U.S. Stock Outlook | Three Major Index Futures Decline Together as U.S. Government Shutdown Countdown Begins

U.S. stock index futures all fell, as concerns about a government shutdown in the United States intensified. Dow futures, S&P 500 futures, and Nasdaq futures fell by 0.14%, 0.14%, and 0.09%, respectively. If Congress fails to reach an agreement, federal agencies will suspend operations, and non-essential employees will face unpaid leave. Despite the risk of a shutdown, the market still shows optimistic sentiment, with investors focusing on the strong performance of the U.S. economy. UBS believes that the impact of the shutdown event on investor risk is limited

Pre-Market Market Trends

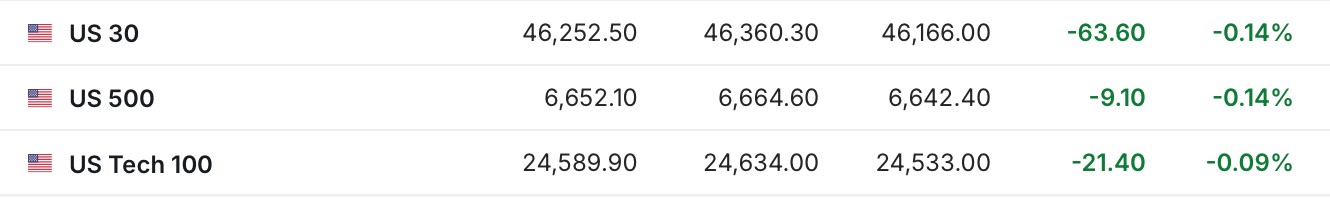

- As of September 30 (Tuesday), U.S. stock index futures are all down before the market opens. As of the time of writing, Dow futures are down 0.14%, S&P 500 futures are down 0.14%, and Nasdaq futures are down 0.09%.

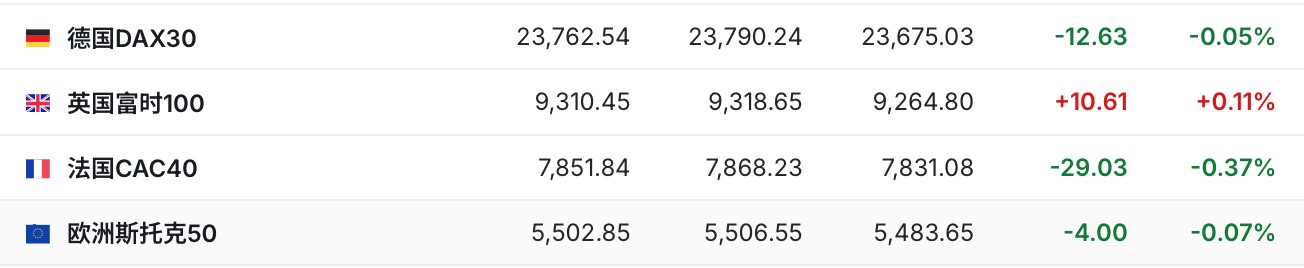

- As of the time of writing, the German DAX index is down 0.05%, the UK FTSE 100 index is up 0.11%, the French CAC40 index is down 0.37%, and the Euro Stoxx 50 index is down 0.07%.

- As of the time of writing, WTI crude oil is down 0.88%, priced at $62.89 per barrel. Brent crude oil is down 0.83%, priced at $66.53 per barrel.

Market News

Countdown to Government Shutdown: U.S. Economic Outlook May Fall into "Data Fog." If Congress fails to reach an agreement before the end of the current fiscal year on Tuesday, most federal agencies will cease operations, and non-essential employees will face unpaid leave or layoffs. According to the latest guidelines, the U.S. Bureau of Labor Statistics, responsible for releasing several authoritative economic data, will stop operations, and the non-farm payroll report originally scheduled for release on Friday is likely to be postponed. Currently, there are still doubts about the impact of Trump's various policies on the U.S. economy, making the employment, inflation, and consumption data released by the federal government particularly important. Any delay in data could disrupt key policy decisions—such as whether the Federal Reserve should cut interest rates again when it meets next month.

U.S. Government Shutdown "Is a Farce, Not a Tragedy"? Market Optimism Soars! Investors are currently calmly responding to the imminent risk of a federal government shutdown, choosing to focus on the strong performance of the U.S. economy and other more positive developments. Karl Schamotta, Chief Market Strategist at Corpay Cross-Border Solutions, stated: "The market has shown stubborn optimism since the beginning of this week, with investors indifferent to the possibility of a government shutdown, betting that the world's largest economy will continue to grow." Although a government shutdown is unwelcome, UBS's Chief Investment Office does not view it as a significant risk event for investors. Ulrike Hoffmann-Burchardi, Chief Investment Officer for the Americas at UBS Global Wealth Management and Head of Global Equities, stated: "We advise investors not to worry about the shutdown but to focus on other market drivers, such as the Federal Reserve's continued interest rate cuts and strong corporate earnings Wall Street's "October Panic": Is it Superstition or Fact? Marketwatch analyst Mark Hulbert summarized monthly data based on the Dow Jones Industrial Average since 1896. He found that the standard deviation of the Dow in October is significantly higher—actually 21% above the average of the other 11 months. Historical data shows that the volatility of U.S. stocks in October is indeed slightly higher. Ultimately, there may be some undiscovered theory that can explain the volatility in October, but until conclusive evidence emerges, all related discussions are merely market noise. Experts point out that investors should focus on corporate fundamentals and macroeconomic trends rather than fixating on seasonal statistical illusions.

Federal Reserve's Musalem: Open to Rate Cuts but Emphasizes Caution. St. Louis Fed President Musalem stated that he is open to further rate cuts in the future, but policymakers should proceed cautiously due to the current inflation rate still being above the central bank's target level of 2%. Musalem emphasized, "I am open to possible rate cuts in the future, but we must act cautiously, as there is limited policy space, and any misstep could lead to excessive easing." He noted that current monetary policy is between moderate restriction and neutrality, with long-term inflation expectations remaining stable. Musalem specifically mentioned that policymakers should "resist" inflation rates slightly above the 2% target, regardless of whether this increase is due to potential tariff impacts, slowing labor growth, or other factors.

Global Copper Mines Hit Hard! Multiple Investment Banks Raise Target Prices. Based on expectations of supply shortages, several Wall Street firms have intensively raised their copper price forecasts. Among them, JP Morgan significantly raised its fourth-quarter LME copper price forecast from $9,350 per ton in July to $11,000, expecting a supply shortage of over 200,000 tons in the fourth quarter, with a shortfall of 180,000 tons in the fiscal year 2026. Bank of America raised its 2026 copper price forecast by 11% to $11,313 per ton, and the 2027 forecast was increased by 12.5% to $13,501; although Goldman Sachs revised its annual gap expectation from a surplus of 105,000 tons to a shortage of 55,000 tons, indicating a complete reversal of supply-demand balance within the year, it believes that December copper prices will remain in the range of $10,200 to $10,500 per ton.

Individual Stock News

Boeing (BA.US) Launches Development of 737 MAX Successor: Aims to Restore Trust and Compete Against Airbus. According to insiders, Boeing is planning a new single-aisle passenger aircraft to replace the existing 737 MAX model, as part of a long-term strategy to regain market share lost amid a series of safety and quality issues and to compete against rival Airbus. Several insiders indicated that this new model is still in the early stages of development, and specific plans have not yet been finalized. This move by Boeing marks a shift in its strategy, as the company had temporarily shelved the development of new models due to multiple challenges faced in recent times. This also reflects the company's bet on next-generation cutting-edge models, hoping to inject new growth momentum for the coming decades Ford (F.US) and General Motors (GM.US) extend $7,500 electric vehicle lease tax credit. According to reports, Ford and General Motors have recently launched related plans for car dealers, which will extend the validity period of the $7,500 electric vehicle lease tax credit. According to documents provided by dealers familiar with the relevant plans and related companies, each automaker's financing department will purchase electric vehicles from dealers' inventories by making advance payments. These advance payments will qualify the auto finance companies for the $7,500 tax credit. Subsequently, dealers will offer customers several months of leasing services for these electric vehicles and incorporate the tax credit into the lease fees. These plans aim to mitigate the impact of the expiration of the tax credit policy.

The end of AI is indeed electricity! CenterPoint (CNP.US) plans to invest $65 billion in expanding the power grid over 10 years. Focusing on generation and distribution, American power giant CenterPoint Energy plans to invest a record $65 billion by 2035, based on the expectation of significant growth in electricity demand from customers in the U.S. market, especially in Texas. This $65 billion "load leap" ten-year infrastructure plan focuses almost entirely on expanding grid capacity, enhancing resilience, and digitization. The company predicts that the peak load demand for its Houston utility will grow by nearly 50% by 2031 and is expected to double to nearly 42 gigawatts in the middle of the next decade.

Layoffs in the oil industry intensify, ExxonMobil (XOM.US) plans to cut 20,000 jobs globally. ExxonMobil plans to cut about 2,000 jobs globally as the Texas-based oil company consolidates smaller offices into regional centers as part of its long-term restructuring plan. ExxonMobil CEO Darren Woods stated in a memo to employees on Tuesday that this layoff represents about 3% to 4% of ExxonMobil's total global workforce and is part of the company's ongoing efficiency improvement program. Imperial Oil (IMO.US) announced on Monday that it would cut 20% of its workforce. It is reported that ExxonMobil holds nearly 70% of Imperial Oil's shares.

Important Economic Data and Event Forecasts

Beijing time 21:00 Speech by 2025 FOMC voting member and Boston Fed President Collins

Beijing time 22:00 U.S. August JOLTs job openings

Beijing time 22:00 U.S. September Conference Board Consumer Confidence Index

Beijing time the next day 00:15 Speech by 2027 FOMC voting member and Richmond Fed President Barkin on economic outlook

Beijing time the next day 01:00 Speech by 2025 FOMC voting member and Chicago Fed President Goolsbee

Earnings Forecast

Wednesday morning: Nike (NKE.US)