The strategy behind the $2 billion big deal: How does InnoCare Pharma leverage Zenas to accelerate the globalization of Obinutuzumab?

InnoCare Pharma has reached a licensing collaboration with Zenas BioPharma worth over $2 billion, aimed at accelerating the globalization of its BTK inhibitor, Orelabrutinib. The deal includes cash and equity, with InnoCare demonstrating confidence in the transaction through share repurchases. The collaboration will enable InnoCare to secure nearly $300 million in revenue and reduce the pressure on R&D funding, further promoting its business development

Just after the National Day holiday, China's innovative drug industry was ignited by a heavyweight deal—on October 8, InnoCare Pharma announced a licensing collaboration with Nasdaq-listed Zenas BioPharma worth over $2 billion (approximately 16 billion RMB), with the core target being its star product, the BTK inhibitor Orelabrutinib. After the market closed on October 10, InnoCare Pharma spent about HKD 12 million to repurchase shares, fully demonstrating the company's confidence in this transaction and its business development.

What strategic logic lies behind this deal that sets a new record for domestic small molecule licensing in the autoimmune field?

Cash + Equity: A Major Beneficial Transaction

Unlike the common purely cash transactions, InnoCare Pharma's deal is unique. Among domestic biotech companies, it ranks among the top in terms of financial strength, with no pressure on cash flow. In making this collaboration, InnoCare Pharma is not seeking business development due to a lack of funds, nor is it doing business development for the sake of it; the core goal is singular: to accelerate the globalization of Orelabrutinib.

- An upfront payment + a recent payment of $100 million, with high certainty on the recent payment according to Zenas's press release and conference call;

- 7 million shares of Zenas stock (valued at approximately $200 million) are secured, equivalent to an upfront payment + recent payment of nearly $300 million, and the stock price potential of this biotech is worth looking forward to;

- A sales share of up to 17%-19%, far exceeding the industry average, indicating Zenas's extreme optimism about the commercialization potential of Orelabrutinib.

The "cash + equity" combination allows InnoCare Pharma to lock in nearly $300 million in revenue in the short term, as 5 million shares were obtained on the day of the transaction, and Wall Street's "strong buy" rating for Zenas (with an average target price of $33.25) makes this equity potentially a long-term cash cow.

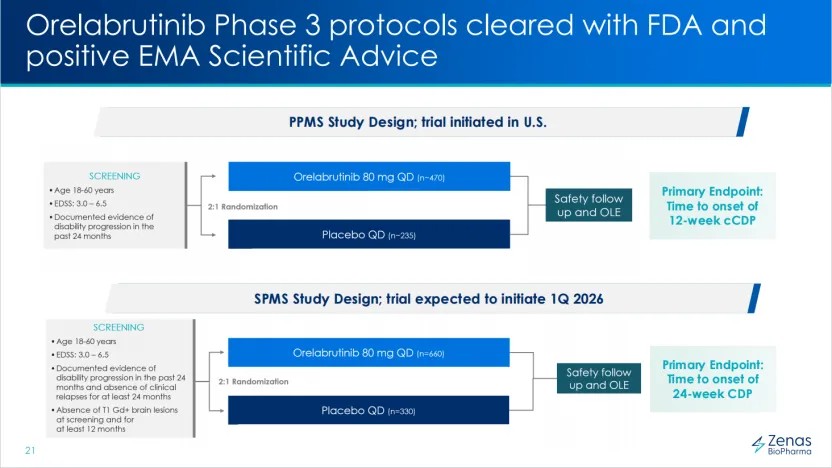

Especially, the market has overlooked an important point: Orelabrutinib's overseas expansion through Zenas is a win-win situation. According to Zenas's conference call, the two global multi-center Phase III clinical trials for Orelabrutinib require the enrollment of five to six hundred patients with multiple sclerosis, with funding needs estimated to reach $500-600 million. Now, with the collaboration, this funding will be provided by Zenas, allowing InnoCare Pharma to avoid using its own R&D funds and instead invest in other pipelines, thereby reducing risk and optimizing resource allocation, which is the key to the "win-win" situation.

Why Not Choose MNCs? Zenas's Three Major Advantages

When asked why they chose Zenas instead of collaborating with multinational pharmaceutical companies (MNCs), InnoCare Pharma's management provided solid reasons during the conference call:

-

Clinical Professional Execution: Zenas's core product Obexelimab (targeting CD19/FcγRIIb) combined with Acalabrutinib (BTK inhibitor) forms a "double sword" in the treatment of multiple sclerosis (MS), which can rapidly advance Acalabrutinib's global Phase III clinical trials. The first indication for Obexelimab, IgG4-RD, is estimated to peak sales of up to $3 billion, with Phase III clinical data expected to be disclosed around the end of this year, making commercialization promising. The company has entered the pipeline value release stage, with a clear timeline for launching the SPMS indication in Q1 2026, which is much more efficient than the lengthy internal processes of multinational corporations.

-

Sufficient Financial Resources: Zenas's interim report shows a cash balance of $275 million at the end of June, and the company has no debt, making its balance sheet very healthy. On September 2, it completed financing of up to $300 million with Royalty Pharma. On the same day that the licensing deal with InnoCare Pharma was announced, it also announced the successful completion of a new round of financing of $120 million, indicating that Zenas has sufficient funds to cover the cash burn requirements for Acalabrutinib's two global Phase III clinical trials (which require the enrollment of over a thousand patients).

-

Team "Turning Stone into Gold": Founder Lonnie Moulder is a Wall Street veteran who previously sold TESARO to GSK for $5.1 billion. The head of R&D is an authority in the MS field, and the head of the commercialization team has led the market launch of over 30 products.

Strategic Ambition: Seizing the "Golden Seat" in the Global MS Market

InnoCare's move conceals a deeper layout:

- Covering the entire course of MS: Acalabrutinib primarily targets PPMS/SPMS (progressive MS), while Obexelimab aims at RMS (relapsing MS), and the combination of the two can capture this global market worth nearly $30 billion.

- Light Asset Overseas Expansion: By having Zenas bear the overseas clinical costs, InnoCare retains global rights in the oncology field while "borrowing a boat to go to sea" in the autoimmune field, exemplifying "minimized risk and maximized returns."

InnoCare Chairman Cui Jisong's summary is insightful: "This cooperation is an important milestone in our globalization... It helps maximize the clinical and commercial value of Acalabrutinib globally." Clearly, Chinese innovative pharmaceutical companies are carving out a new path for overseas expansion in a smarter way.

Author of this article: E Pharma Manager, Source: E Pharma Manager, Original Title: "The Strategy Behind the $2 Billion Deal: How InnoCare Accelerates Acalabrutinib's Globalization by Leveraging Zenas?"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk