U.S. Stock Outlook | Three Major Index Futures Mixed, U.S. Government's New Favorite Trilogy Metals Soars

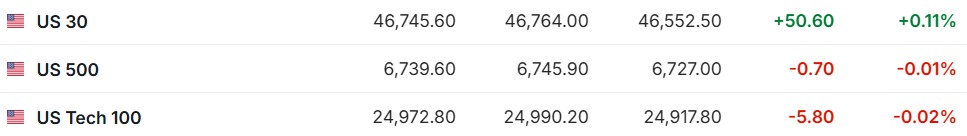

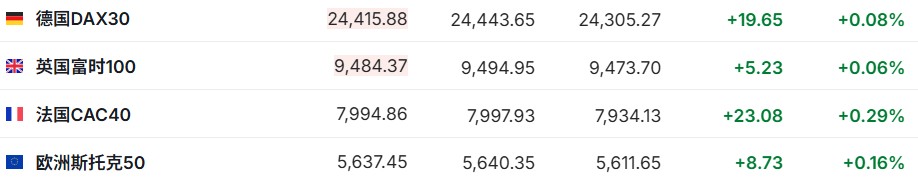

On October 7th, the three major U.S. stock index futures were mixed, with Dow futures up 0.11%, S&P 500 futures down 0.01%, and Nasdaq futures down 0.02%. Meanwhile, the German DAX index rose 0.08%, and the UK FTSE 100 index increased by 0.06%. U.S. President Trump announced a 25% tariff on all imported medium and heavy trucks starting November 1st. Morgan Stanley warned that a sharp drop in inflation could be the biggest threat to U.S. stocks

- As of October 7th (Tuesday) before the US stock market opens, the three major US stock index futures are mixed. As of the time of writing, Dow futures are up 0.11%, S&P 500 index futures are down 0.01%, and Nasdaq futures are down 0.02%.

- As of the time of writing, the German DAX index is up 0.08%, the UK FTSE 100 index is up 0.06%, the French CAC 40 index is up 0.29%, and the Euro Stoxx 50 index is up 0.16%.

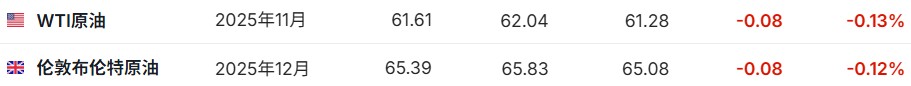

- As of the time of writing, WTI crude oil is down 0.13%, priced at $61.61 per barrel. Brent crude oil is down 0.12%, priced at $65.39 per barrel.

Market News

Changes in US truck tariff policy: scope expanded to medium trucks, effective date postponed to November 1st. US President Trump stated on his social media platform "Truth Social" that starting November 1st, a 25% tariff will be imposed on all medium and heavy trucks imported into the US. It is reported that this measure expands the scope from the original policy that was set to take effect on October 1st, which only targeted heavy trucks, while providing a buffer for US automakers importing parts from overseas. However, Trump did not clarify whether the tariffs would apply to imported vehicles protected under the US-Mexico-Canada Agreement. On September 25th, Trump stated that starting October 1st, a 25% tariff would be imposed on all imported heavy trucks to strengthen domestic manufacturing. According to the latest policy, medium and heavy trucks and their parts with a total weight exceeding 10,000 pounds will be subject to this tariff.

Where is the bottom of valuations? Morgan Stanley warns: a sharp drop in inflation is the biggest threat to US stocks. Michael Wilson, Chief US Equity Strategist and Chief Investment Officer at Morgan Stanley, pointed out that if nominal GDP and earnings growth accelerate due to rising inflation, stock valuations may be supported. He analyzed that since the new economic cycle began in April, the expansion of market price-to-earnings ratios has benefited from three factors: the start of a new cycle, expectations for future earnings recovery, and the support of a high inflation environment for stock risk premiums. Wilson particularly emphasized that the ratio of the S&P 500 index to gold—a reliable indicator of long-term real returns—is currently nearly 70% lower than its peak 25 years ago, intuitively reflecting that stock prices in 1999-2000 were far higher than current levels.

US inflation remains too high! Kansas City Fed President is cautious about further rate cuts. Kansas City Fed President Esther George stated on Monday that the current interest rate policy is "slightly restrictive," but "is in the right place," and the central bank does not need to rush to take more easing measures for now Schmidt pointed out in his speech at the CFA Society in Kansas City that the current inflation level in the United States remains too high, and the Federal Reserve must maintain its "credibility and determination" regarding prices, insisting on bringing the inflation rate back to the 2% target. He stated, "History tells us that while inflation is generally disliked, not all inflation needs to be fought at the same cost. Inflation caused by supply and demand imbalances, like that during the COVID-19 pandemic, can be controlled without causing severe unemployment or economic recession."

IEA lowers U.S. renewable energy growth forecast by 50%, global growth remains strong. The International Energy Agency (IEA) released its "2025 Renewable Energy Report" on Tuesday, showing that due to recent policy adjustments by the Trump administration, the agency has cut its U.S. renewable energy growth forecast for 2030 by 50%. Currently, the IEA expects that from 2025 to 2030, the new installed capacity of renewable energy in the U.S. will be close to 250 gigawatts, a significant reduction from the previous forecast of 500 gigawatts. This forecast adjustment is mainly due to several policy changes, including the gradual phase-out of federal tax credits, new import restrictions, a pause on new offshore wind project leasing approvals, and restrictions on permitting for onshore wind and solar projects on federal lands. Meanwhile, the IEA expects that by 2030, global renewable energy generation capacity will double, with an additional scale of 4,600 gigawatts.

Goldman Sachs raises December 2026 gold price forecast to $4,900. Goldman Sachs has raised its December 2026 gold price forecast from $4,300 per ounce to $4,900 per ounce, citing strong inflows into Western ETFs and expectations that central banks will continue to increase their gold holdings. Goldman Sachs stated, "We believe that with the revised gold price forecast, the overall risk remains tilted to the upside. This is because if the private sector diversifies its assets into the relatively small gold market, it could push ETF holdings beyond our estimates based on interest rate models." It is reported that New York futures gold has historically reached the $4,000 per ounce mark for the first time, soaring over 50% this year. Spot gold is reported at $3,976.94 per ounce, also setting a historical high.

Individual Stock News

OpenAI's "golden finger" effect emerges! Stock prices of several named companies soar. OpenAI has proven its "golden finger" effect in collaborating with other tech companies to launch AI products. However, its influence on the stock market is rapidly expanding to companies it has briefly discussed collaboration with. The company held its annual developer conference on Monday, and just mentioning other listed companies caused their stocks to soar, including: Figma (FIG.US), HubSpot (HUBS.US), Salesforce (CRM.US), Expedia (EXPE.US), TripAdvisor (TRIP.US), and Mattel (MAT.US).

With U.S. government stake, Canadian mineral exploration company Trilogy Metals (TMQ.US) surges. The U.S. government announced it will acquire a 10% stake in Canadian mineral exploration company Trilogy Metals (TMQ.US) as part of a $35.6 million investment plan aimed at securing key energy and mining projects in Alaska Boosted by this news, as of the time of publication, Trilogy Metals surged over 185%.

It is reported that Tesla (TSLA.US) plans to launch a lower-priced Model Y on Tuesday, fulfilling its commitment to introduce more affordable models in response to the cancellation of electric vehicle subsidies in the United States. According to insiders, the new entry-level Model Y is the model that Tesla began teasing on social media last weekend. Insiders stated that Tesla primarily aims to reduce costs for the Model Y by optimizing the battery pack and motor. They noted that this lower-priced model will reduce some features and use lower-grade materials to offset the impact of the cancellation of up to $7,500 in federal tax credits. The U.S. government has stopped providing this subsidy this month.

After being investigated by the SEC, AppLovin (APP.US) continued to decline in pre-market trading following a flash crash. The U.S. Securities and Exchange Commission (SEC) is conducting a potential investigation into the data collection processes of digital advertising technology company AppLovin (APP.US). As a result of this news, the company's stock price plummeted 14% by the close on Monday. As of the time of publication, the stock was down 2.81% in pre-market trading. Insiders indicated that the SEC's investigation focuses on an allegation that AppLovin violated service agreements with platform partners by improperly pushing more targeted ads to consumers. An AppLovin spokesperson stated, "We regularly communicate with regulators, and if we receive inquiries, we will respond appropriately as per our usual process," adding, "If there are significant developments, we will disclose them through appropriate public channels." Reports indicate that the SEC has not yet formally charged AppLovin with any violations.

It is reported that UBS (UBS.US) plans to launch an SRT transaction linked to a $1 billion corporate loan to address capital regulatory pressures. UBS is conducting exploratory communications with investors regarding a significant risk transfer scheme, aiming to alleviate strict capital regulatory pressures through a structured tool (SRT) linked to a corporate loan portfolio. According to insiders, the bank is considering associating the structured risk transfer (SRT) with a $1 billion loan portfolio, with the SRT size potentially reaching about 12.5% of the reference portfolio. Since the transaction is still in its early stages, specific terms and sizes remain variable, and UBS declined to comment on this. Additionally, it has been revealed that UBS is also advancing another SRT transaction linked to a CHF 2 billion (approximately $2.5 billion) loan portfolio, intending to issue related notes through the J-Elvetia platform. Notably, J-Elvetia is one of the platforms UBS used to issue SRT notes before acquiring Credit Suisse.

Shell (SHEL.US) energy trading stabilizes and rebounds, injecting confidence into Q3 performance. Shell stated that following performance pressure in the second quarter due to geopolitical fluctuations, its oil and gas trading business has shown recovery. In a performance forecast released on Tuesday (with full financial results to be announced later this month), the company noted that the natural gas trading business showed "significant improvement," and the oil trading business also "achieved enhancement." Based on market conditions for most of the third quarter, Brent crude oil futures prices remained stable in a narrow range of $65 to $70 per barrel, providing a favorable environment for the recovery of trading business At the same time, Shell announced a $600 million asset impairment charge for its recently shelved biofuel plant in the Netherlands. As of now, the cumulative impairment amount for this plant has reached $1.4 billion since last year.

Important Economic Data and Event Forecast

Beijing time 20:30: U.S. trade balance for August (in hundreds of millions of dollars).

Beijing time 23:00: U.S. September New York Fed 1-year inflation expectations (%).

Next day, Beijing time 04:30: U.S. API crude oil inventory change for the week ending October 3 (in ten thousand barrels).

Beijing time 22:00: 2027 FOMC voting member and Atlanta Fed President Bostic will speak on the economic outlook.

Beijing time 22:30: Federal Reserve Governor Mulan will participate in a fireside chat, and 2026 FOMC voting member and Minneapolis Fed President Kashkari will speak.

Next day, Beijing time 00:00: EIA will release the monthly Short-Term Energy Outlook report