzhen Component Index fell by 0.29%, and the ChiNext Index fell by 0.19%.

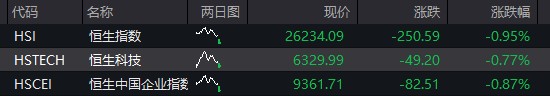

Hong Kong stocks: As of the time of writing, the Hang Seng Index fell by 0.95%, and the Hang Seng Tech Index fell by 0.77%.

Bond market: Government bond futures rebounded across the board. As of the time of writing, the 30-year main contract rose by 0.27%, the 10-year main contract rose by 0.10%, the 5-year main contract rose by 0.09%, and the 2-year main contract rose by 0.04%.

Commodities: Domestic commodity futures generally fell. As of the time of writing, coking coal, coke, lithium carbonate, rubber, and glass fell by more than 1%. Industrial silicon, rebar, hot-rolled coils, container shipping index, stainless steel, iron ore, ferrosilicon, alumina, caustic soda, polysilicon, pulp, eggs, and soybean meal also fell.

09:57

The Hong Kong Hang Seng Index fell by 0.87%, and the Hang Seng Tech Index fell by over 1%.

Horizon Robotics fell by over 5%, as the company issued shares at a discount of about 5.75%, raising approximately HKD 6.34 billion. Xiaomi Group once fell by 4%. WuXi AppTec once fell by over 4%, now down less than 3%.

09:56

Tech stocks in Hong Kong generally fell, with Xiaomi down nearly 4%, JD Health down over 2%, and JD Group, MEITUAN, Alibaba, and others down over 1%.

In terms of news, Alibaba announced on the Hong Kong Stock Exchange that it grants the board of directors a general authorization to issue, allocate, and otherwise handle no more than 10% of the company's issued ordinary shares as of the date of passing this ordinary resolution during the issuance period. Any ordinary shares issued and allocated under this authorization shall not be priced at more than 10% below the benchmark price.

In terms of news, Alibaba announced on the Hong Kong Stock Exchange that it grants the board of directors a general authorization to issue, allocate, and otherwise handle no more than 10% of the company's issued ordinary shares as of the date of passing this ordinary resolution during the issuance period. Any ordinary shares issued and allocated under this authorization shall not be priced at more than 10% below the benchmark price.

09:53

Huahong Semiconductor rose more than 5% during the session, with its stock price reaching a new historical high, accumulating over 220% increase this year.

09:49

Automobile stocks strengthened, with Seres strongly hitting the limit up, and its stock price reaching a historical high; Wanxiang Qianchao, TQM, and YUELING also hit the limit up, while BYD rose over 3%.

09:41

In the early session, the storage chip concept strengthened again, with Unisoc hitting the limit up, and Giantec Semiconductor, Baiwei Storage, Tailong Co., Jingzhida, and Wanrun Technology also rising.

09:38

Pharmaceutical stocks weakened in the early session, with Guangshengtang and Aosaikang falling over 8%, and Jimin Health, Hanyu Pharmaceutical, Wanbangde, Hengrui Pharmaceutical, and Huiyu Pharmaceutical all declining.

According to CCTV News, on September 25 local time, U.S. President Trump announced on his social media platform "Truth Social" that starting October 1, the U.S. will implement a new round of high tariffs on various imported products. The measures include a 25% tariff on all imported heavy trucks; a 50% tariff on kitchen cabinets, bathroom sinks, and related building materials; a 30% tariff on imported furniture; and a 100% tariff on patented and branded drugs.

09:36

The non-ferrous sector rose again, with copper leading the gains, as Jingyi Co. and Lidao New Materials hit the limit up, while Jiangxi Copper, Tongling Nonferrous, Yuguang Gold Lead, and Baiyin Nonferrous also rose.

In terms of news, the Copper Branch of the China Nonferrous Metals Industry Association firmly opposes the "involution" competition in the copper smelting industry. Additionally, on the same day, the Grasberg mine in Indonesia, the world's second-largest copper mine, announced "force majeure" and ceased production due to a landslide accident 09:26

The Shanghai Composite Index opened down 0.35%, and the ChiNext Index fell 0.42%.

The Nasdaq has fallen for three consecutive days at high levels, with technology stocks generally retreating. Fiberglass, CPO, and photolithography machine concepts saw significant declines, while computing power, GPU, and Moore Threads concepts adjusted simultaneously. The Digital Renminbi International Operation Center officially began operations in Shanghai, with related stocks generally strengthening, and rare earth and automotive stocks rebounding.

09:21

The Hong Kong Hang Seng Index opened down 0.8%, and the Hang Seng Tech Index fell 0.97%.

CXO and innovative drug concept stocks collectively opened lower, with BeiGene opening down 3.5% and WuXi AppTec down 2.07%. XPeng and Nio opened higher