BYD enters Japan with K-car: expected to capture 30% of the market, contributing 400 million to 1 billion in annual profit, with strategic significance outweighing the numbers

JP Morgan stated that K-cars account for 30-40% of Japan's automobile sales, with annual sales of 1.2 million units. Although the profit only accounts for 1-2% of BYD's expected earnings in 2026, the strategic significance is substantial, demonstrating BYD's long-term commitment to the international market. This is the first new model specifically designed and developed for the unique needs of overseas markets, marking a shift for Chinese car manufacturers from simple exports to deep localization operations

BYD's strategic layout in the Japanese market is achieving significant breakthroughs.

On November 6th, according to news from the Wind Trading Platform, JP Morgan stated in its latest research report that BYD launched the K-car model Racco, specifically developed for the Japanese market, at the Tokyo Motor Show, which is expected to capture over 30% of this unique market segment, with annual profit contributions estimated to reach RMB 400 million to 1 billion.

JP Morgan analyst Nick Lai pointed out that this move demonstrates BYD's long-term commitment to international markets, marking the company's first new model designed and developed specifically for the unique demands of overseas markets. The K-car market accounts for 30-40% of car sales in Japan, with annual sales of approximately 1.2 million units, providing BYD with significant growth opportunities.

At the same time, the analysts believe that although Racco's direct profit contribution only accounts for 1-2% of BYD's expected earnings in 2026, its strategic significance far exceeds financial figures. This model reflects BYD's localization strategy of "in Japan, for Japan," marking an important shift for Chinese car manufacturers from simple exports to deep localization operations.

JP Morgan maintains an "overweight" rating on BYD's A-shares and H-shares, with target prices of RMB 140 and HKD 150, respectively, expecting the stock to gradually bottom out and rebound driven by the launch of new models and overseas expansion.

A New Chapter in BYD's Globalization Strategy: Targeting the Blue Ocean Market of Japanese K-cars

The research report states that at the recently opened Tokyo Motor Show, BYD unexpectedly launched its first new model tailored specifically for a single overseas market—the pure electric K-car "Racco."

The firm believes this move sharply contrasts with most Chinese car manufacturers, who only make minimal modifications to existing models for export, highlighting BYD's determination for deep localization.

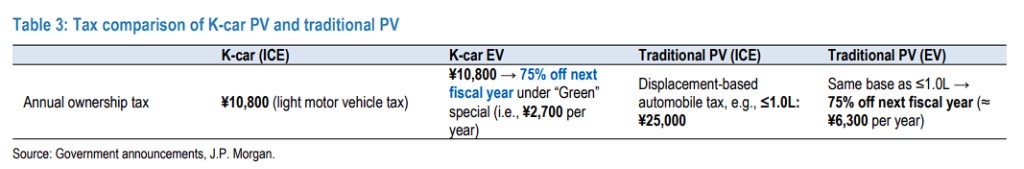

K-cars are a unique category of vehicles in Japan, with strict regulations on body dimensions (length, width, and height limited to 3.4m x 1.48m x 2.0m) and engine power.

In return, K-car owners enjoy lower tax benefits, and pure electric K-cars can receive government subsidies of up to 550,000 yen. This niche market is crucial in Japan, consistently accounting for 30% to 40% of total vehicle sales.

According to JP Morgan's analysis, the K-car market exhibits a highly concentrated oligopoly structure, with Suzuki (38%), Daihatsu (22%), and Honda (19%) accounting for about 80% of the market share. K-car sales in 2024 are projected to be 1.2 million units, maintaining a level of 1.2 to 1.3 million units over the past three years

BYD's newly launched Racco is expected to be priced similarly to local competitors, around 2.5 million yen (approximately $17,000). This "In Japan and for Japan" strategy is an upgraded version derived from its experience in the European market.

Previously, BYD's Dolphin-surf (modified from the Chinese Seagull model, with an extended wheelbase and enhanced power) became a popular model in Europe with a competitive price of around 20,000 euros. The launch of Racco marks a new stage in BYD's global expansion, entering a more mature and targeted phase.

JP Morgan expects that compared to similar compact cars sold by BYD in China, the price of Racco is nearly doubled, providing the company with higher profit margins.

Profit Contribution Estimation: Incremental Value of 400-1,000 Million Yuan Annually

JP Morgan believes that entering the Japanese K-car market is not only a strategic declaration for BYD but also a considerable business opportunity. According to research reports, its potential earnings are quite significant:

Market Size: The annual sales volume of the Japanese K-car market stabilizes between 1.2 million to 1.3 million units. Considering that about two-thirds of Japanese consumers prefer domestic brands, BYD's target customer group is the remaining 30-35% willing to try new brands, which means an Addressable Market of approximately 350,000 to 450,000 units annually.

Market Share Target: The report estimates that after Racco officially debuts and pricing is announced in the first half of 2026, BYD has the capability to capture 20% to 30% of the aforementioned Addressable Market.

Profitability: Although Racco is a newly developed model with higher initial depreciation and production costs, its price of approximately 2.5 million yen (equivalent to about 114,000 yuan) is significantly higher than BYD's compact cars sold in China. Therefore, the report estimates that its profit per vehicle could reach 5,000 to 8,000 yuan.

Based on the above assumptions, Racco alone could contribute a net profit of 400 million to 1 billion yuan annually for BYD after reaching full production capacity. This profit will enhance BYD's profit forecast for 2026 by 1-2%, the report considers this "significant," especially considering this is just a small car in a single market.

The analysts emphasized that the strategic significance of Racco lies in proving BYD's long-term commitment to the international market. The company is further supporting this strategic layout by building overseas production bases in Brazil, Indonesia, Malaysia, Thailand, Hungary, and Turkey.

Globalization Strategy Upgrade: From Product Export to Localization Operations

In addition to the highlight of the K-car, BYD also showcased its comprehensive strategic layout at the Tokyo Motor Show, supporting its global ambitions:

All-new design language: The Dynasty D (SUV) and Ocean S (sedan) concept cars exhibited by BYD indicate the design direction for its next generation of production models.

Balanced PHEV and BEV product line: BYD has clearly shifted from an export strategy focused on pure electric vehicles (BEV) to a balanced strategy that emphasizes both pure electric and plug-in hybrid electric vehicles (PHEV).

Aggressive global channel expansion: BYD has adopted a model of authorizing local dealers and has expanded its sales network to approximately 70 countries.

According to JP Morgan's estimates, the number of BYD's overseas stores has reached 900-1000. Thanks to higher prices in overseas markets (typically 1.5-2.0 times that of the domestic market), BYD can offer dealers a generous distribution profit of 8-13%, which results in a very short investment return cycle for dealers (about 6 months in Southeast Asia and about 9-12 months in Europe), greatly stimulating the expansion motivation of partners