Insider Buying: Integer (NYSE:ITGR) Director Purchases 1,600 Shares of Stock

Integer Holdings Corporation (NYSE:ITGR) Director Cheryl Capps purchased 1,600 shares at $66.70 each, totaling $106,720, increasing her stake by 15.84% to 11,702 shares valued at approximately $780,523.40. The transaction was disclosed to the SEC. Integer's stock opened at $68.81, with a market cap of $2.41 billion. The company reported $1.79 EPS, exceeding estimates, and announced a $200 million share repurchase plan. Analysts have mixed ratings, with price targets ranging from $87 to $145.

Integer Holdings Corporation (NYSE:ITGR - Get Free Report) Director Cheryl Capps purchased 1,600 shares of Integer stock in a transaction that occurred on Thursday, November 6th. The shares were bought at an average cost of $66.70 per share, for a total transaction of $106,720.00. Following the completion of the transaction, the director directly owned 11,702 shares in the company, valued at $780,523.40. This represents a 15.84% increase in their position. The purchase was disclosed in a document filed with the SEC, which is available through this link.

Integer Holdings Corporation (NYSE:ITGR - Get Free Report) Director Cheryl Capps purchased 1,600 shares of Integer stock in a transaction that occurred on Thursday, November 6th. The shares were bought at an average cost of $66.70 per share, for a total transaction of $106,720.00. Following the completion of the transaction, the director directly owned 11,702 shares in the company, valued at $780,523.40. This represents a 15.84% increase in their position. The purchase was disclosed in a document filed with the SEC, which is available through this link.

Integer Stock Up 0.8%

- After blowout earnings, Integer may be headed to new highs

Shares of NYSE:ITGR opened at $68.81 on Tuesday. The company has a market capitalization of $2.41 billion, a price-to-earnings ratio of 28.79, a price-to-earnings-growth ratio of 0.60 and a beta of 0.95. The company has a 50 day moving average of $94.70 and a two-hundred day moving average of $108.53. Integer Holdings Corporation has a 52-week low of $62.00 and a 52-week high of $146.36. The company has a quick ratio of 2.45, a current ratio of 3.71 and a debt-to-equity ratio of 0.70.

Integer (NYSE:ITGR - Get Free Report) last announced its earnings results on Thursday, October 23rd. The medical equipment provider reported $1.79 earnings per share for the quarter, beating the consensus estimate of $1.68 by $0.11. Integer had a net margin of 4.75% and a return on equity of 12.84%. The firm's revenue was up 8.4% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.43 earnings per share. Integer has set its FY 2025 guidance at 6.290-6.430 EPS. As a group, analysts forecast that Integer Holdings Corporation will post 6.01 earnings per share for the current fiscal year.

Integer declared that its board has authorized a share repurchase plan on Tuesday, November 4th that permits the company to repurchase $200.00 million in shares. This repurchase authorization permits the medical equipment provider to purchase up to 8.3% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's board of directors believes its stock is undervalued.

Institutional Investors Weigh In On Integer

Institutional investors and hedge funds have recently made changes to their positions in the company. Teacher Retirement System of Texas bought a new position in Integer during the first quarter worth $579,000. OneDigital Investment Advisors LLC lifted its position in shares of Integer by 14.1% in the 1st quarter. OneDigital Investment Advisors LLC now owns 1,969 shares of the medical equipment provider's stock worth $232,000 after buying an additional 243 shares during the last quarter. Nisa Investment Advisors LLC boosted its holdings in shares of Integer by 1.0% in the 1st quarter. Nisa Investment Advisors LLC now owns 20,450 shares of the medical equipment provider's stock valued at $2,413,000 after buying an additional 197 shares during the period. Xponance Inc. grew its position in shares of Integer by 5.1% during the 1st quarter. Xponance Inc. now owns 2,518 shares of the medical equipment provider's stock valued at $297,000 after buying an additional 122 shares during the last quarter. Finally, New York State Common Retirement Fund raised its stake in Integer by 7.4% during the first quarter. New York State Common Retirement Fund now owns 249,847 shares of the medical equipment provider's stock worth $29,484,000 after acquiring an additional 17,278 shares during the period. 99.29% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

ITGR has been the subject of several recent analyst reports. Weiss Ratings restated a "hold (c-)" rating on shares of Integer in a research note on Friday, October 31st. KeyCorp dropped their price objective on Integer from $145.00 to $133.00 and set an "overweight" rating on the stock in a report on Tuesday, October 21st. Bank of America lowered Integer from a "buy" rating to a "neutral" rating and set a $87.00 target price on the stock. in a research report on Friday, October 24th. Raymond James Financial reissued an "outperform" rating and set a $95.00 price target (down previously from $143.00) on shares of Integer in a research report on Friday, October 24th. Finally, Truist Financial cut their price target on shares of Integer from $121.00 to $88.00 and set a "buy" rating on the stock in a report on Friday, October 24th. Four analysts have rated the stock with a Buy rating and seven have issued a Hold rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $96.75.

View Our Latest Stock Report on ITGR

Integer Company Profile

(Get Free Report)

Integer Holdings Corporation operates as a medical device outsource manufacturer in the United States, Puerto Rico, Costa Rica, and internationally. It operates through two segments, Medical and Non-Medical. The company offers products for interventional cardiology, structural heart, heart failure, peripheral vascular, neurovascular, interventional oncology, electrophysiology, vascular access, infusion therapy, hemodialysis, non-vascular, urology, and gastroenterology procedures.

Featured Stories

- Five stocks we like better than Integer

- How to Use the MarketBeat Stock Screener

- Insiders Sold Big at These 3 Stocks—Should You Worry?

- Pros And Cons Of Monthly Dividend Stocks

- Shares Down, Price Targets Up: 3 Stocks Upgraded After +10% Drops

- 3 Grocery Stocks That Are Proving They Are Still Essential

- Nuclear Stocks Are Melting Down—Should Investors Panic?

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. Please send any questions or comments about this story to [email protected].

Insider Buying or Selling at Integer?

Sign-up to receive InsiderTrades.com's daily insider buying and selling report for Integer and related companies.

From Our Partners

NEW LAW: Congress Approves Setup For Digital Dollar?

Trump Ally Says Congress Approved the Setup for a Digital Dollar 2.0 But according to Rep. Marjorie Taylor ...

Goldco Precious Metals

Nvidia Chief: Billions Could Flow Here Next…

This Feels Like Collecting ‘Toll Money’ From AI… Every time AI ‘thinks,’ data has to move, and that moveme...

Stocks To Trade

Nvidia CEO Issues Bold Tesla Call

While headlines focus on Tesla’s car sales, tech analyst Jeff Brown says the real story is Tesla’s role in a $...

Brownstone Research

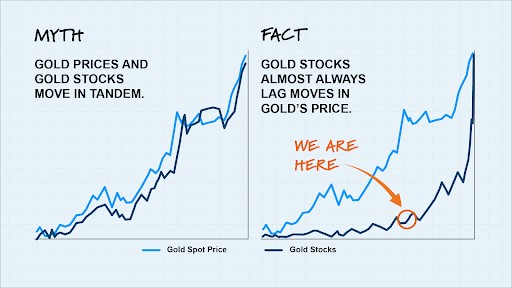

This gold stock is STILL undervalued by 80%...

“Like buying gold for $1,000/oz” If you could go back in time to 10+ years ago and buy gold for $1,000 an o...

Golden Portfolio

Everyone’s watching Nvidia right now. Here’s why I’m excited.

So, unless you’ve been living under a rock, you probably saw the news… Nvidia just signed a $7 BILLION deal...

Timothy Sykes

Claim $3,452/Mo in AI Equity Checks

The U.S. government just took advantage of Public Law 81-774 to crack down on AI companies... In turn, enfo...

Angel Publishing

Wall of Cash incoming… Prepare now

A record $7.7 trillion is now sitting in cash — and The Wall Street Journal reports that upcoming rate cuts co...

InvestorPlace

He Called Nvidia at $1.10. Now, He Says THIS Stock Will…

A Millionaire With SEVEN Clicks? $1,000 in just seven stocks in 2004 could have turned into a million-dolla...

The Oxford Club