Temporary profit-taking or reversal? Gold and silver futures turn down, spot silver falls back after historically breaking above $50

The recent surge in silver prices is attributed to tight supply in the London market, industrial demand, and safe-haven demand. If the US dollar depreciates, the boost to silver will exceed that of gold, while rising gold prices will also drive silver prices higher. Analysts warn that technical indicators show that gold and silver are severely overbought, and historically, periods of a strong US dollar are often accompanied by a pause or adjustment in gold prices

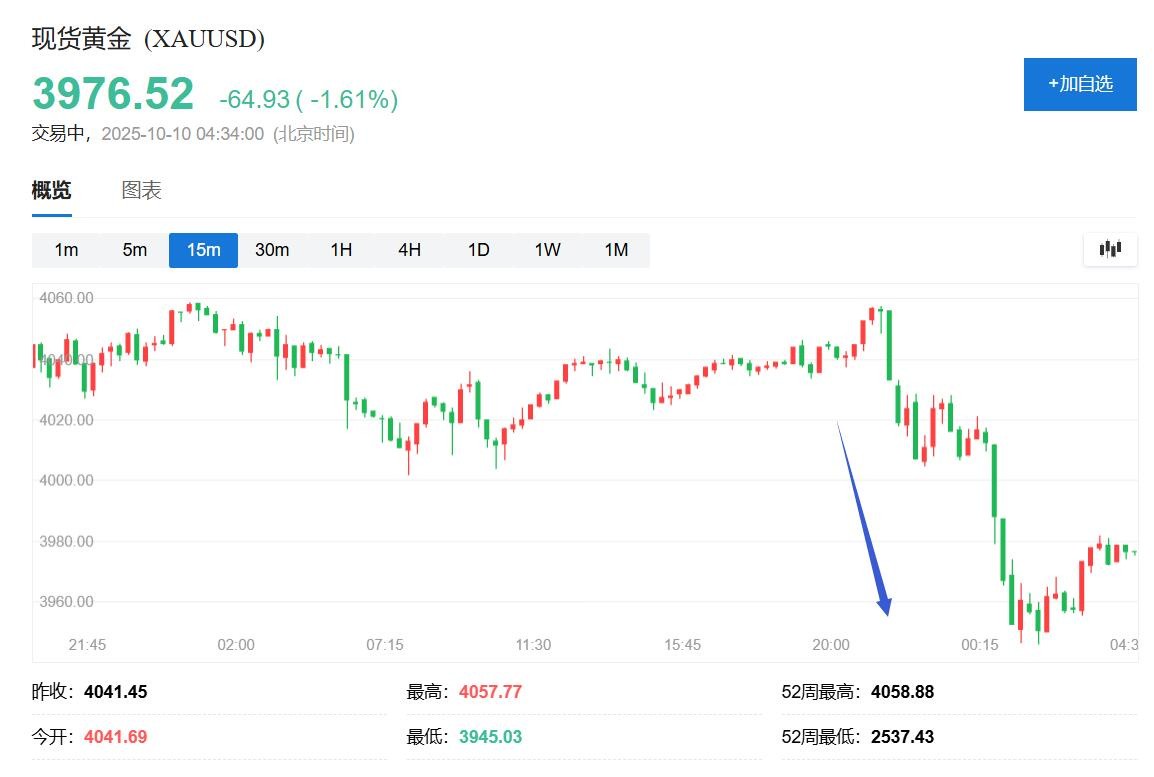

Recently, gold and silver, which have been hitting new highs, experienced a dramatic intraday reversal this Thursday.

Both gold and silver futures in the external market turned down after reaching intraday historical highs and multi-decade highs. Spot silver surged past the historic 50 USD mark before giving back most of its gains. Both futures gold and spot gold saw intraday fluctuations, reflecting the market's continued optimism about the long-term bull market prospects for precious metals.

On Thursday, as U.S. stocks hit intraday record highs for the fourth consecutive day, COMEX December gold futures approached 4,078 USD, up nearly 0.2% for the day, while spot gold neared 4,058 USD, up nearly 0.4%. However, as U.S. stocks turned down at the beginning of trading and refreshed daily lows at midday, futures gold fell below 3,958 USD, down nearly 2.8% for the day, and spot gold dropped to just under 39,451 USD, down 2.4% for the day.

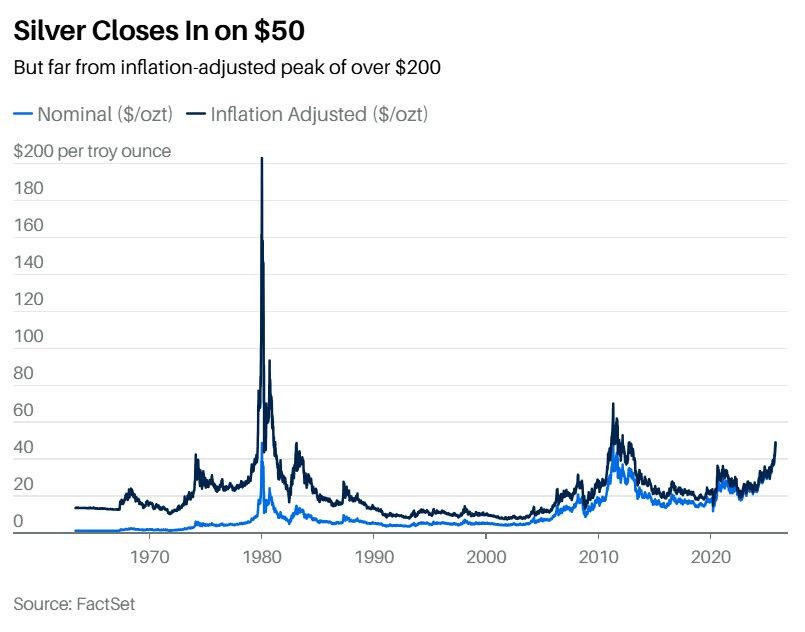

COMEX December silver futures briefly rose to 49.965 USD before turning down, approaching the intraday record high of 50.35 USD set in 1980. By midday, it refreshed its daily low to 46.89 USD, down 4.3% for the day. Spot silver had previously surged above 51 USD in early U.S. trading, marking a new high since the 1980 Hunt brothers market manipulation short squeeze event, up 4.8% for the day, but by midday, it had nearly erased all its gains.

Some commentators believe that the pullback in gold and silver indicates that investors are choosing to take profits after the recent days of significant price increases into the technically overbought territory. Some analysts attribute this partly to the preliminary agreement on a ceasefire in the Gaza Strip, which has eased geopolitical risks. Peter Cardillo, Chief Market Economist at Spartan Capital Securities, stated that the decline on Thursday was a necessary adjustment that may be short-lived, advising investors to consider buying on further pullbacks.

The Market Ear commented that warning signals have emerged in the options market, with soaring volatility possibly indicating an impending adjustment.

Technical Indicators Show Severe Overbought Conditions for Gold and Silver

Technical analysis indicates that both gold and silver are in an extremely overbought state.

According to analysis from The Market Ear, the Cboe Gold Volatility Index (GVZ) has risen to recent highs, and historical data shows that gold often enters a pause or adjustment phase after a significant increase in volatility.

The Cboe Silver ETF Volatility Index (VXSLV) has seen explosive growth, with each surge in volatility over the past year accompanied by a pause or adjustment in silver prices.

The Cboe Silver ETF Volatility Index (VXSLV) has seen explosive growth, with each surge in volatility over the past year accompanied by a pause or adjustment in silver prices.

The Market Ear points out that the gold monthly RSI is at "the most overbought level since most existing speculators were born."

The silver monthly RSI has reached its highest level since the panic rise in 2011.

Analysts at Saxo Bank state that strong ETF inflows, momentum trading, and panic buying have pushed prices into technically overbought territory, triggering short-term caution. Nevertheless, increasing political uncertainty, expectations of further interest rate cuts in the U.S., and central bank purchases continue to provide strong support for precious metals.

A stronger dollar also poses a potential threat to gold prices. The Market Ear observes that while gold has historically preferred a weaker dollar, the dollar has performed strongly recently, creating a "dislocated gap" with gold prices. Periods of a strong dollar have often been accompanied by pauses or adjustments in gold's upward trend.

Tight Silver Supply Drives Prices Soaring

Comments this Thursday noted that silver has accumulated a rise of over 67% since the beginning of the year, marking the largest increase for silver in the same period since 1979, significantly outperforming gold's approximately 54% rise this year. According to Dow Jones market data, this is the largest gap in silver prices exceeding gold prices in 15 years.

Tight supply in the London spot market is seen as a key factor driving the recent surge in silver prices. The supply-demand imbalance stems from market concerns that the U.S. government may impose tariffs on silver, prompting traders to ship silver metal to New York, leading to a decline in London inventories and a reduction in available silver for borrowing.

This Thursday, the one-month annualized leasing rate for silver, reflecting the borrowing costs in the London market, namely the SOFR one-month net value, rose to 11.1%, the highest level since data records began in 2002.

Daniel Ghali, a commodity strategist at TD Securities, stated on Thursday that the market is currently at what the firm previously referred to as the "buyable silver short squeeze" peak. He believes that higher spot prices in London will attract more liquidity, and traders will purchase cheaper metals from the U.S. and China to ship to the UK to capture the price difference

Dual Drivers of Industrial Demand and Safe-Haven Demand

The rise in silver prices is also attributed to strong industrial demand and "currency devaluation trades." The metal is widely used in new energy equipment such as solar panels and wind turbines, with industrial applications accounting for more than half of silver sales. Demand is expected to exceed supply for the fifth consecutive year by 2025.

Kieron Hodgson, a commodity analyst at Peel Hunt, stated that the theme of currency devaluation "has ignited investor enthusiasm for gold and silver, shifting the focus from regression analysis to how investors view AI or technology sectors."

Paul Wong, a market strategist at Sprott Asset Management, wrote in a report: “We believe that for silver prices to sustain their rise, there needs to be significant disruption to the demand for silver end uses with lower economic value, such as photography and silverware. At the same time, demand for end uses with higher economic value also needs to continue growing, such as the electrical and electronic demand driven by AI-related spending, photovoltaic power generation, and other technology-related needs.”

Dollar Devaluation Boosts Silver More Than Gold; Rising Gold Prices Also Lift Silver Prices

If the dollar further depreciates, silver prices may rise further as this would encourage more international buyers to take action.

Global pricing and trading of silver are conducted in dollars. The market size of silver is much smaller than the over $25 trillion gold market, meaning that in terms of percentage changes, dollar fluctuations have a greater impact on silver than on gold. Rising inflation may also support demand for tangible assets like silver.

HSBC's report this week predicts that silver prices could peak at $53 per ounce this year and reach as high as $55 next year, but a correction is expected in the second half of next year. The bank's chief precious metals analyst, James Steel, believes that part of the rise in silver will come from gold, which typically exerts a "strong attraction" on silver, possibly due to "investors who have not fully capitalized on the opportunity of rising gold prices" buying in.

Wong stated that if silver's trading price can remain above $50, "this may indicate that the economic value and store of value function of silver are being reassessed, or that silver is being repriced at market value."