U.S. Stock Outlook | Three Major Index Futures Rise Together, Applied Digital Soars After Earnings

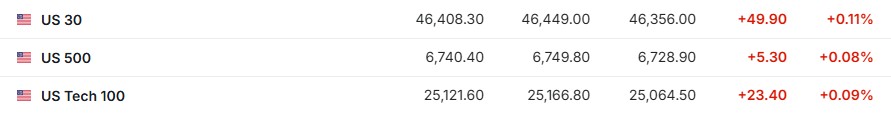

On October 10th, the three major U.S. stock index futures rose together, with Dow futures up 0.11%, S&P 500 futures up 0.08%, and Nasdaq futures up 0.09%. Nuveen Chief Investment Officer Saira Malik stated that corporate earnings will drive the stock market to continue rising before the end of the year, despite increasing concerns about a stock market bubble. The Boston Fed report pointed out that the sharp rise in inflation expectations poses a risk to the Federal Reserve's control of prices

Pre-Market Market Trends

- As of October 10 (Friday), U.S. stock index futures are all up before the market opens. As of the time of writing, Dow futures are up 0.11%, S&P 500 futures are up 0.08%, and Nasdaq futures are up 0.09%.

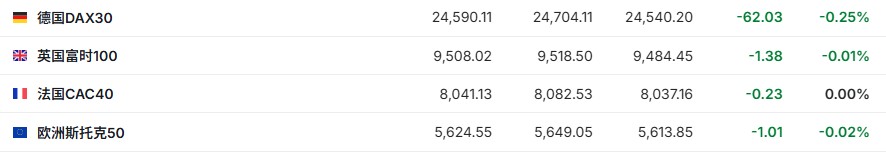

- As of the time of writing, Germany's DAX index is down 0.25%, the UK's FTSE 100 index is down 0.01%, France's CAC 40 index is down 0.00%, and the Euro Stoxx 50 index is down 0.02%.

- As of the time of writing, WTI crude oil is down 1.17%, priced at $60.79 per barrel. Brent crude oil is down 1.09%, priced at $64.51 per barrel.

Market News

Is the U.S. stock market's year-end rally solidifying? Nuveen: Giant profits will be the "stabilizing force," and AI remains the core engine! Saira Malik, Chief Investment Officer of Nuveen Asset Management LLC, stated that the U.S. stock market is likely to continue its upward trend before the end of the year, with robust corporate earnings—especially from mega-cap tech giants—continuing to drive stock prices higher. Malik pointed out that the fourth quarter "is typically a strong performing quarter, especially given the significant gains achieved year-to-date. Therefore, the probability of this rally continuing is relatively high." Although this round of gains has pushed stock market valuations above historical levels and raised concerns about a market bubble, Malik believes that strong corporate performance is sufficient to support current valuations. She expects that as the third-quarter earnings season begins next week, corporate profits will once again exceed market expectations.

Beware! The thing the Federal Reserve fears most is happening: the risk of uncontrolled inflation expectations is surging. A recent report from the Boston Fed indicates that the sharp rise in current inflation expectations poses a greater risk to the Federal Reserve's ability to control prices compared to the past. Unlike during the pandemic, the current upward adjustment of households' one-year inflation expectations is not primarily driven by food and energy prices. This characteristic increases the risk of inflation expectations remaining persistently above the Fed's 2% policy target. Since the beginning of this year, as American households gradually digest the aggressive trade policies of the Trump administration and prepare for rising prices of imported goods, consumer inflation expectations have continued to rise. Federal Reserve officials are also closely monitoring these policy measures to assess whether tariff policies will trigger a one-time price shock or lead to more persistent inflation spikes U.S. September CPI Expected to Be Released on Time! Labor Statistics Bureau Recalling Employees to Rush Report. Despite the ongoing federal government shutdown in the United States, investors may still receive the September inflation data as scheduled. Reports indicate that the U.S. Bureau of Labor Statistics (BLS) has recalled some employees to complete the report's release. The U.S. Consumer Price Index (CPI) for September, originally scheduled for release on October 15, had raised doubts about whether the publication time would be delayed due to the government shutdown. The report is now expected to be released in time for the Federal Reserve's monetary policy meeting on October 28-29. Reports cite that the White House Office of Management and Budget (OMB) has requested the Labor Statistics Bureau to recall employees to ensure the CPI data is compiled by the end of this month.

Federal Reserve's Hawkish Tone Triggers Strong Dollar Awakening! Dollar Bears Are Facing a Squeeze. The decline of the euro and yen, along with the hawkish remarks from Federal Reserve officials collectively urging caution in further rate cuts, have significantly increased the attractiveness of the dollar as a global reserve currency. Traders in Asia and Europe report that hedge funds are ramping up options bets, believing that the dollar's rebound against most major currencies will continue until the end of the year. Meanwhile, "shorting the dollar" is evolving into a "pain trade" for investors. Of course, no one can be certain about the dollar's next move. The Federal Reserve's next actions will play a crucial role.

Gold Prices Approach $4,000 Again! As of the time of writing, spot gold is up 0.54%, priced at $3,997.66 per ounce; COMEX gold futures are up 1.00%, priced at $4,012.25 per ounce. Previously, gold prices had risen rapidly for several consecutive days, reaching a historical high of $4,059.31 per ounce on Wednesday, but fell below the $4,000 mark in early trading on Friday. The decline in gold prices may be influenced by a variety of factors, including easing geopolitical tensions and profit-taking by investors. Reports indicate that Trump stated that Israel and Hamas reached an agreement on the first phase of a "peace plan." Both Hamas and the Israeli Prime Minister's office issued statements confirming the agreement. Additionally, technical indicators show that gold prices have been in overbought territory for most of the past month, prompting some investors to take profits.

Individual Stock News

Tesla (TSLA.US) China Wholesale Sales Stop Decline and Rebound: September Up 2.8% Year-on-Year to 90,812 Units. Tesla's wholesale sales in China increased by 2.8% year-on-year in September, reaching 90,812 units, ending a two-month decline. Previously, its new six-seat model had begun deliveries in China. Sales of the Model 3 and Model Y produced at Tesla's Shanghai factory (including vehicles exported to Europe and other markets) increased by 9.2% compared to August. Earlier reports indicated that the American automaker also saw a partial rebound in its European sales this month.

Google (GOOGL.US) Faces Increased Scrutiny from UK Antitrust Authority, Becomes First Company with "Strategic Market Status" in the UK. Google has become the first company in the UK to be designated with "strategic market status," which subjects its online search and advertising business to stricter scrutiny from the UK antitrust authority The UK's Competition and Markets Authority (CMA) stated that Google's entrenched market dominance is sufficient to support this determination—aimed at ensuring fair competition in the digital market. The agency also expressed concerns about the fairness of Google's search results, high advertising costs, and AI-generated search responses. The CMA noted that this investigation did not cover Google's Gemini AI assistant, but "given the uncertainty in market developments, this situation will continue to be assessed."

Qualcomm (QCOM.US) is under investigation, pre-market down nearly 2%. On October 10, according to the website of China's State Administration for Market Regulation, Qualcomm is suspected of violating the Anti-Monopoly Law of the People's Republic of China for failing to legally declare its acquisition of Autotalks. The market regulator has initiated an investigation into Qualcomm. Qualcomm's stock fell in pre-market trading on Friday, with a decline of up to 4%.

AI computing power demand surges! Applied Digital (APLD.US) Q1 revenue skyrockets 84%, exceeding expectations. AI data center company Applied Digital reported first-quarter revenue that surpassed Wall Street expectations, despite still recording a net loss, showcasing strong growth momentum. This performance is driven by a surge in demand for its data center services—an increasing number of clients are expanding their computing power to support rapidly developing generative AI applications. In the quarter ending August 31, the company's revenue grew 84% year-over-year to $64.2 million, exceeding analysts' previous expectations of $50 million. The adjusted loss per share was 3 cents, better than the analysts' expected loss of 13 cents. As of the time of publication, Applied Digital's stock surged nearly 24% in pre-market trading on Friday.

Strong demand in North America, Stellantis (STLA.US) Q3 global deliveries increase by 13%. Stellantis announced on Friday that its global vehicle sales in the third quarter increased by 13% year-over-year, driven by the launch of new models and increased demand in the North American market, indicating that the business has begun to recover after several quarters of sales decline. The Franco-Italian-American joint automotive manufacturer estimated that it delivered a total of 1.3 million vehicles from July to September. The final data for sales and revenue in the third quarter will be released on October 30. The company stated in a release that vehicle deliveries in North America surged by 35% to 403,000 units, partly due to the launch of the Ram 1500 model equipped with a V8 engine and the normalization of inventory levels after production cuts last year.

Important Economic Data and Event Forecasts

Beijing time 21:45, 2025 FOMC voting member and Chicago Fed President Goolsbee will deliver opening remarks and host a discussion at a community bankers' seminar.

Beijing time 22:00, U.S. October Michigan University Consumer Sentiment Index preliminary value.

Beijing time the next day 01:00, 2025 FOMC voting member and St. Louis Fed President Bullard will give a speech