Is the wind changing? Wall Street begins to discuss: How should investors respond to the "overheating" of the U.S. economy?

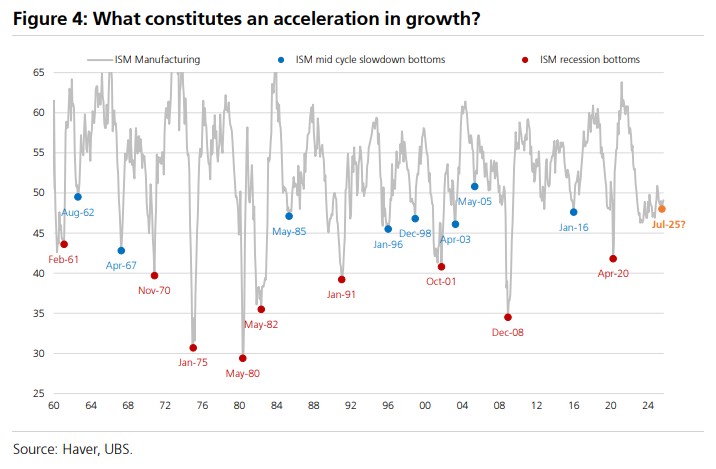

After Goldman Sachs warned that the risk of a "re-acceleration" of the U.S. economy is increasing, UBS began analyzing for clients the scenario of "what if the U.S. economy re-accelerates," defining economic acceleration as an increase of more than 10 points in the ISM Manufacturing Index within 12 months, and emphasizing it as a "significant risk that must be hedged." Citigroup, on the other hand, directly discusses the scenario of "economic overheating" in the U.S. as an important trading strategy, believing that after a cyclical slowdown in the economy in the next 1-2 quarters, there may be a risk of inflation reigniting in the second half of the year

Goldman Sachs, UBS, and Citigroup, the three top investment banks on Wall Street, have all mentioned in their research reports that the risk of the U.S. economy "re-accelerating" is rising. This expectation is based on multiple favorable factors, including labor market resilience, expectations of fiscal stimulus, and a loose financial environment.

On October 5th, according to news from the Wind Trading Desk, Goldman Sachs, UBS, and Citigroup all warned that the risk of the U.S. economy "re-accelerating" is increasing. UBS, while still leaning towards a baseline scenario of economic slowdown, has also begun to analyze for clients "what would happen if the U.S. economy re-accelerates." Citigroup has directly discussed the scenario of "economic overheating" in the U.S. as an important trading strategy.

The three investment banks unanimously believe that the current U.S. economy is performing strongly across multiple indicators, with third-quarter data showing resilience. If the economy does indeed re-accelerate, it will have a significant impact on the monetary policy path and lead to major adjustments in asset allocation. The investment banks suggest that investors consider hedging strategies such as U.S. small-cap stocks, Latin American currency carry trades, steepening yield curves, and commodities.

Wall Street Reassesses the Logic of U.S. Economic Overheating

As previously reported by Jianwen, Goldman Sachs pointed out that the U.S. economy is showing strong performance across several key indicators. The bank's U.S. macroeconomic surprise index has recently surged, initial jobless claims data is encouraging, and the global investment research department expects the U.S. GDP growth rate for the third quarter to reach a healthy 2.6%. The report lists key factors driving this risk:

Loose financial conditions: The good performance of risk assets, expectations of future interest rate cuts by the Federal Reserve, and a weaker dollar have collectively created a loose financial environment.

Fiscal and investment: A positive fiscal policy pulse is expected in the first half of next year, while capital expenditures in the field of artificial intelligence will continue to provide growth momentum.

Consumers and regulation: The U.S. consumer base remains solid, and the impact of deregulation cannot be ignored.

UBS has listed "U.S. economic re-acceleration" as one of three main scenarios in its analysis of 15 key charts. Although the bank's baseline expectation remains an economic slowdown, the team led by analyst Bhanu Baweja pointed out:

If inflation rises less than expected (supporting real income) or capital expenditures expand from being driven solely by technology to other sectors, the U.S. economy could re-accelerate.

UBS defines economic acceleration as the ISM manufacturing index rising more than 10 points within 12 months.

The bank emphasizes that this is a "significant risk that must be hedged." Early third-quarter data shows resilience, and although labor market data is weak, spending data remains strong Citigroup's Global Macro Strategy Team discussed the potential "run it hot" scenario for the U.S. economy in their latest research report, suggesting that after a cyclical slowdown in the economy over the next 1-2 quarters, there may be a risk of inflation reigniting in the second half of the year.

Citigroup analysts pointed out that the current weakness in the U.S. labor market may not be entirely due to cyclical factors.

Data shows that U.S. technology capital expenditures as a percentage of GDP have reached twice the level during the dot-com bubble and are close to the residential investment levels before the 2008 financial crisis.

More importantly, the per capita sales of S&P 500 companies are showing a broad upward trend, indicating that productivity is improving.

Against this backdrop of structural change, the reduction in some jobs may reflect productivity gains rather than purely cyclical weakness.

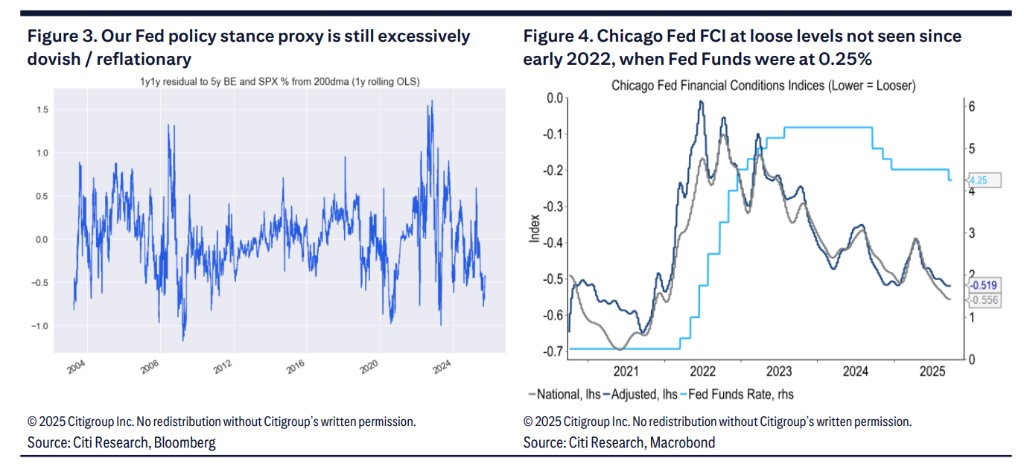

At the same time, two policy indicators suggest that the risk of a rebound in the U.S. economy is rising next year:

The market pricing of the Federal Reserve's policy stance remains overly dovish, and the Chicago Fed Financial Conditions Index is currently looser than when the federal funds rate was at 0.25% in 2022.

How should investors respond from small-cap stocks to commodities?

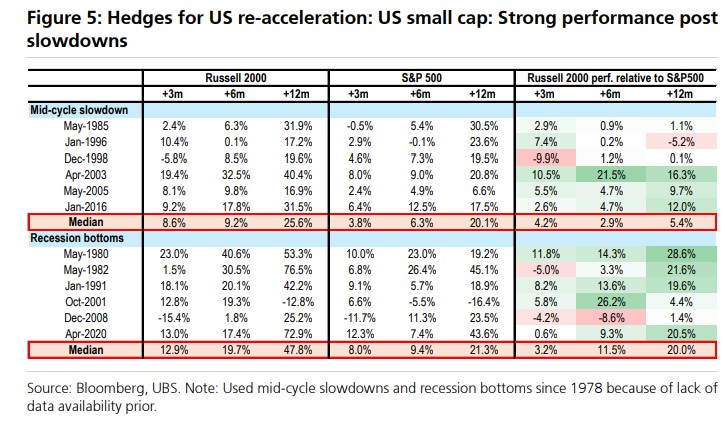

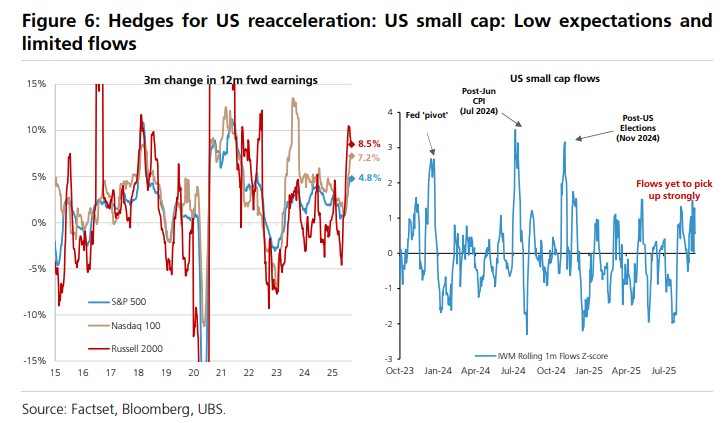

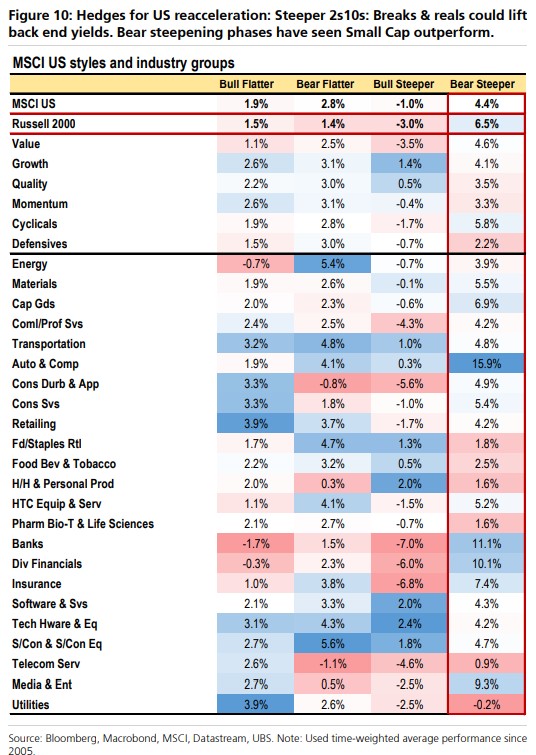

UBS historical data shows that during economic expansion phases, small-cap stocks typically outperform large-cap stocks, whether after a recession or after a mid-cycle slowdown. In the 12 months following a mid-cycle slowdown, small-cap stocks outperformed the S&P 500 by a median of 5.4%, and after a recession, this figure reached 20%.

UBS data indicates that small-cap stocks currently have low expectations and limited capital inflows, with a 12-month forward return expectation of only 4.8% over the next 3 months, compared to 7.2% for the S&P 500 and 8.5% for the Nasdaq 100. This provides upward potential for small-cap stocks.

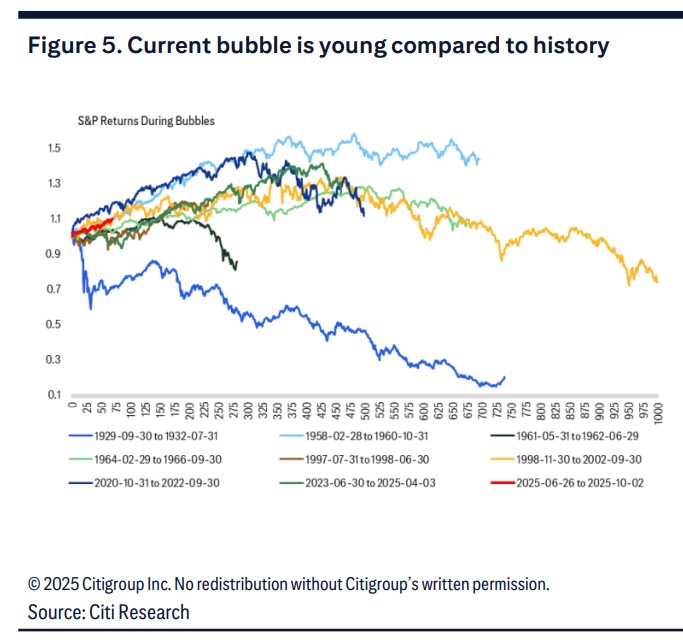

Citigroup pointed out that the current U.S. stock market is in a bubble state, but this is a relatively short-lived bubble, and the Federal Reserve is injecting liquidity into it, which has never happened historically. The bank advises investors to maintain a long position before the bubble bursts.

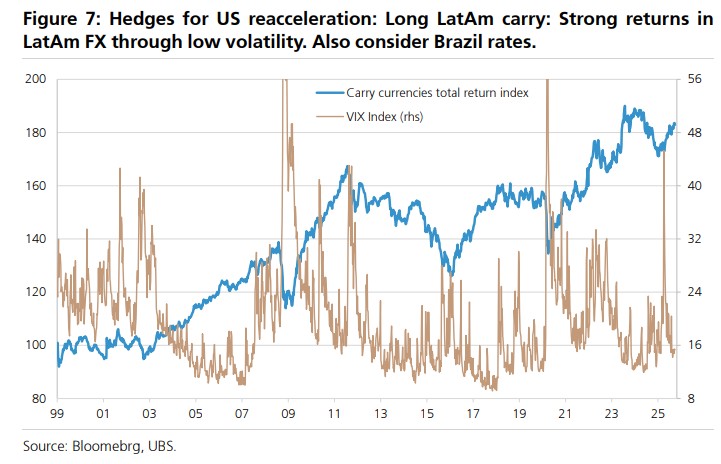

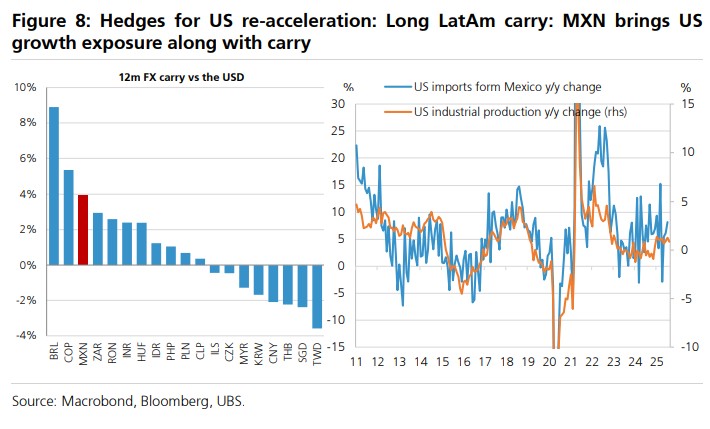

Both UBS and Citigroup recommend Latin American currency carry trades as a hedging strategy. UBS noted that a stronger U.S. economy could further compress already tight risk premiums, but expressing a low volatility view through carry trades in the foreign exchange space is more attractive

The Mexican peso is specifically mentioned because it offers both carry trade opportunities and can benefit from stronger U.S. growth.

Data shows that U.S. imports from Mexico are closely related to U.S. industrial production. Citigroup has launched a carry trade basket that includes the Brazilian real, Mexican peso, Turkish lira, South African rand, and Chilean peso.

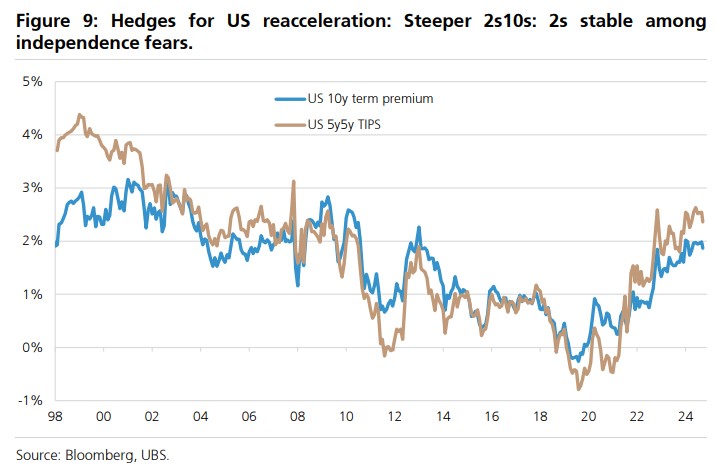

Goldman Sachs and Citigroup both recommend hedging against the risk of a re-acceleration of the U.S. economy through a steepening yield curve.

Goldman Sachs suggests going long on the steepening of the 2-year and 10-year Treasury yield curve, believing that the future largely depends on the policy inclination of the new Federal Reserve Chair in the face of the risk of economic re-acceleration.

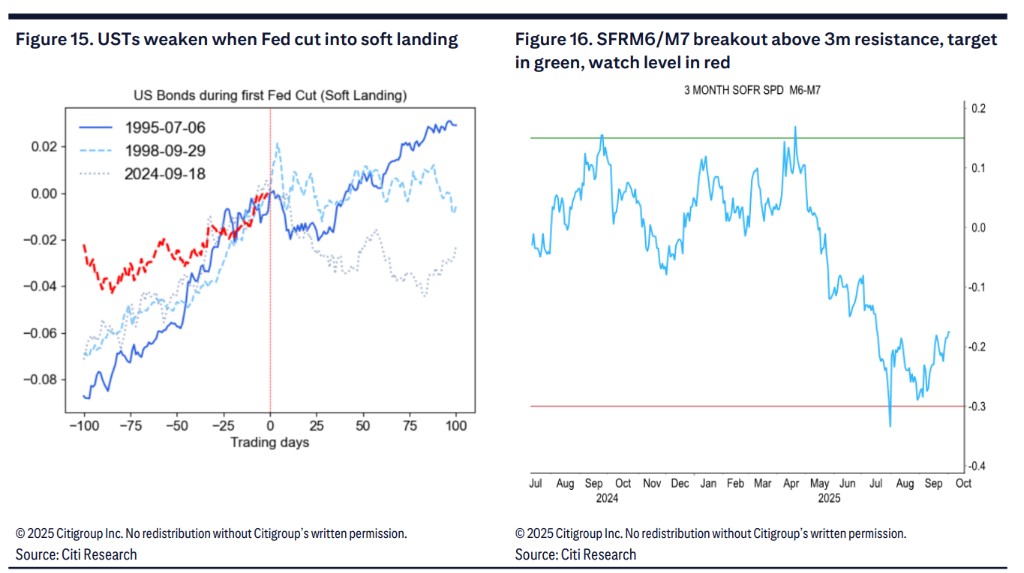

Citigroup believes that even if the U.S. economy re-accelerates, it does not expect a significant rise in front-end rates, as the market's pricing of the Federal Reserve's easing cycle is overly aggressive.

The bank recommends the SOFR M6/M7 steepening trade, believing that the pricing of a 17 basis point rate cut represents good value for a re-inflation scenario in the second half of 2026.

UBS points out that during periods of U.S. stock market bubbles, the yield curve often steepens in a bear market, with 10-year yields rising while the front end remains stable.

Historical data shows that during the steepening phase of a bear market, small-cap stocks outperform large-cap stocks.

Both Citigroup and UBS are optimistic about the performance of commodities in the scenario of economic re-acceleration.

Citigroup recommends buying copper options, believing that macro factors and fundamentals support further increases in copper prices. The bank points out that global manufacturing PMI and earnings expectations revisions are at historically bullish levels for copper prices.

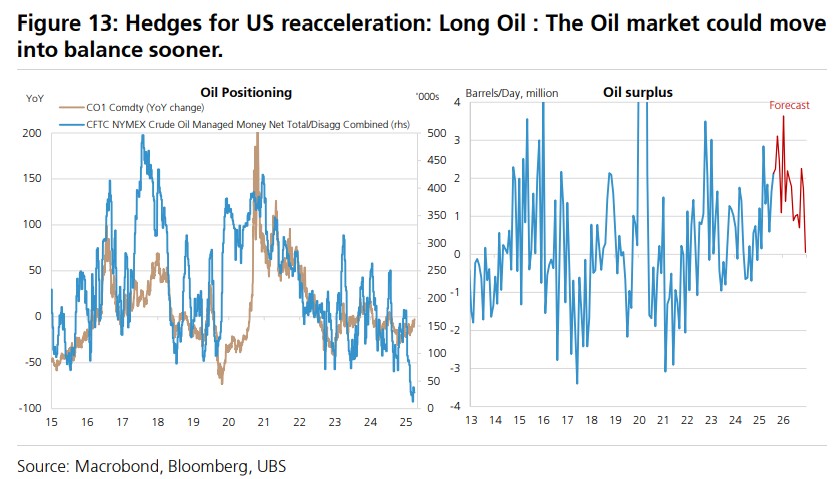

UBS recommends oil as a hedging tool, despite the market being generally bearish.

The bank believes that if the U.S. re-accelerates and energy consumption exceeds expectations by 10%, it could increase global oil demand by 2-3%, bringing the market to balance more quickly. Historical data shows that oil averages a 44% increase within 12 months of a mid-cycle recovery

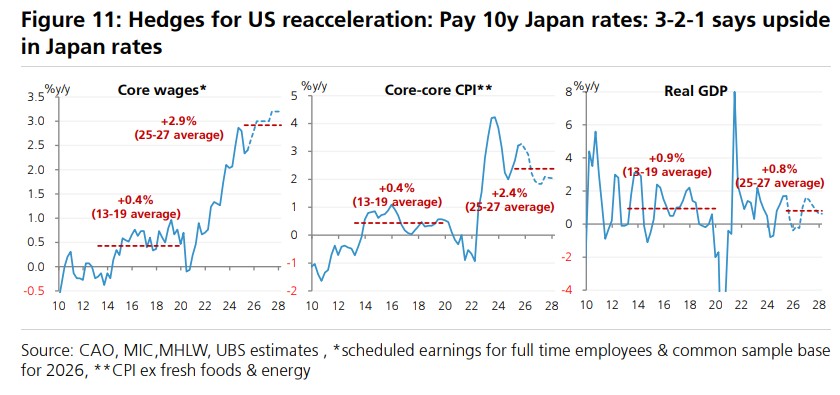

UBS also suggests paying attention to Japanese interest rates, believing that in the scenario of a renewed acceleration of the U.S. economy, the Bank of Japan may raise interest rates to 2% within the next two years, which has upside potential compared to the current market pricing of 1.25%.